O’Connor’s review of 2023 data released by Clayton County, Georgia indicates that the median time-adjusted buying price for a typical home in Clayton County, Georgia, is $220,000 overall. Surprisingly, the median assessed worth is $4,600 more expensive than the asking price of $215,400. As a result, residential real estate in Clayton County is overvalued by 1.4%. In this study, the time-adjusted sales price is contrasted with the 2023 tax assessor value for Clayton County.

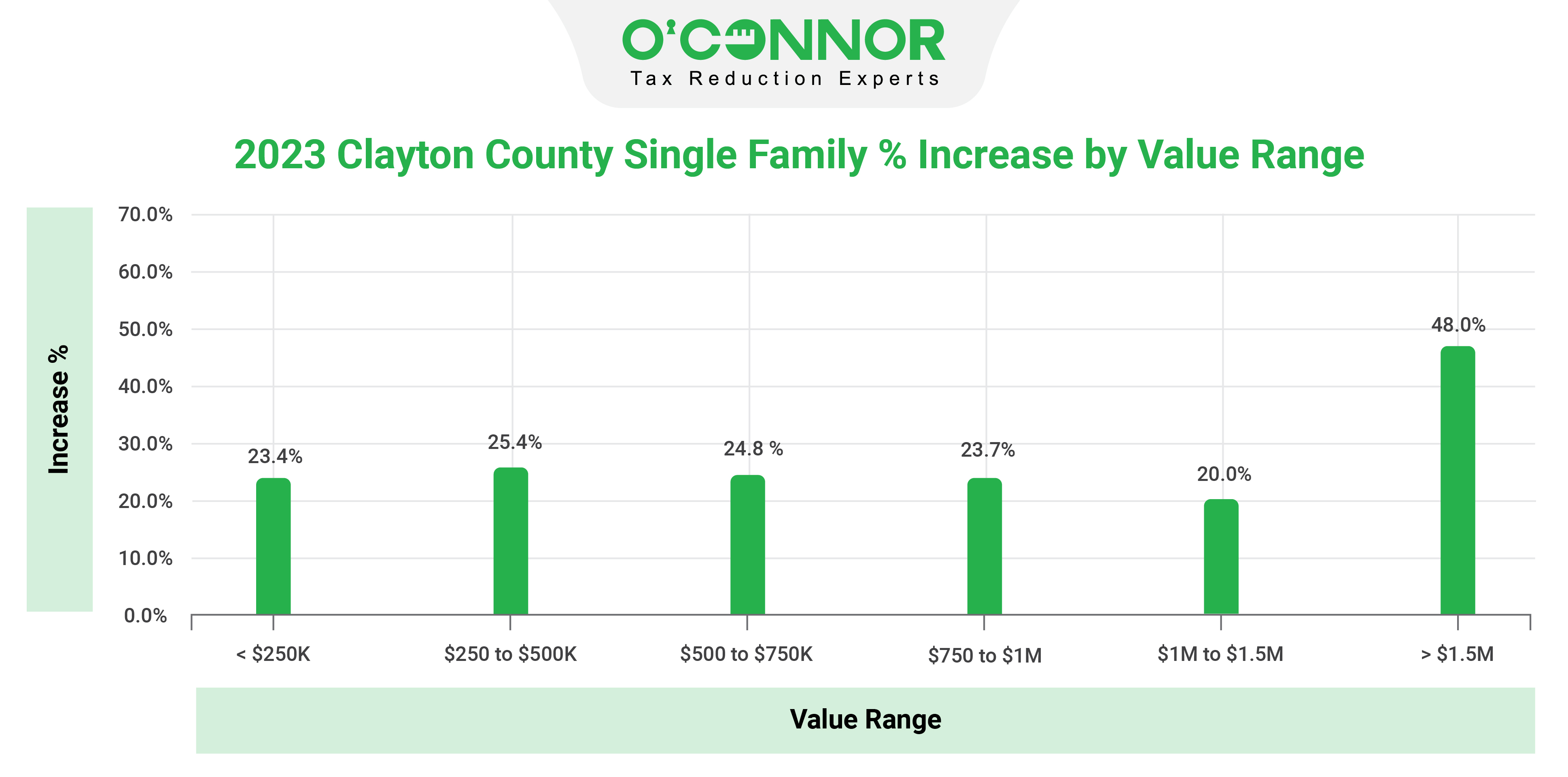

A median property in Clayton County has increased in value by 24.3%, but residences over the $1.5M price range have been impacted harder, seeing their homes growing in value by 48%. Homeowners in the $250K to $500k price bracket are also experiencing the burden as a result of 25.4% higher evaluations for 2023.

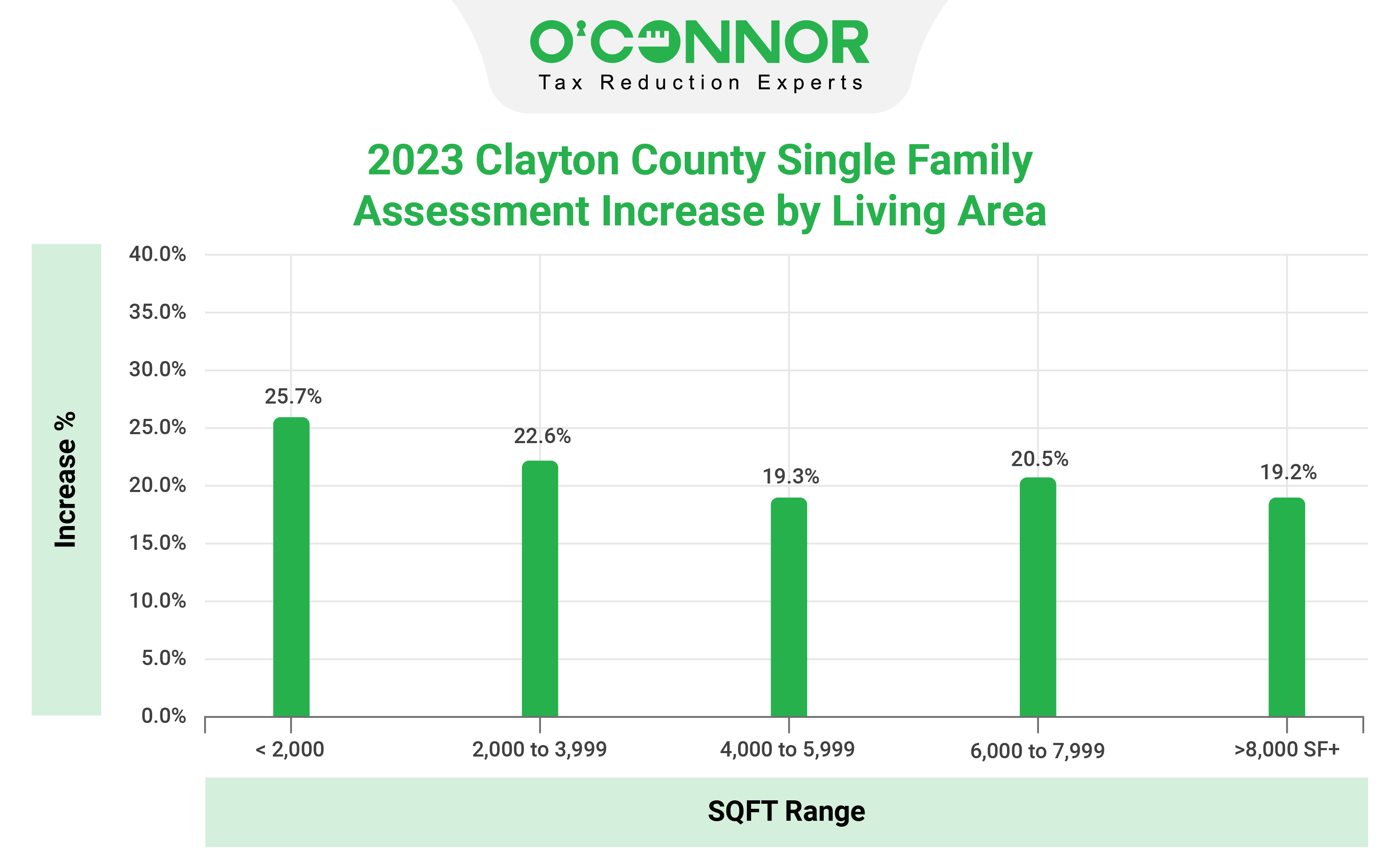

In Clayton County, single-family houses with fewer than 2,000 square feet have seen the most gain in value. Property tax assessments increased by 20.5% for homes between 6,000 and 7,999 square feet and by 22.6% for homes between 2,000 and 3,999 square feet.

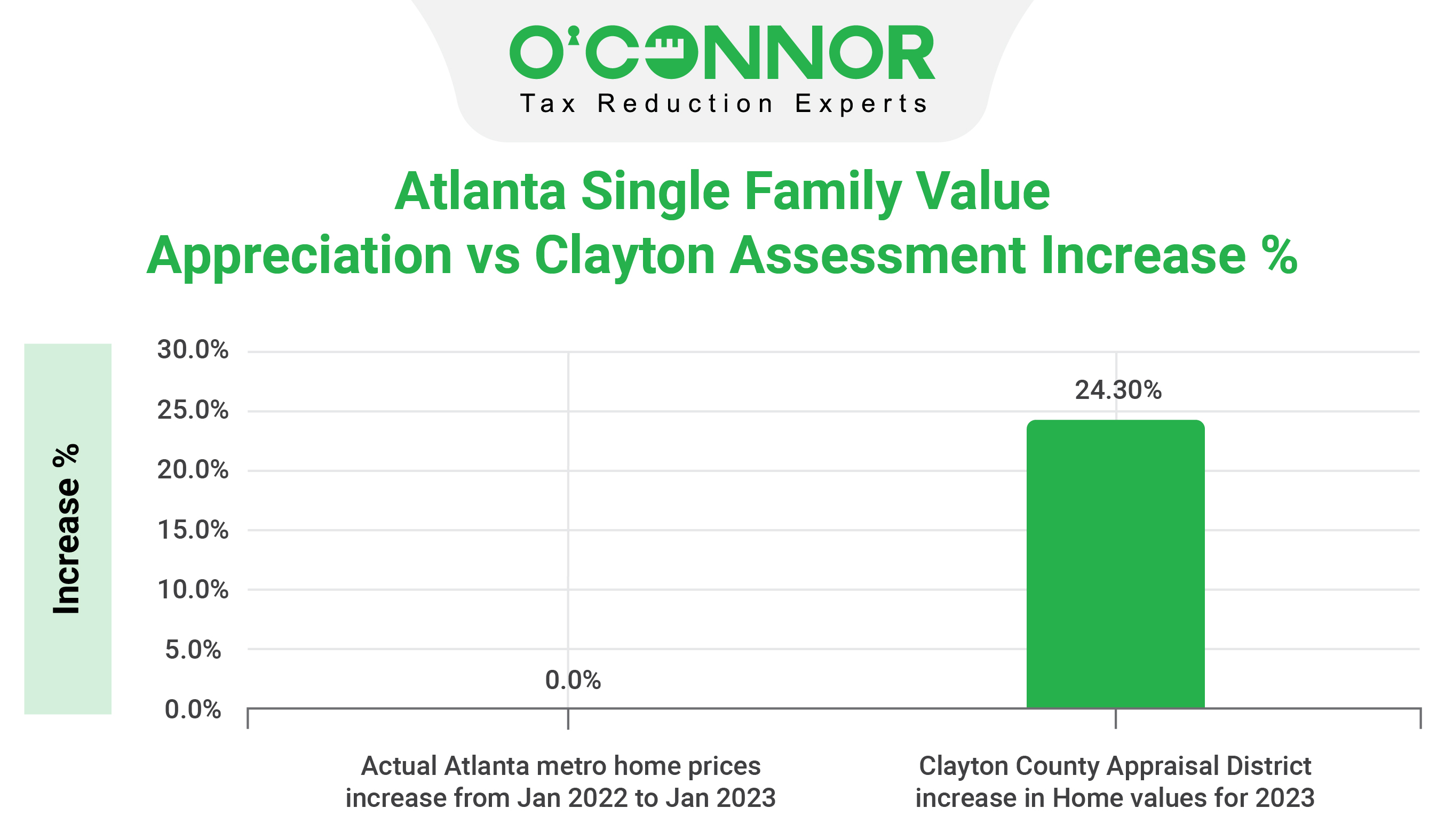

Despite a decline in housing costs as indicated by the Actual Metro home sales price data, Clayton County property tax valuations rose by 24.30%. To put it simply, assessments in the metro region rose sharply while sales showed zero increase.

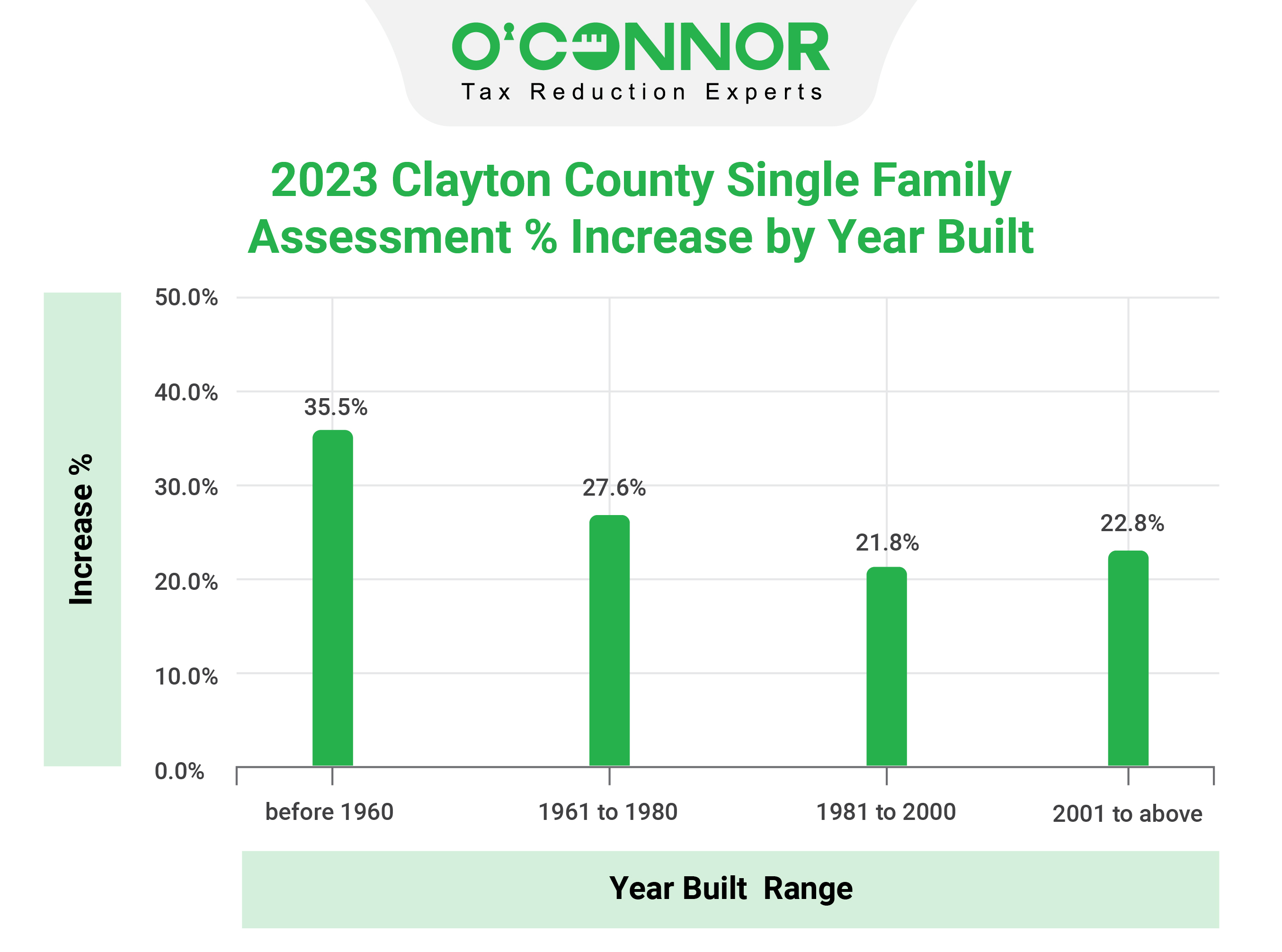

In 2023, assessments for Clayton County residences built between 1961 and 1980 jumped by 27.6%, with those built before 1960 seeing the largest rise at 35.5%. Single-family homes constructed between 1981 and 2000 were least affected, however, assessment values in these homes still rose on average by 21.8%.

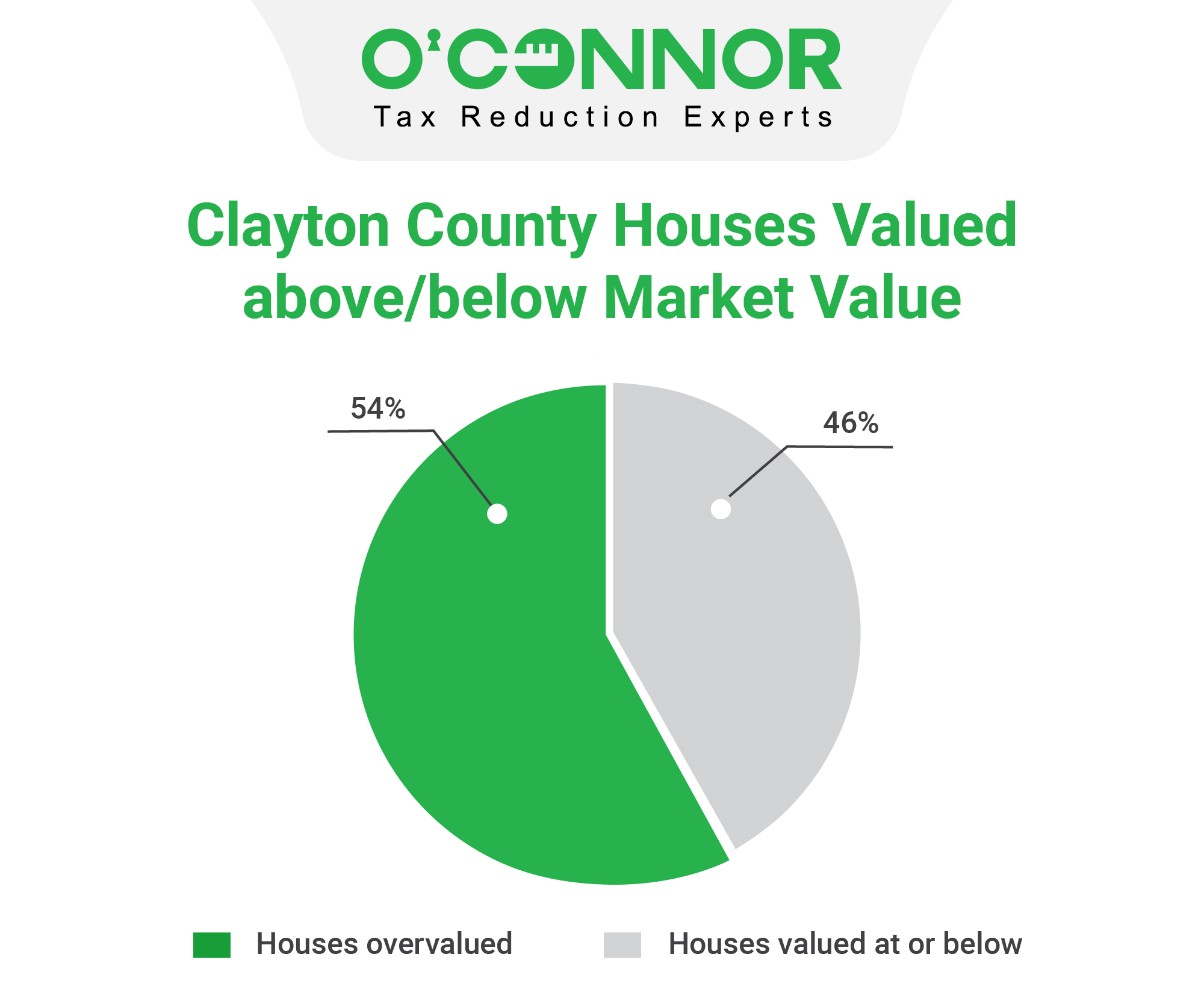

In the example above, residences in Clayton County with taxable values higher than their market values are compared to those with values that are lower. Only 46% of the properties in Clayton County were priced below market value, compared to 54% that are over market value.

The Clayton County Tax Assessor faces a challenging task when assessing dwellings spanning the entire county. The property owner has the obligation to inspect and the right to appeal. In 2023, when home values have risen by more than the typical 24.3% and 54% of them are above market value, it could be worthwhile to take another look.