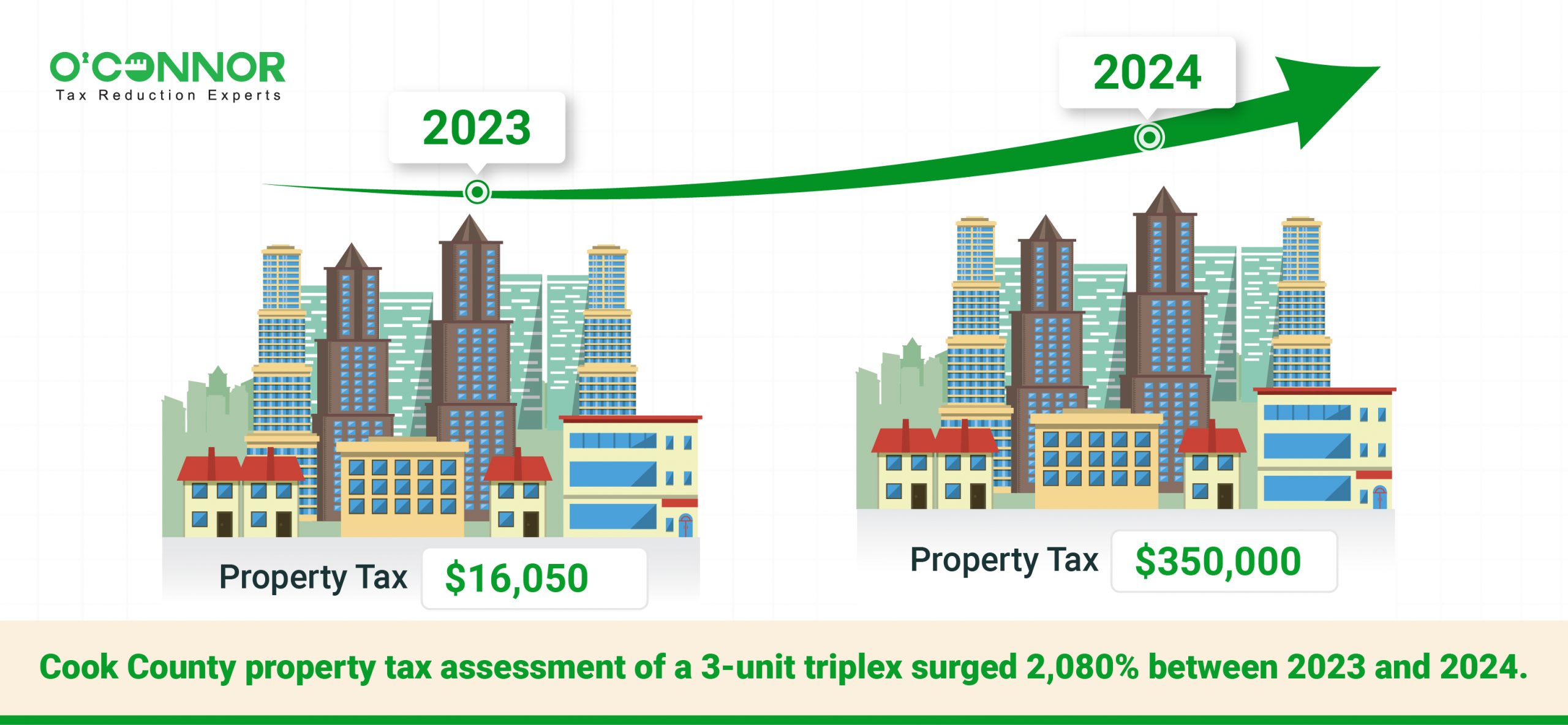

The owner of the 3-unit triplex at 1633 S Avers Avenue (Chicago IL 60623) saw their Cook County property tax assessment increase 2,080% between 2023 and 2024. This is not a typo. The Cook County Assessor increased their opinion of the value of this property from $16,050 ($5,350/unit) to $350,000 ($116,667/unit). How can the value of a 3-unit rental property increase from $5,350 per unit to $116,667 per unit in one year?

Is This Large Increase Justified?

The first reaction when seeing such a massive increase is that the owner must have added a building or completely remodeled the property. Alternatively, perhaps the property sold recently, and the assessor realized the sales price was much higher than the assessor’s estimate of market value. But these do not appear to apply to 1633 S Avers. The Cook County Assessor reports no recent sale and no remodeling for this 109-year-old residential property.

The 2024 total market value soared to $350,000 in 2024 from $16,050 in 2023. The total assessed value was $1,605 in 2023 but was raised to $35,000 in 2024. After reviewing the information available on multiple sources, there is no explanation for such a colossal increase in property taxes:

- The property has not sold since 2018, when it sold for $25,000.

- No permits have been issued according to the Cook County Assessor.,

- Cook County Assessor does not show that buildings were added,

- The property was built in 1915, so the issue is not the building was partially completed in

2023 and completed in 2024.

Can there possibly be any rational reason for such a large increase for an old building with no renovations, no new buildings and no recent sale? Is it possible that the value of a West Chicago Township duplex rose 20-fold in one year? If this year’s value is correct, was last year’s value only 5% of market value. Alternatively, is the 2024 value much higher than market value?

Cook County Assessor Property Description

The Cook County Assessor reports this triplex has 3,885 square feet of gross building area and 2,900 square feet of land. It was built over a century ago, in 1915, or 109 years ago. The assessor also reports the building is in average condition, has never been renovated, has not had a kitchen remodel nor an exterior remodel.

Surrounding Properties

This three-story triplex is skinny, deep, and has a flat roof. It appears there is one unit per floor. The building exterior is brick. It is located in a mostly residential area.

Property Location

This triplex is on the east side of S Avers Avenue, south of West 16th and north of West 18th. West 16th appears to be a major thoroughfare and includes two pharmacies, a soul food restaurant and a Kipp School near West 16th and S Avers Avenue. Most of the properties near the subject are residential.

Can the Cook County Assessor Legally Increase Property Taxes over

2,000%

Yes, there is no cap on the amount of tax assessment increase, and property tax increase in one year. Since there is no renovation and no new buildings and no recent sale it appears two explanations are most likely:

1) The assessor made a gross error in 2024 and massively over-valued the property (or)

2) Last year’s value was just a pittance, only 5% of market value. The photos on the Cook County Assessor site do not indicate a recent renovation.

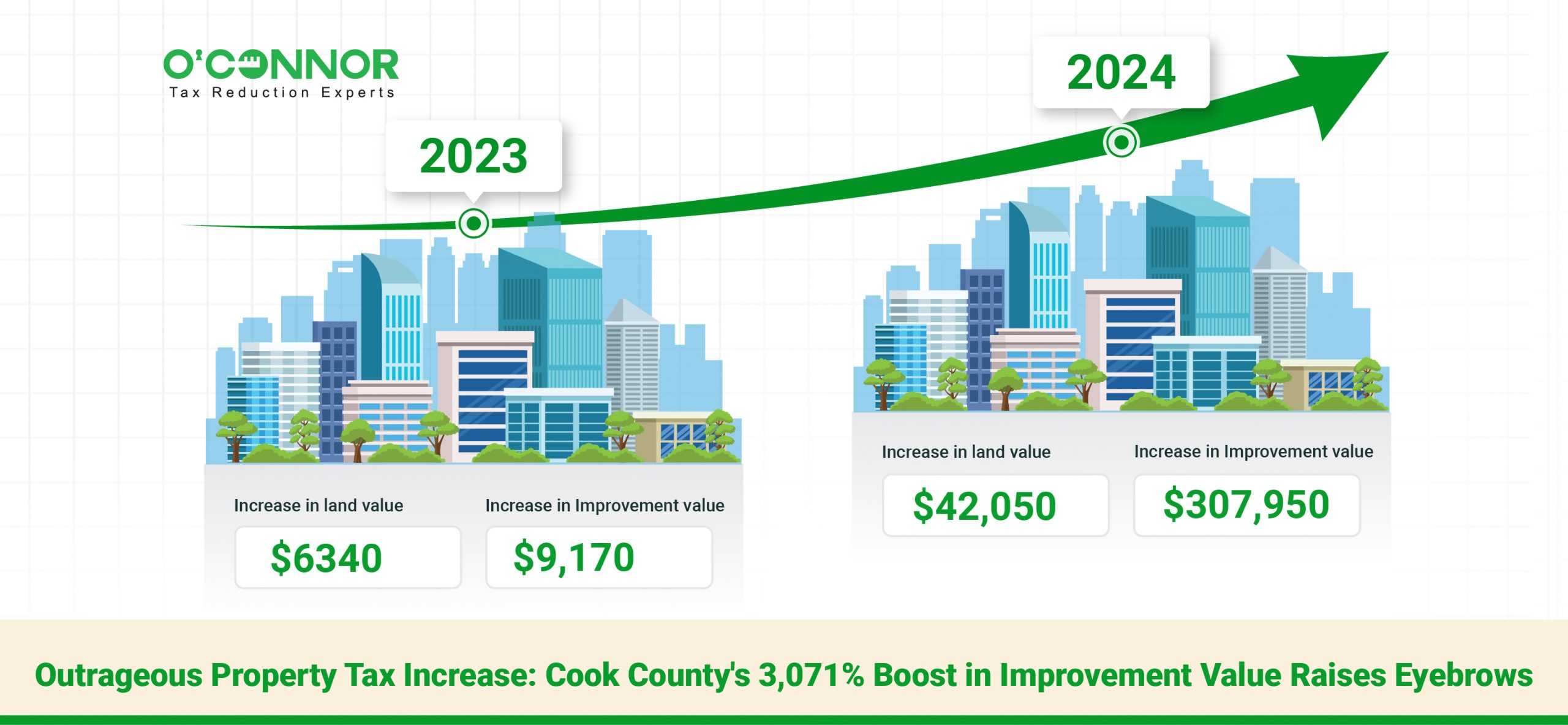

The Cook County Assessor increased the land value by over 500% ($6340 in 2023 to $42,050 in 2024). A 500% increase seems outrageous. But wait; the big increase was on the improvements, a 3,071% increase (from a market value of $9,170 to $307,950 in 2024). Even if this increase is legal, it is disturbing in the absence of evidence to support such an increase.

What Really Happened Here?

It appears the 2023 value was only perhaps 5% of market value. This raises the issue of fairness, if you recently purchased a property, and the assessor raised your value to the purchase price, is your property tax assessment equitable?

If in fact this property was only assessed at 5% of market value last year, and other similar properties in Cook County were valued at or near 100% of market value (such as recent sales), this would not be legal or constitutional.

The Illinois Constitution provides the following guidance for real estate taxes:

SECTION 4. REAL PROPERTY TAXATION

(a) Except as otherwise provided in this Section, taxes upon real property shall be levied uniformly by valuation ascertained as the General Assembly shall provide by law (emphasis added).

What Opportunity Does the Requirement for Uniform Taxation Provide?

The provision of the Illinois constitution providing for uniform taxation provides opportunity for those whose valuation is near 100% of market value if other properties are valued lower levels. Property tax consultants refer to this as “uniform and equal” or “equity”.

After helping property owners reduce their property taxes for 40 years, it is crystal clear to me that,

- Property taxes are unpopular but people understand the need for local government funding, and

- Irritation with property taxes become indignation, disapproval and shock when owners believe they are taxed unfairly.

Hence, the constitutional right to protest property taxes because of inconsistent tax assessments is equally important as the right to protest taxes because the assessment exceeds market value.

Unequal Appraisal for Cook County Residential Protests

Most Cook County property tax protests for residential property are based on unequal appraisal. Based on recent sales, it appear more likely that the value was quite low in 2023. In that case, it means buildings like this (valued substantially under market value) are an excellent source of assessment comparables for an unequal appraisal protest.

How Does Unequal Appraisal Work?

Fundamental fairness demands that similar properties are taxed similarly. The classic unequal appraisal case occurs when the assessor substantially revalues one property but not other similar properties. Most state constitutions, including Illinois, require uniform and equal taxation for like properties. Owners of property valued at market value, perhaps due to a recent sale, have a sound basis for appealing property taxes. Unless the assessor is valuing everyone at full market value, no individual properties should be assessed at market value. It is just not fair.

Your Next Steps

We encourage you to appeal on unequal appraisal if you haven’t already. It is simple. You just have to find similar properties that have a more favorable level of assessment. It does not matter whether or not your assessor market value is already below market value. If other properties have a more favorable level of assessment, your property taxes should be based on the more favorable tax assessment comparables.

Why Do Such Large Variances Exist?

The Cook County Assessor has limited resources and time available. Their valuation process is not similar to the process followed by independent licensed fee appraisers. Independent licensed fee appraisers routinely inspect the subject property, drive by the comparable sales and make adjustments for the comparables. Fee appraisers value based on comparable sales, but assessors typically use the cost approach to value residential property.

The cost approach is used by tax assessors value residential, including duplexes, triplexes and fourplexes. This cost approach is the least reliable method of valuation, particularly for older properties. Assessors use a series of data tables and math to estimate value. They have tables to describe the subject property, tables for replacement cost and tables for depreciation. However, all the tables are just estimates. They are approximately correct, and in some cases generate grossly unreliable results. Sometimes the cost approach overstates value and sometimes it understates value. Depreciation tables used by assessors rarely address functional obsolescence and economic obsolescence, and both are critical and essential components of correctly calculating market value with the cost approach

Inaccurate property data + inaccurate cost data + incorrect depreciation = valuation errors. The issue is not whether or not the appraisal district has the correct property data and cost data; they don’t. The issue is how inaccurate is it and how consistently is it applied.

You Can Reduce Your Property Taxes Assessor Errors

Each assessor tends to have a slightly different process, often developed as the office standard over decades. The assessor will not change their valuation process for you, but they will correct your value if you protest and provide a basis for reduction. And even if the assessor does not make it right, you can appeal to the Cook County Board of Review and further. While you can’t correct an inherently unreliable valuation system, you can make sure you don’t pay more than your fair share. O’Connor recommends the following three steps to reduce your property taxes:

- Check to see if the assessor has overstated the quantity or quality of improvements or if they have overstated the amount of land,

- File your homestead exemption is applicable, and

- Protest regularly, especially in triennial revaluations.

Responsible Property Ownership Manages Property Taxes

Routine maintenance is part of property ownership. Most of us visit the dentist regularly. You paint the exterior of the house as needed. You change the filter in your refrigerator. You regularly change the oil in your car. You periodically have your HVAC / heating serviced. Consider making protesting your property taxes one of the routines measure to safeguard and protect your assets. The unknown fact is that most property tax protests reduce property taxes. There is typically no downside and great upside potential if you protest regularly.