O’Connor performed a ratio analysis on Cobb County, Georgia property values, finding the typical home’s median time-adjusted sales price is $363,000. Additionally, the median assessed value is $373,050, $11,050 more expensive than the going rate for the average home. As a result, the typical Cobb County residential property is overvalued by 3.2%. The analysis compares the time-adjusted sales price to the Cobb County tax assessor’s projected value for 2023.

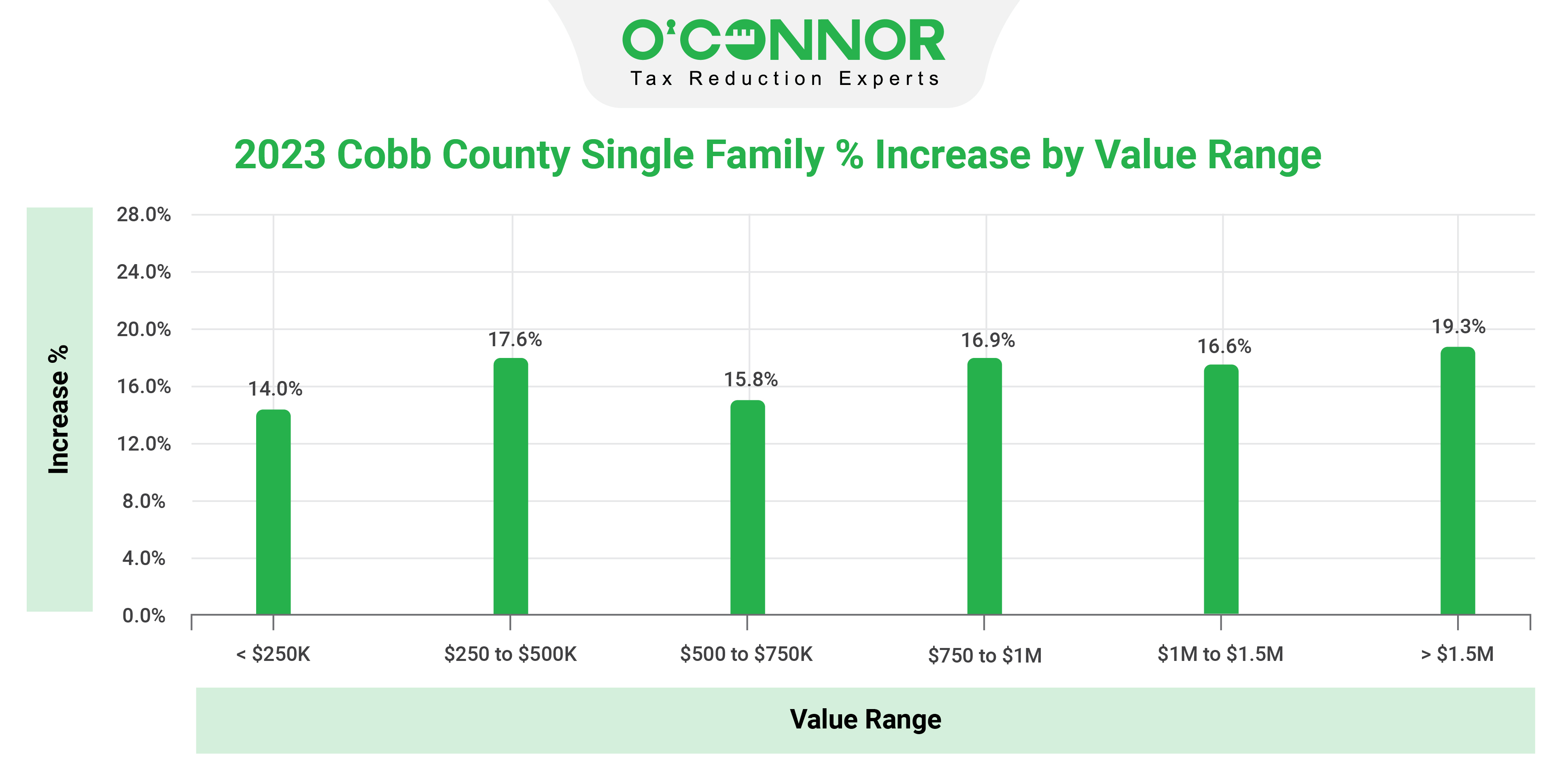

Cobb County’s average value has climbed by 16.9%, but residences valued above $1.5 million have been impacted worse, seeing a 19.3 %increase in value. Appraisals for homes in the $250K to $500K bracket are 17.6% higher for 2023, which is hurting those properties as well.

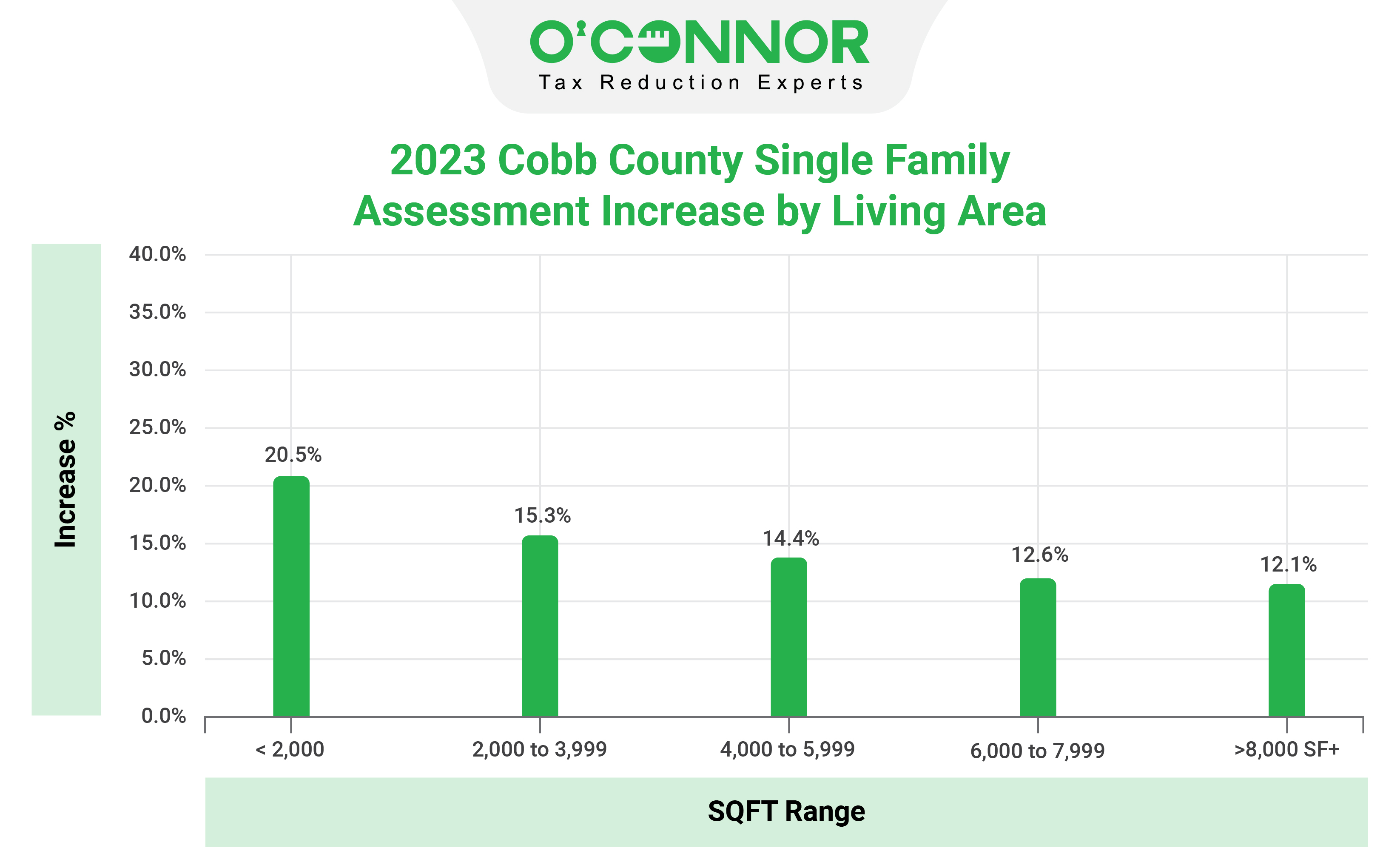

The highest increases in property tax assessments occurred in the properties with the smallest square footage. Property tax assessment increases were 20.5% for homes under 2,000 square feet, while properties exceeding 8,000 square feet saw an increase of 12.1%.

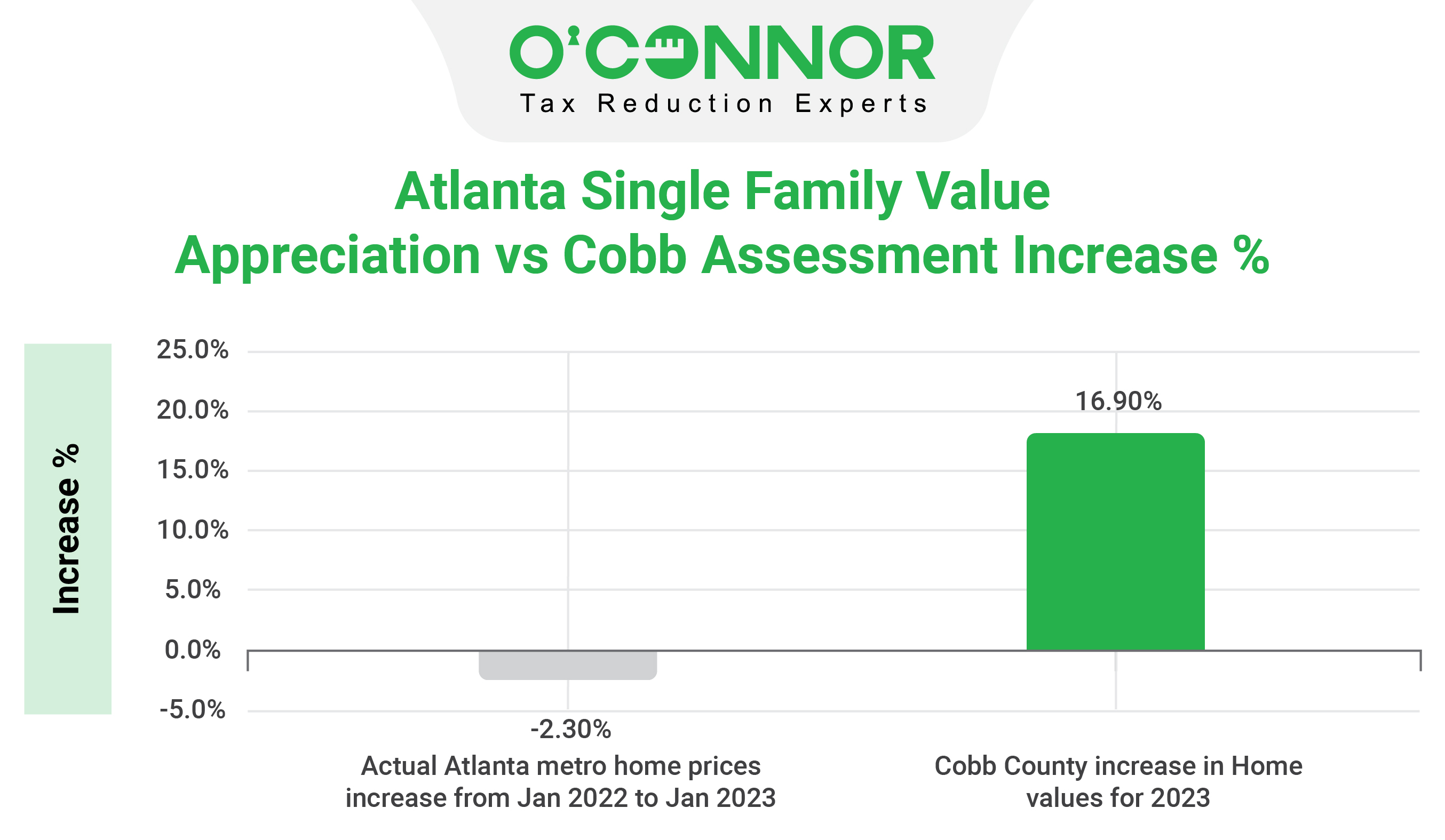

Residential values decreased by 2.30% according to Atlanta Metro sales price data, while property tax assessments skyrocketed by 16.9%. As a point of reference, this demonstrates how metro sales average home prices decreased from 2022 to 2023 but Cobb assessments continued to rise.

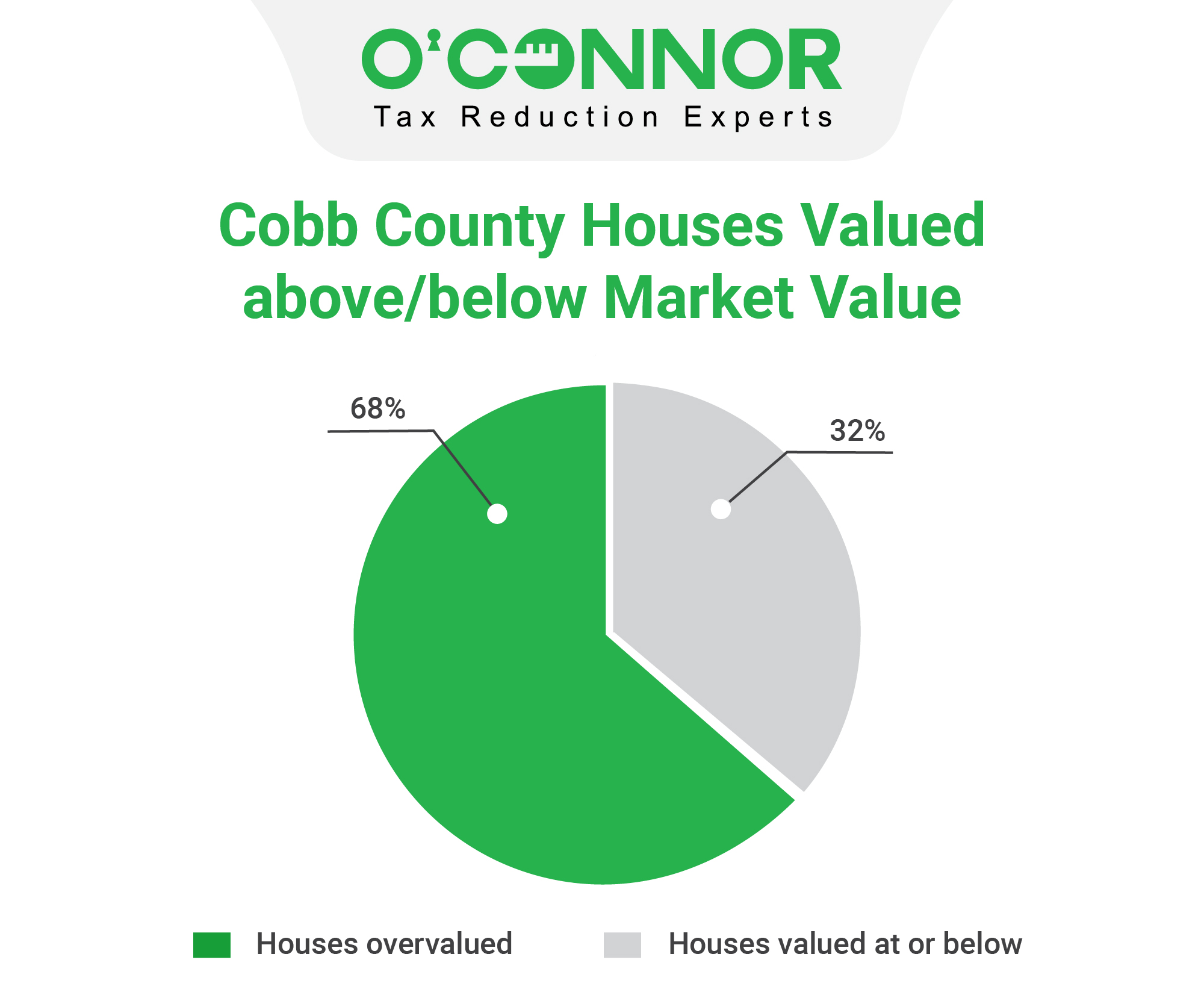

The homes in Cobb County with assessed values higher than their market values are contrasted with those with lower values in the chart. 32% of the properties in Cobb County are undervalued, while roughly 68% are overpriced.

In 2023, when home values have risen by more than the average 16.9% and 8,957 accounts, or 68% of them, are overvalued, it is appropriate for homeowners to carefully check their assessments. Because of the number of properties, the Cobb County Tax Assessor’s task of figuring out the worth of each house in the county is quite challenging. Property owners must take their appeals rights into account.