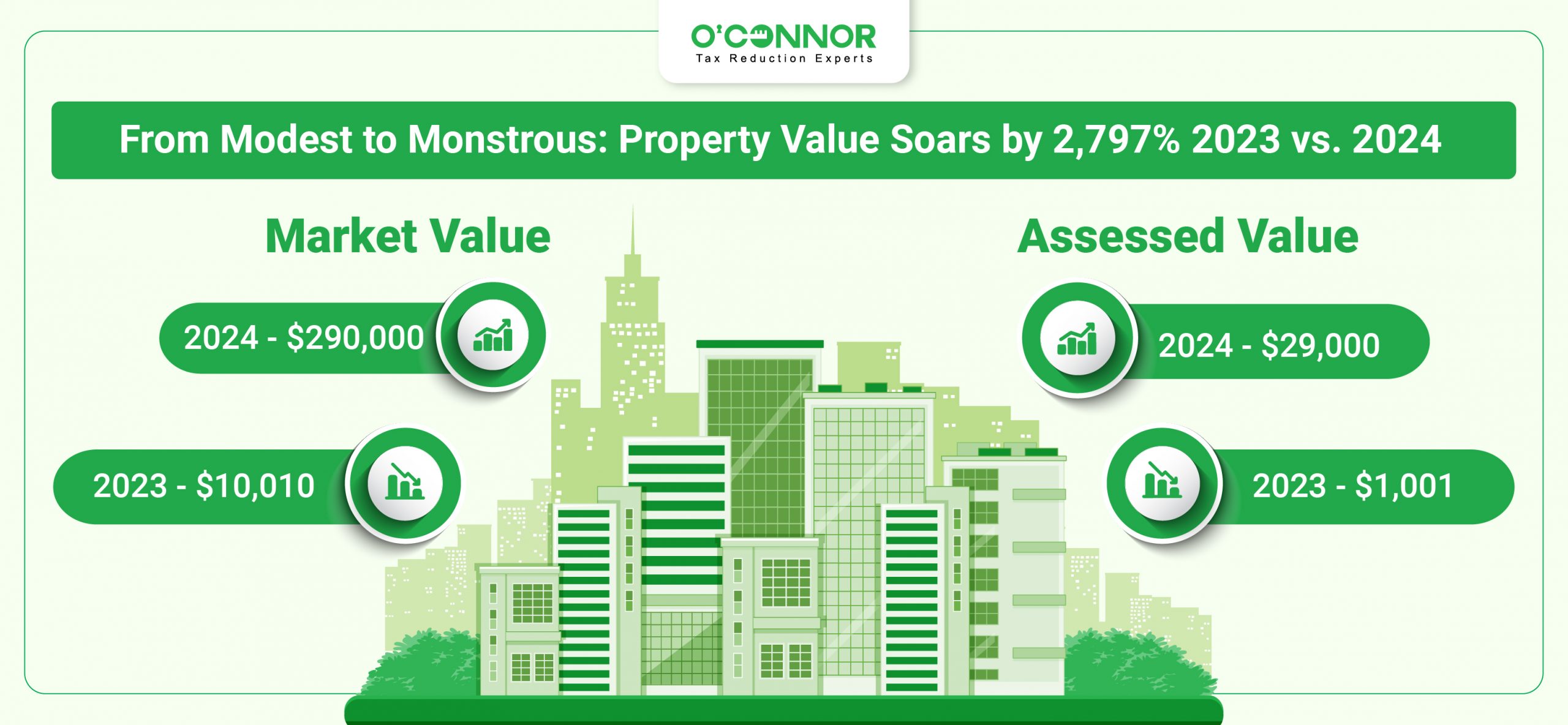

The Cook County Assessor raised the market value of 626 N Long Avenue, Chicago by 2,797% in just one year! This is for a duplex in West Chicago Township.

The 2024 total market value was bounced to $290,000 in 2024 from $10,010 in 2023. The assessed value rose to $29,000 from just $1,001 in 2023! The basis for such a massive increase is not clear:

- The property has not sold since 2017,

- Cook County Assessor does not indicate any permits have been issued,

- Cook County Assessor does not show that buildings were added,

- The property was built in 1934 so the issue is not the building was partially completed in 2023 and completed in 2024.

So, how is it possible that the value of a West Chicago Township duplex rose 28-fold in one year? If this year’s value is correct, was last year’s value only 3% of market value. Alternatively, is the 2024 value much higher than market value?

What is the Basis for Such a Huge Property Tax Increase?

With no recent renovation and no sale, it appears that either last years value was really low or this year’s value is exceptionally high. The photos on the Cook County Assessor site do not indicate a recent renovation.

However, the market value of improvements rose from $3,330 in 2023 to $195,200 in 2024, a 5,761% increase in one year just on the improvements. Even if this is not a world record property tax increase, it is highly unusual.

Can You Afford for Your Property Tax Bill to Increase 28-fold in One Year?

Unless you protest, the initial guesstimate by the county assessor is the value you WILL pay taxes upon. The assessor has a difficult job in valuing hundreds of thousands of properties with limited staff and resources. However, their mistake IS your problem, unless you appeal their initial estimate of value. Actual property taxes are not available, but it appears the increase in property taxes for 2024 is as follows:

→ 2023 Property Taxes: $210

→ 2024 Property Taxes: $6,080

→ One-Year Increase in Property Taxes: $5,870

Cook County Property Data

This duplex has 2,321 square feet of gross building area and 7,900 square feet of land, according to the Cook County Assessor. It was built during the middle of the Great Depression in 1934, or 90 years ago. Cook County Assessor further reports the building has not been renovated (ever) and is in average condition.

Surrounding Properties

This two-story building is deep and narrow and has a pitched roof. It appears part of the building is wood exterior, and part is masonry exterior. It is located in the middle of a residential subdivision with residential buildings to the east, west and south and a vacant lot to the north.

Property Location

This 2-unit residential building is located on the west side of Long Avenue, south of West Huron Street and north of Ohio Street. Long Avenue is a tertiary road with residential property. West Huron and Ohio secondary traffic roads with a mixture of mostly residential with some commercial properties.

What Happened Here?

Here is what we know:

- The 2024 property taxes will be 28-times as much as 2023 unless the value is reduced by protesting.

- Neither a sale, construction activity nor permits indicate any material change in the property. .

There appear to be just two conclusions:

- Last year’s value was incredibly low or

- The assessor grossly overshot in 2024.

What This Means for You

Protests on unequal appraisal are the basis for most property tax appeals in Cook County for residential. Based on recent sales, it appear more likely that the value was quite low in 2023. In that case, it means buildings like this (valued substantially under market value) are an excellent source of assessment comparables for an unequal appraisal protest.

What Is Unequal Appraisal?

Unequal appraisal is the concept that owners of similar properties should be valued consistently for property taxes. If some properties are valued at full market value, perhaps due to a recent sale, and others are valued at deed discounts from market value, the underassessed properties trump market value. It is more important that property taxes be fair and equally distributed than to have individually properties “fully valued” while others pay just a fraction as much.

Next Steps for You

Appeal on unequal appraisal if you haven’t already. Just identify similar properties near your property that are assessed at a much lower level, and you have the evidence needed to prevail in an unequal appraisal protest!

How Is It Possible for Such Large Disparities to Exist?

Cook County Tax Assessor Estimates of Market Value

Property tax assessors have limited resources and time to value property. They do not follow the same process as fee appraisers in inspecting the property, inspecting the comparables and making adjustments for the comparables.

Tax assessors value residential, including duplexes, triplexes and fourplexes using the cost approach to valuation. It is the least reliable approach to value, particularly for older properties. They use tables of data regarding your property, estimated costs to build a similar property, deduct depreciation for age, functional obsolescence and economic obsolescence, and finally add back the value for land.

The problem with the cost approach used by tax assessors is that the property data is not reliable, the cost estimates are just estimates and the assessor models rarely properly apply depreciation. (They typically just adjust for age / physical depreciation with no consideration for functional or economic obsolescence.)

Inaccurate property data + inaccurate cost data + incorrect depreciation = valuation errors. The issue is not whether or not the appraisal district has the correct property data and cost data; they don’t. The issue is how inaccurate is it and how consistently is it applied.

Assessor Errors Provide Tax Reduction Opportunity

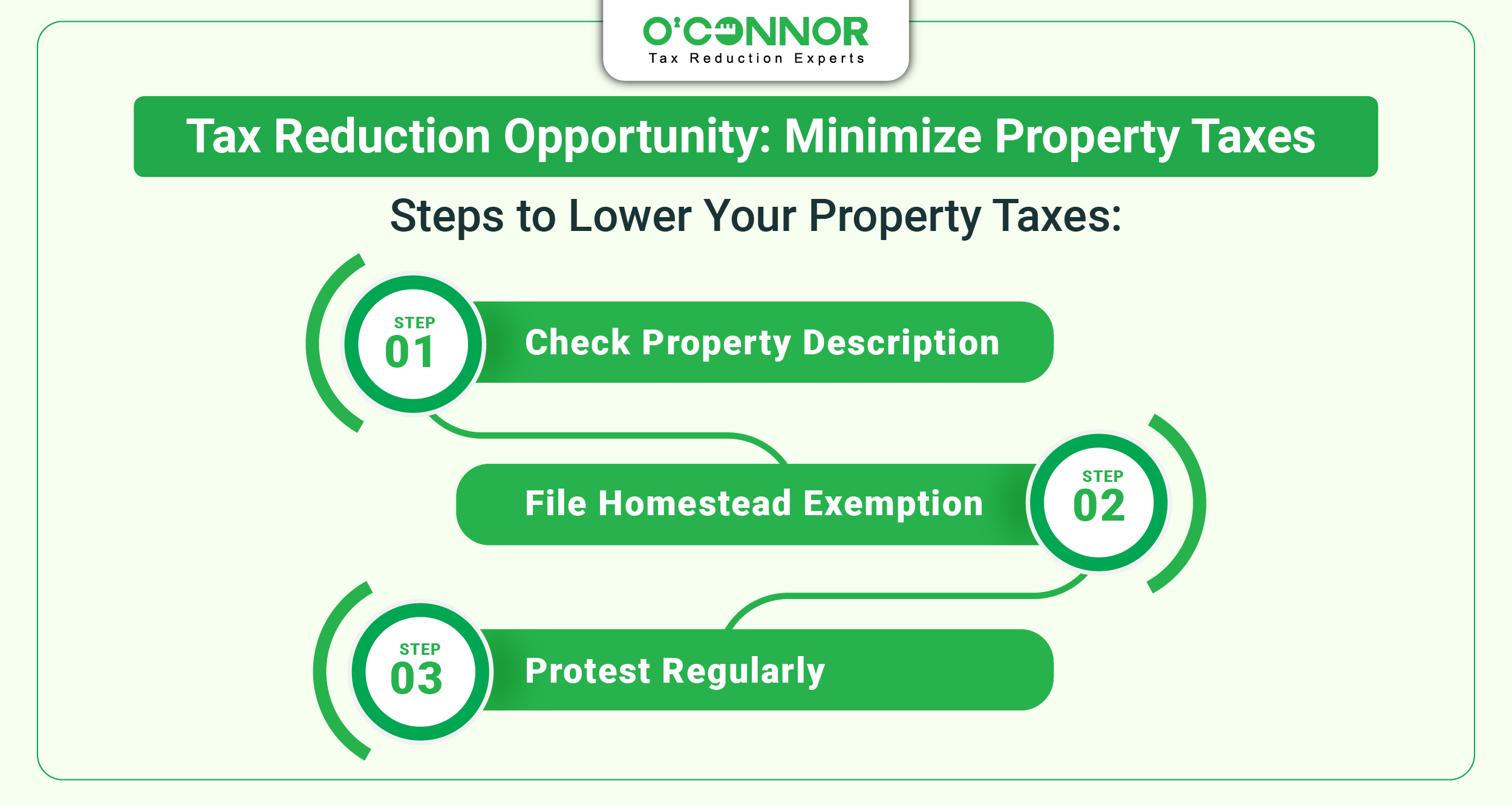

You can’t change the process used to value property by assessors. However, you can make sure you don’t pay more than your fair share. The first three steps to minimize your property taxes are:

- Check the property description on the Cook County Assessor site to determine if they have overstated the quantity or quality of improvements or if they have overstated the amount of land,

- File your homestead exemption if applicable, and

- Protest regularly, especially in triennial revaluations.

Tax Appeals are a Responsibility of Property Ownership

You regularly change the oil in your car. You likely have your HVAC / heating serviced periodically. We strongly encourage protesting your property taxes. Most appeals are successful, and you likely will pay more than your fair share unless you protest regularly.