Are you looking for new strategies to increase cash flow for your medical facility, then this is the best time to opt for a cost segregation study. If you are planning to construct a new medical facility or purchase an existing building then cost segregation will help you reduce your income tax liabilities and also add cash flow to your bottom line.

How does cost segregation work?

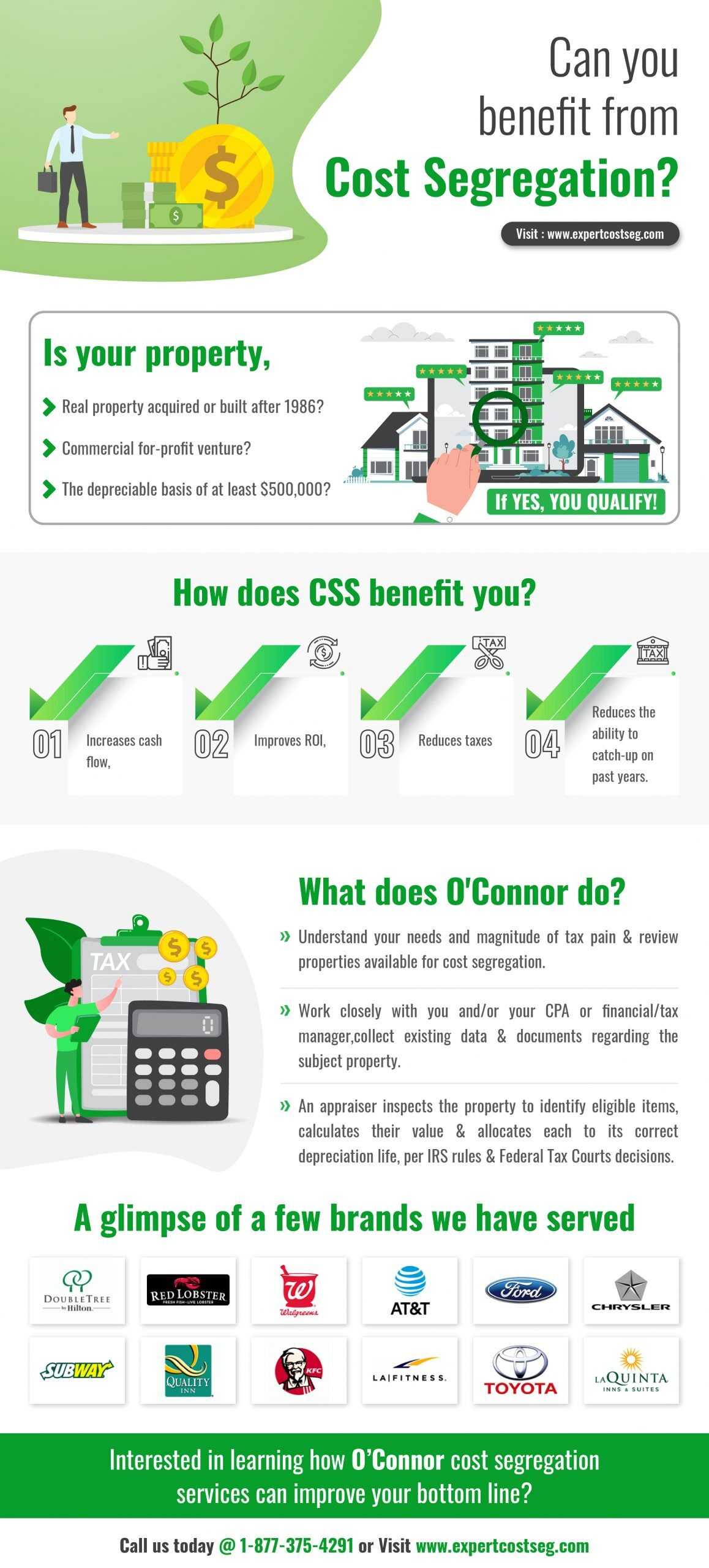

A CSS identifies and classifies assets of the medical facility to minimize the income tax burden. The building however is depreciated over 39 years but a few components of the building have a shorter life and can be depreciated over a period of 5, 7, or 15 years.

Purchasers now can head back up to 1987 to correct the tax lives of assets that could have taken advantage of the Modified Accelerated Cost Recovery System. Taxpayers are now allowed by the IRS to change their depreciation accounting method which helps them take advantage of accelerated depreciation. The difference from the past years is written off in the current year as a lump sum.

Is CSS a DIY project?

As per the IRS guidelines, the assets are required to be assigned to the right asset class using the right method and a proper recovery period. This requires an engineering approach along with expertise in tax accounting. The expertise of an appraiser and a valuation expert is required too in order to allocate the purchase price of a property. Hence, a cost segregation study cannot be considered a DIY. However, some firms specialize in providing cost segregation services as per the IRS guidelines. Cost segregation studies offered by O’Connor are IRS tested, CPA approved, and warrantied for the duration of your ownership of the asset studied! Satisfaction is guaranteed; if not satisfied, you do not pay.