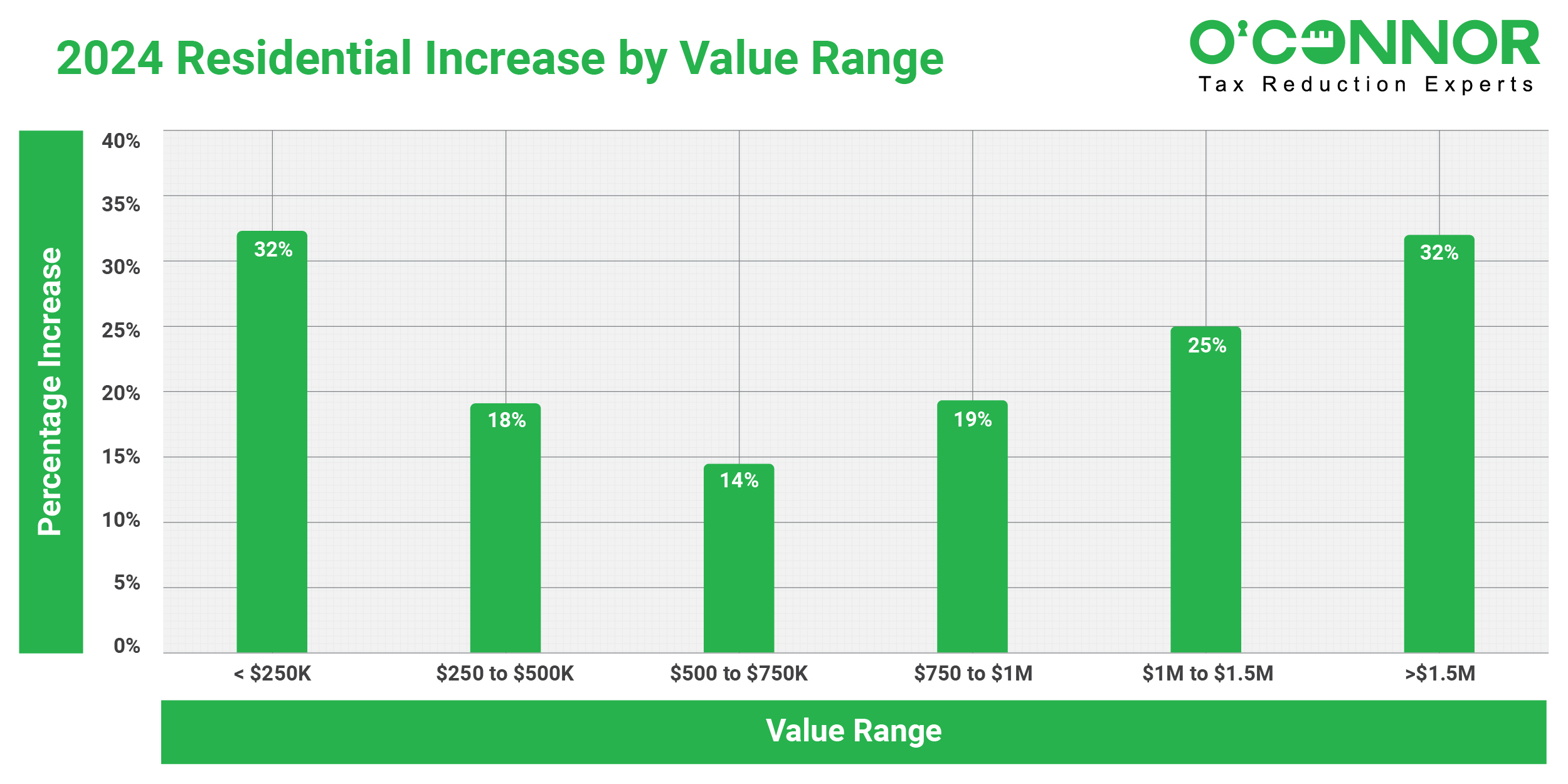

Residential Assessment Surges

Property owners in Cook County are all too familiar with the ascent of their home values. In 2024, residential property in West Chicago Township has collectively jumped from just over $38 billion to $45.9 billion, an increase of 21%. The climb in assessments is the most pronounced for homes in the highest and lowest value ranges. Property under $250K saw an average increase of 32%. Homes over the $1.5 million price point saw an equal escalation of 32%. It is a poor consolation to residential owners of homes in the $500K to $750K range to know that their values averaged the least gain in assessment with only a 14% rise in assessed value.

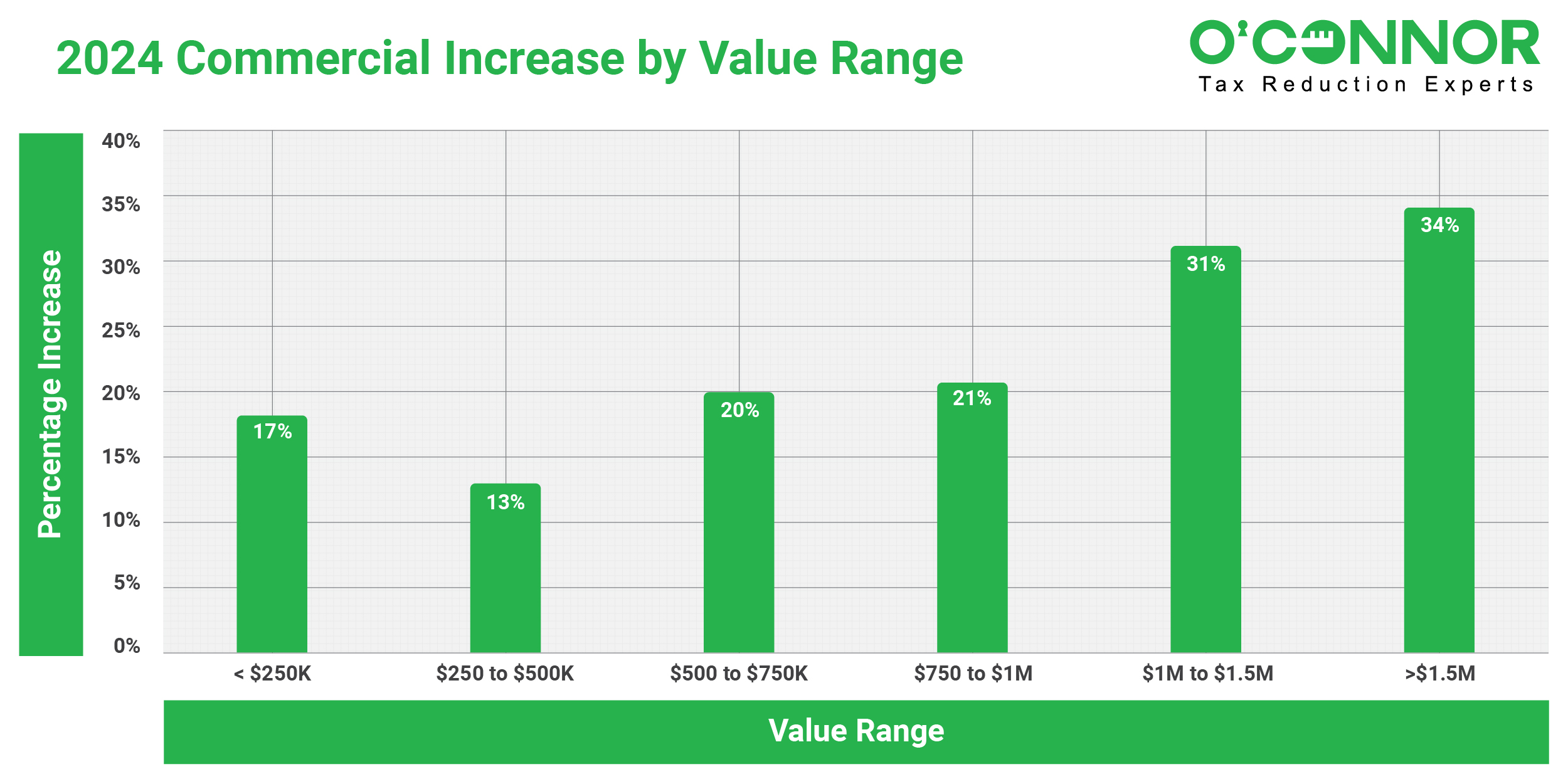

Commercial Values Gain Even More Pronounced

In contrast to homes, commercial property increases appear to have hit the highest valued accounts the hardest. Commercial property worth over $1.5 million in West Chicago Township of Cook County, Illinois was on average assessed at 34% higher in 2024 than in 2023. Owners of commercial properties valued between $250K and $500K witnessed the smallest percent increase of 13%. On average, commercial values rose 32%.

What Can Property Owners Do?

These numbers are just a snapshot, but they are illustrative of the alarming rise in assessments across Cook County. Property owners should take care to ensure that they have all exemptions for which they qualify in place and prepare to appeal. Understanding the appeal process can be daunting, but O’Connor is available to assist in the appeals process. Our licensed tax agents work closely with our team of researchers who maintain a proprietary database offering the best evidence to support sales and unequal appraisal reduction arguments. O’Connor partners with attorneys specializing in property tax to pursue every reasonable step available to secure a property tax reduction for our clients.