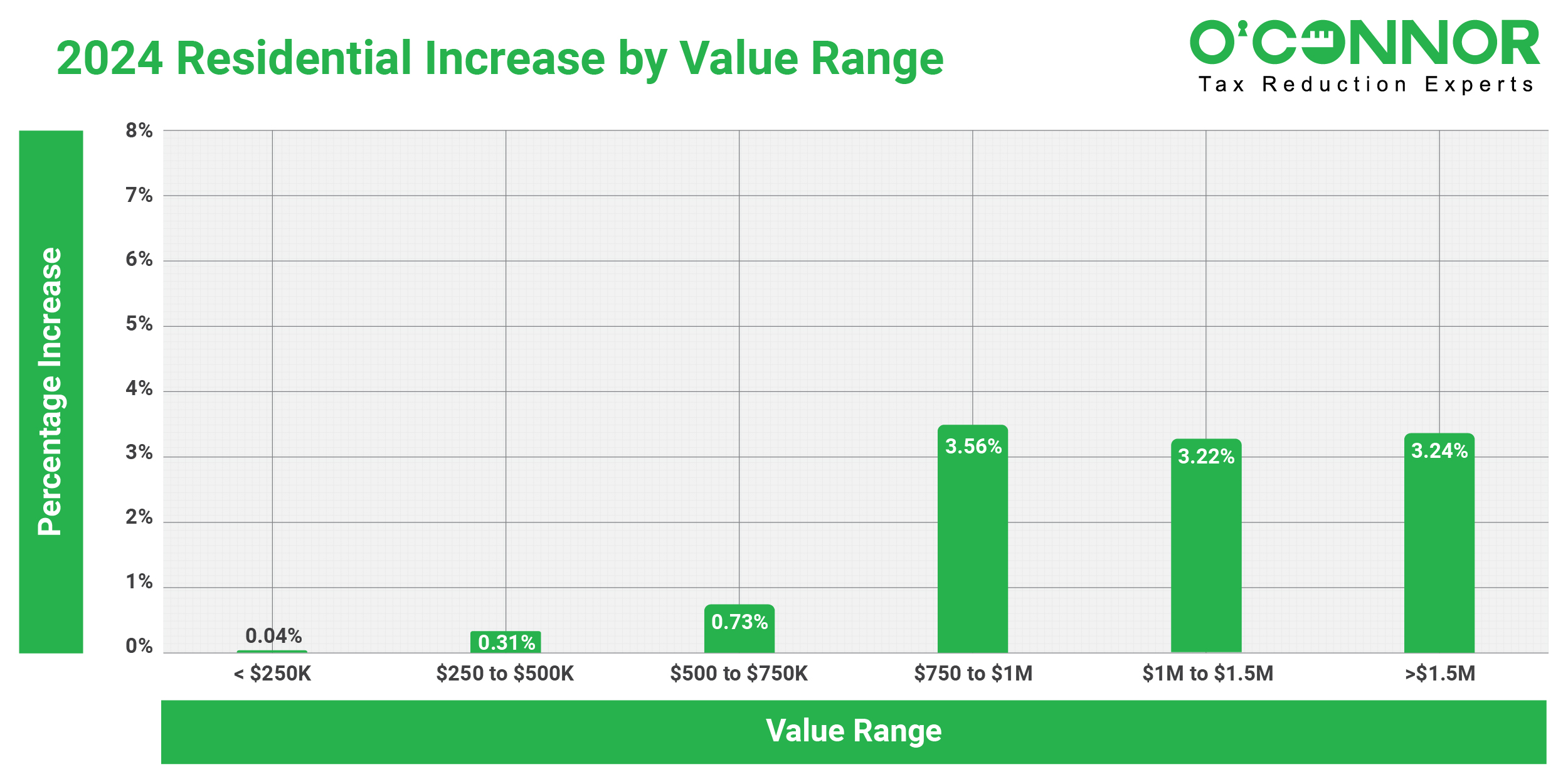

Residential Assessment Surges

Property owners in Palos Township, Cook County, experience an annual rise in their residential property market values. The residential property market in Palos Township experienced a modest increase of 0.5% from $6.1 billion in 2023 to $6.2 billion in 2024. The properties in the $1.5 million or higher value range experienced the most substantial value increase of 3.24%. The most substantial increases were observed in residences of higher value, while a relatively modest increase was observed in residences of lesser value. For instance, the value of residences valued at $250k or less increased by 0.04%. Properties valued between $750k and $1 million experienced a 3.56% increase.

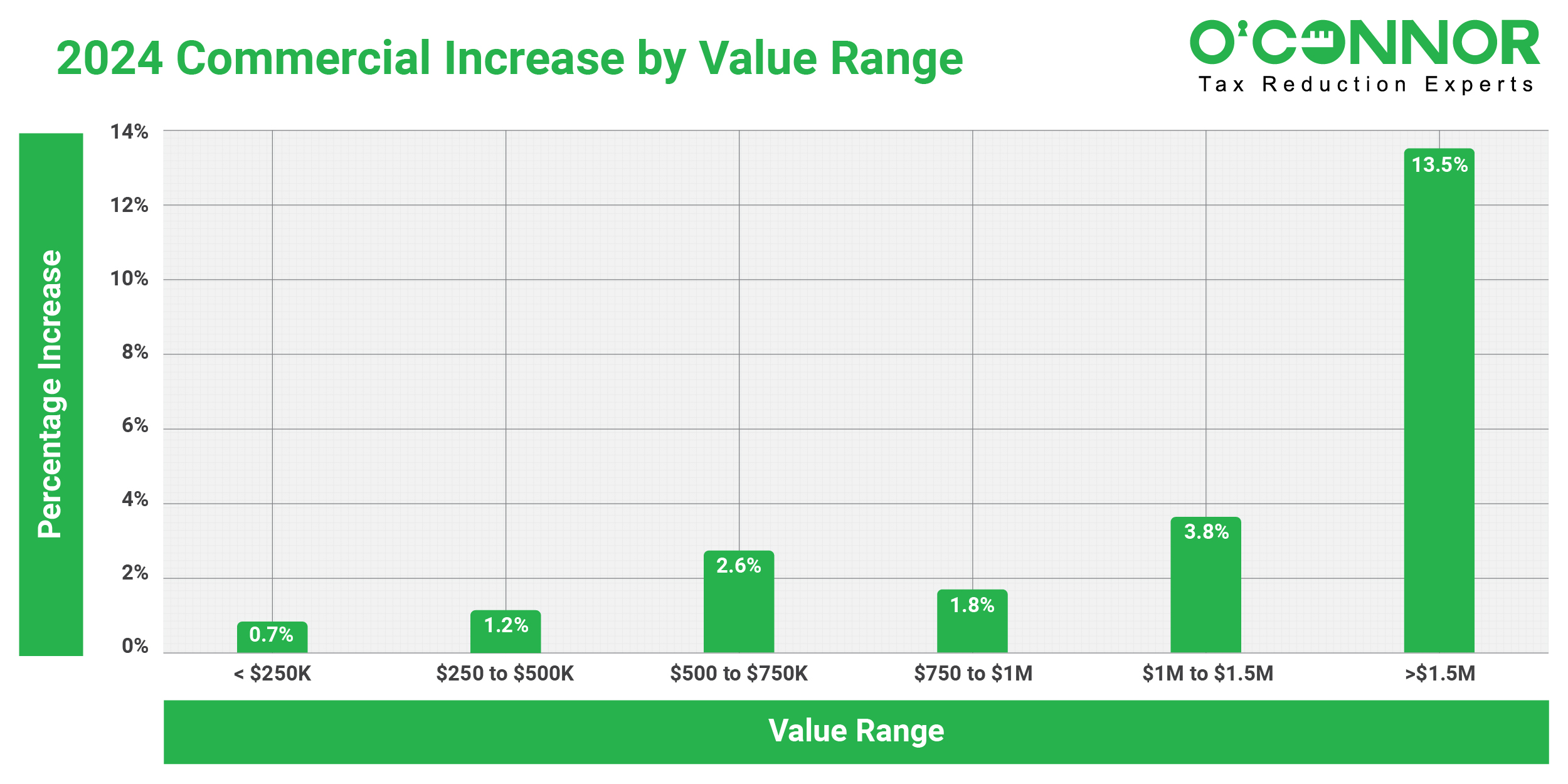

Commercial Values Gain Even More Pronounced

In contrast to residential properties, commercial properties in Palos Township have strikingly greater increases in value. Commercial values experienced a substantial increase of 8.0% for 2024. Palos township commercial property exceeding $1.5 million in 2024 find average assessment up 13.5%. Commercial property owners who own properties valued between $1 million and $1.5 million experienced a 3.8% increase. Moderate increases were observed in properties with a wide range of market values. A 2.6% increase was found in the value of properties between $500k and $750k.

What Can Property Owners Do?

The assessment for Palos Township in Cook County, Illinois, has increased significantly, as indicated by the graphs. In order to potentially obtain a reduction, taxpayers in Cook County must first determine whether they are eligible for any exemptions before protesting the assessment value. Residents of Cook County may reduce their annual property tax payments by applying for exemptions, provided that they are granted approval. The appeals procedure may be confusing to taxpayers; however, O’Connor is available to provide assistance. O’Connor employs skilled property tax specialists to guarantee that the most reliable evidence is utilized to substantiate requests for tax reductions and unequal appraisals. O’Connor and his team of property tax attorneys strive to reduce their clients’ property tax expenses by conducting a thorough examination of all viable alternatives.