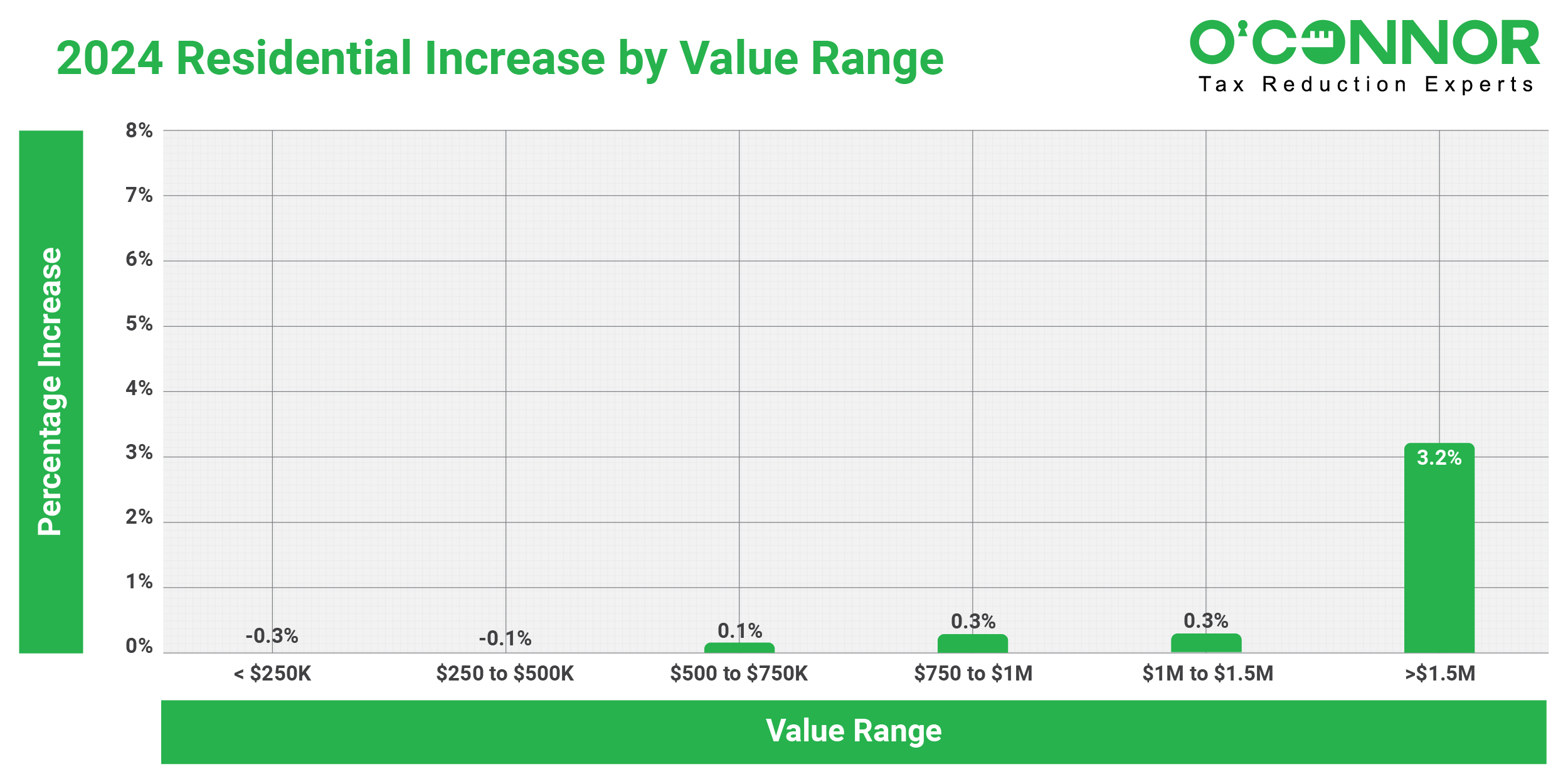

Residential Assessment Somewhat Higher

The residential property market values of property owners in New Trier Township, Cook County can increase annually. In 2024, the residential property market value in New Trier Township saw a slight increase of 1.3%, increasing from $19.7 billion in 2023 to $19.9 billion. The properties with the most substantial value increase of 3.2% were within the $1.5 million or higher value range. The most significant increases were observed in residences of higher value, while those of lower value experienced a relatively modest increase or even slight decreases. For instance, the value of residences between $250k and $500k experienced a decline of 0.1%.

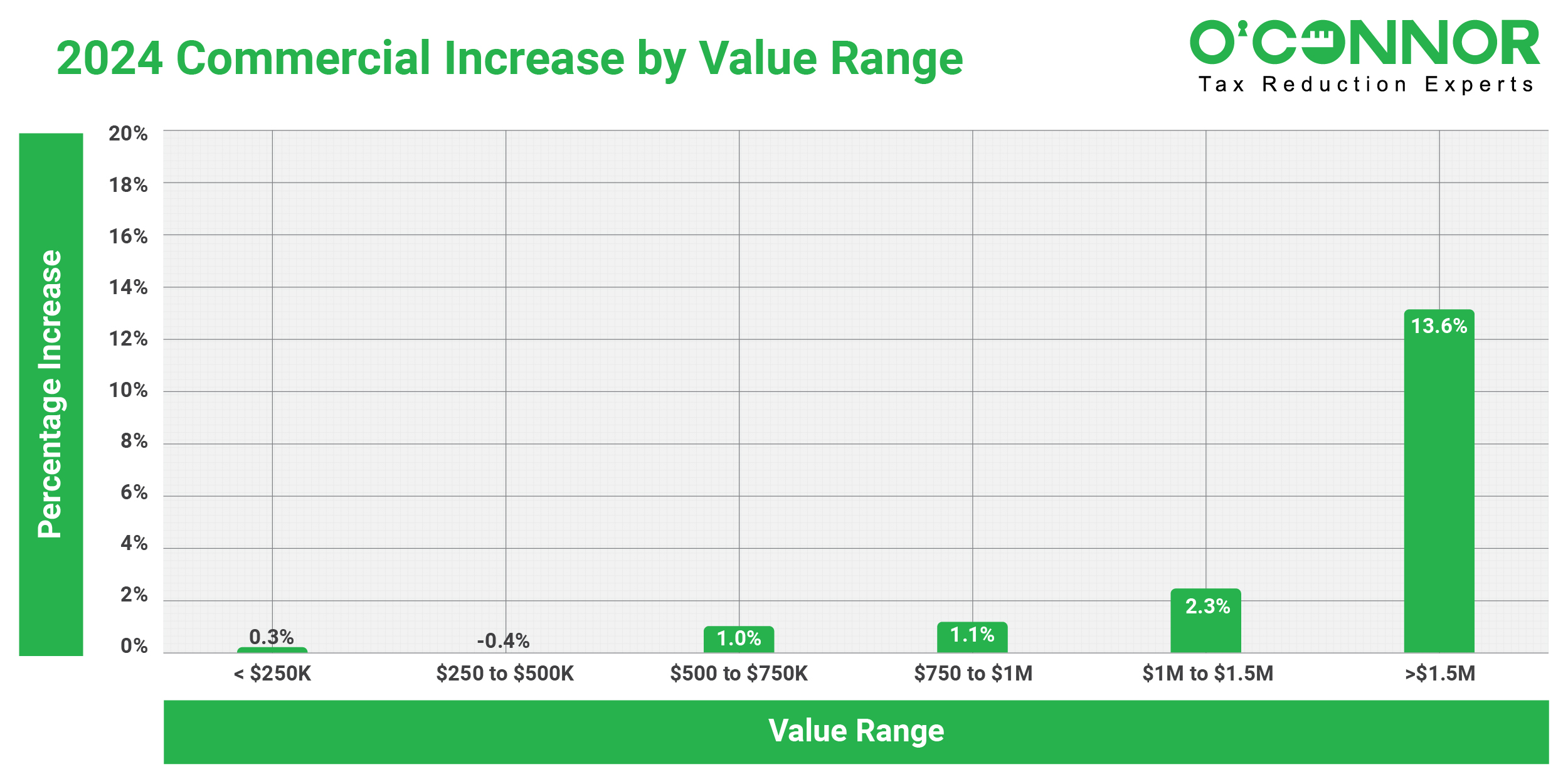

Commercial Values Gain

In contrast to residential properties, commercial properties in New Trier Township have experienced a substantial increase in value in accounts. Commercial values encountered an extraordinary 9.4% increase by 2024. The average assessment of commercial property in New Trier Township of Cook County was 13.6% in 2024, and the property’s value exceeded $1.5 million. Commercial property owners who own properties valued between $1 million and $1.5 million experienced a significant increase of 2.3%. Homes with a higher market value exhibited the most substantial increases.

What Can Property Owners Do?

The data suggests that the assessment for New Trier Township in Cook County, Illinois, has significantly increased. Taxpayers in Cook County must initially determine whether they are eligible for any exemptions prior to protesting the assessment value for chances of a reduction. Residents of Cook County may save money annually by applying for property tax exemptions, provided that they are granted approval. Property owners may find the appeals procedure to be perplexing; however, O’Connor is available to provide assistance. O’Connor collaborates with esteemed property tax specialists to ensure that the most dependable evidence is utilized to support requests for tax reductions and unequal appraisals. O’Connor and his team of property tax attorneys strive to reduce their clients’ property tax expenses by examining all viable alternatives.