A review of Chatham County 2023 property tax assessments reveals an average increase of 87% per house. Houses valued between $500,000 and $750,000 had the largest increases in property tax assessments; an unbelievable 147.7% increase in one year! This analysis was conducted by O’Connor.

Homes valued between $250,000 to $500,000 were also increased over 100%; the average property tax assessment increase in this value range in Chatham County was 128.3%.

Homes with more modest increases were those valued at $1.0 to 1.5 million (8.6% increase in property tax assessment). Homes valued over $1.5 million incurred increases in property tax assessment of 17.5%.

The following graph illustrates the property tax assessment increase by value strata:

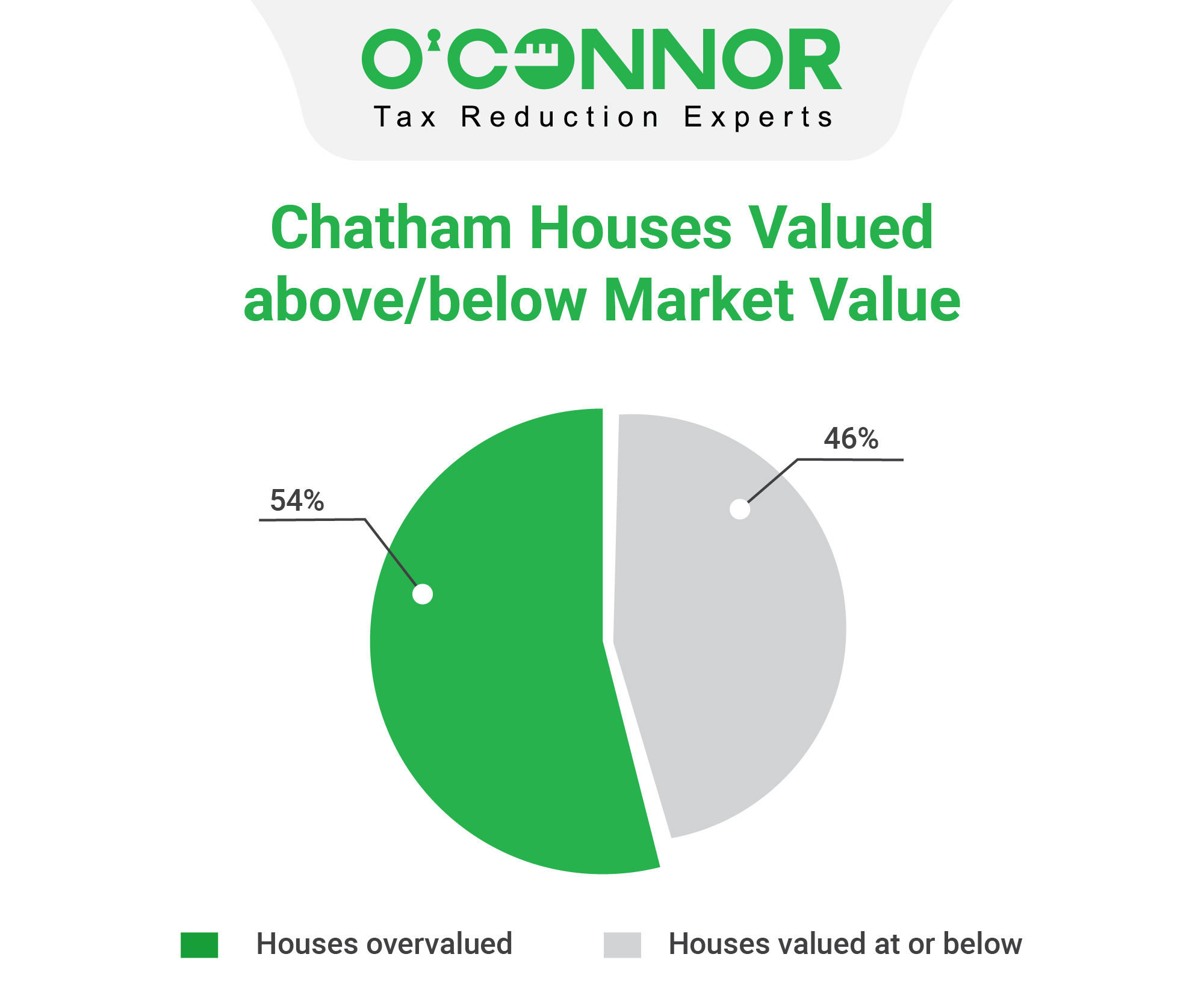

The typical home in Chatham County is over-valued by 4.9% based on a ratio study by O’Connor. The ratio study compares the time adjusted sales price and the 2023 value assessed by the county tax assessor. The median time adjusted sales price is $260,500 but the median assessed value for these properties is $276,300, or $15,800 higher than the market value.

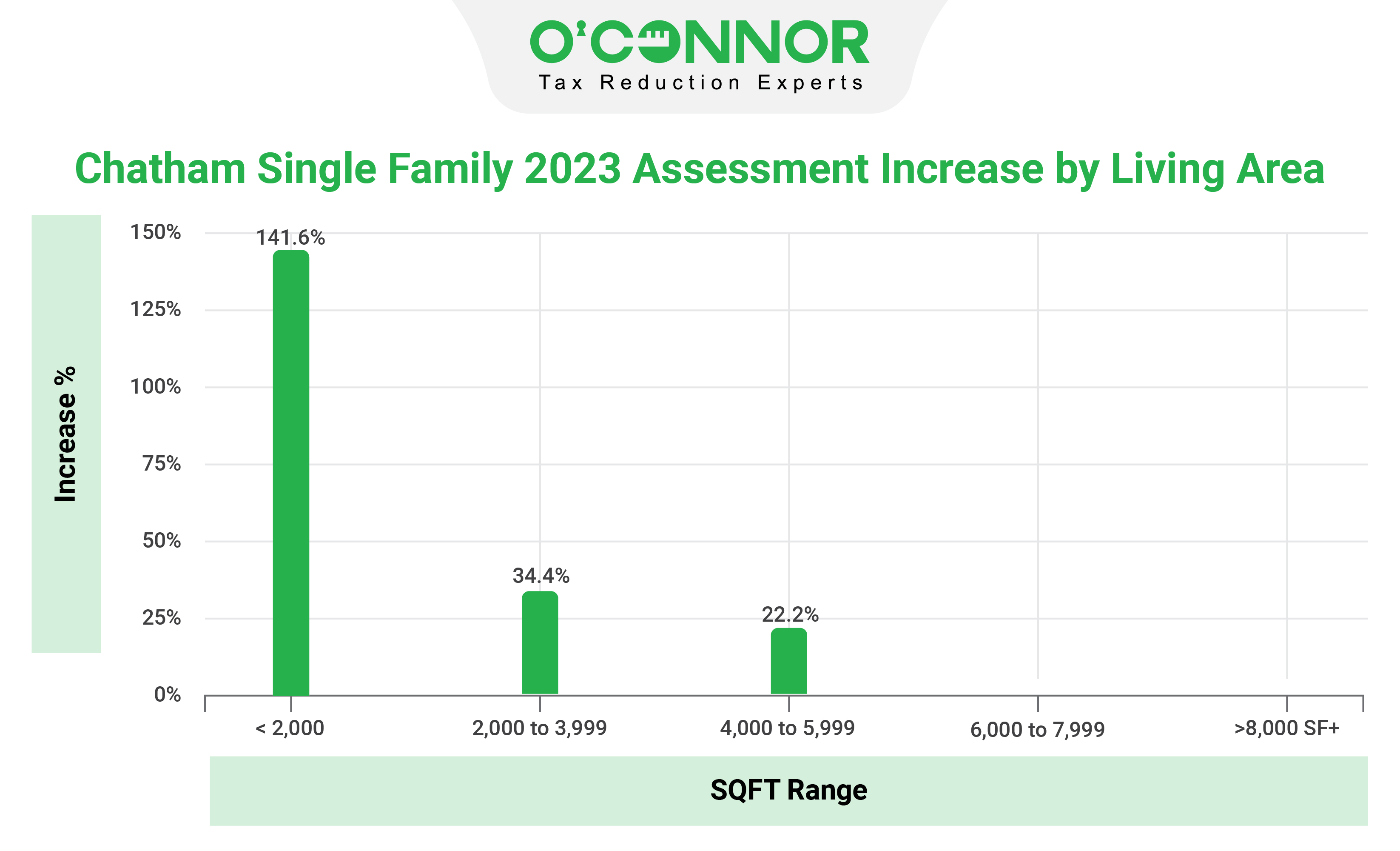

Homes with less than 2,000 square feet incurred the largest increases in property tax assessments.

Homes with under 2,000 square feet incurred property tax assessment increases of 142% versus 34% for houses with 2,000 to 4,000 square feet and 22% for houses with over 4,000 square feet.

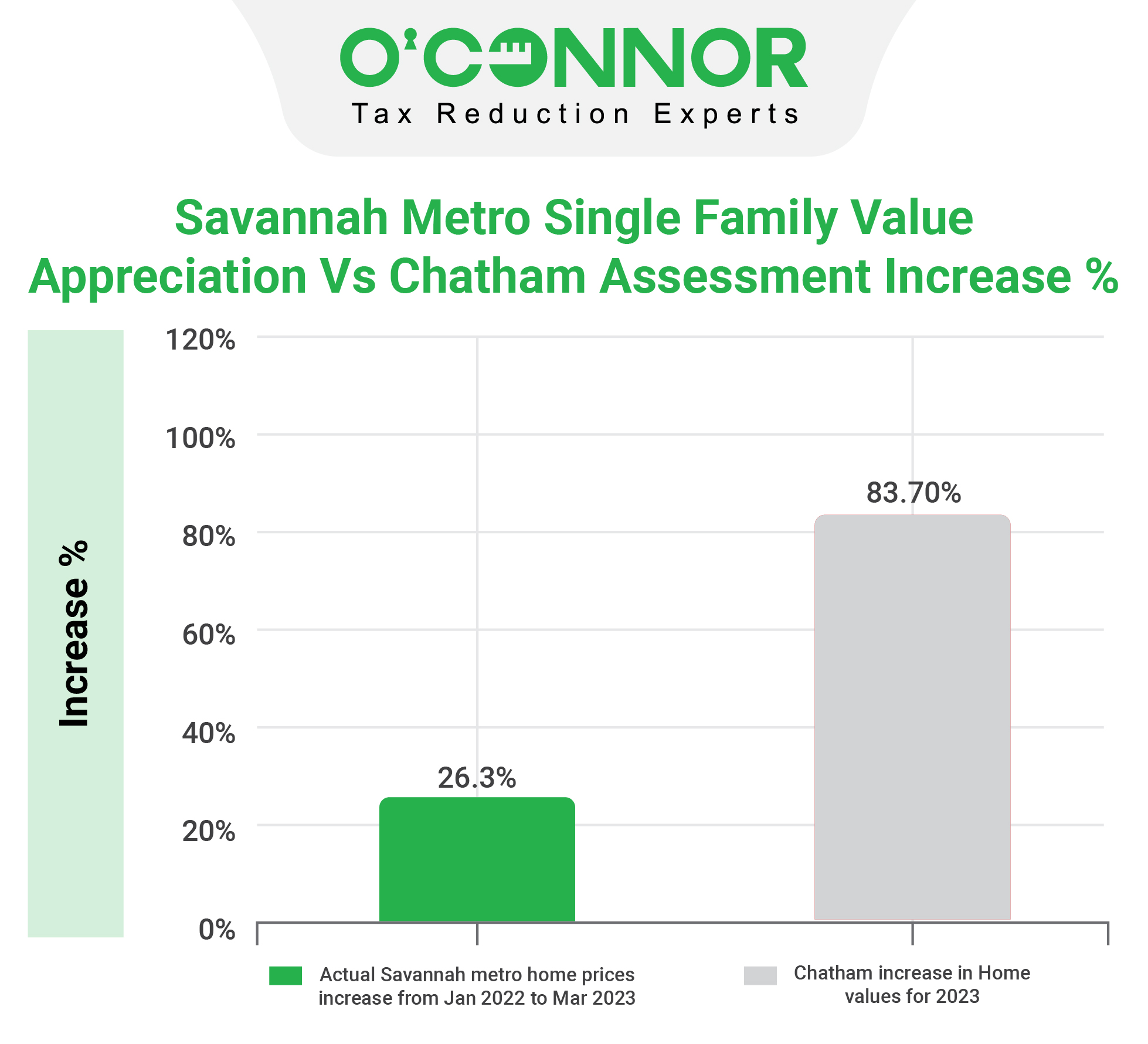

Home Price Appreciation versus Property Tax Assessment Increases

Savannah area Realtors reported that home prices increased by 26% versus the 83% increase in property tax assessments assessed by the Chatham County Tax Assessor.

Analysis of home sales (including adjustments for market condition) versus 2023 property tax assessments by Chatham County Tax Assessor indicates 54% of home assessments exceeded market value while 46% were below market value.

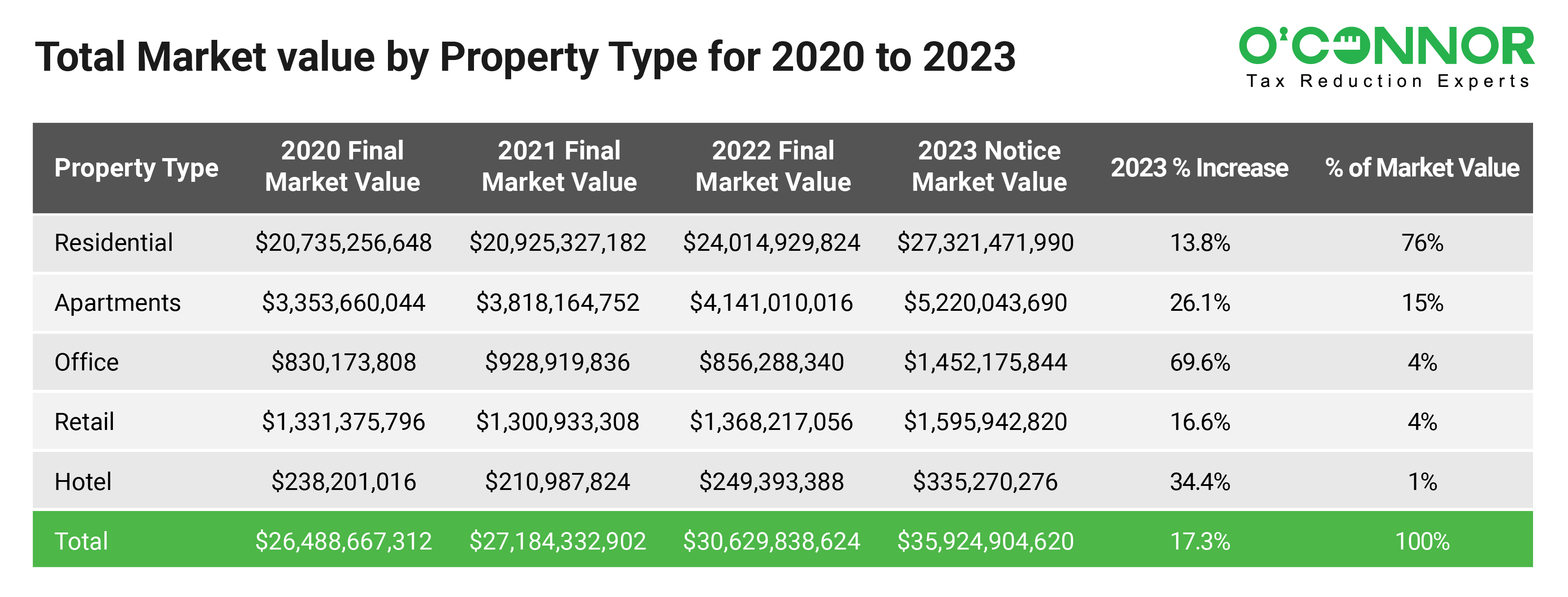

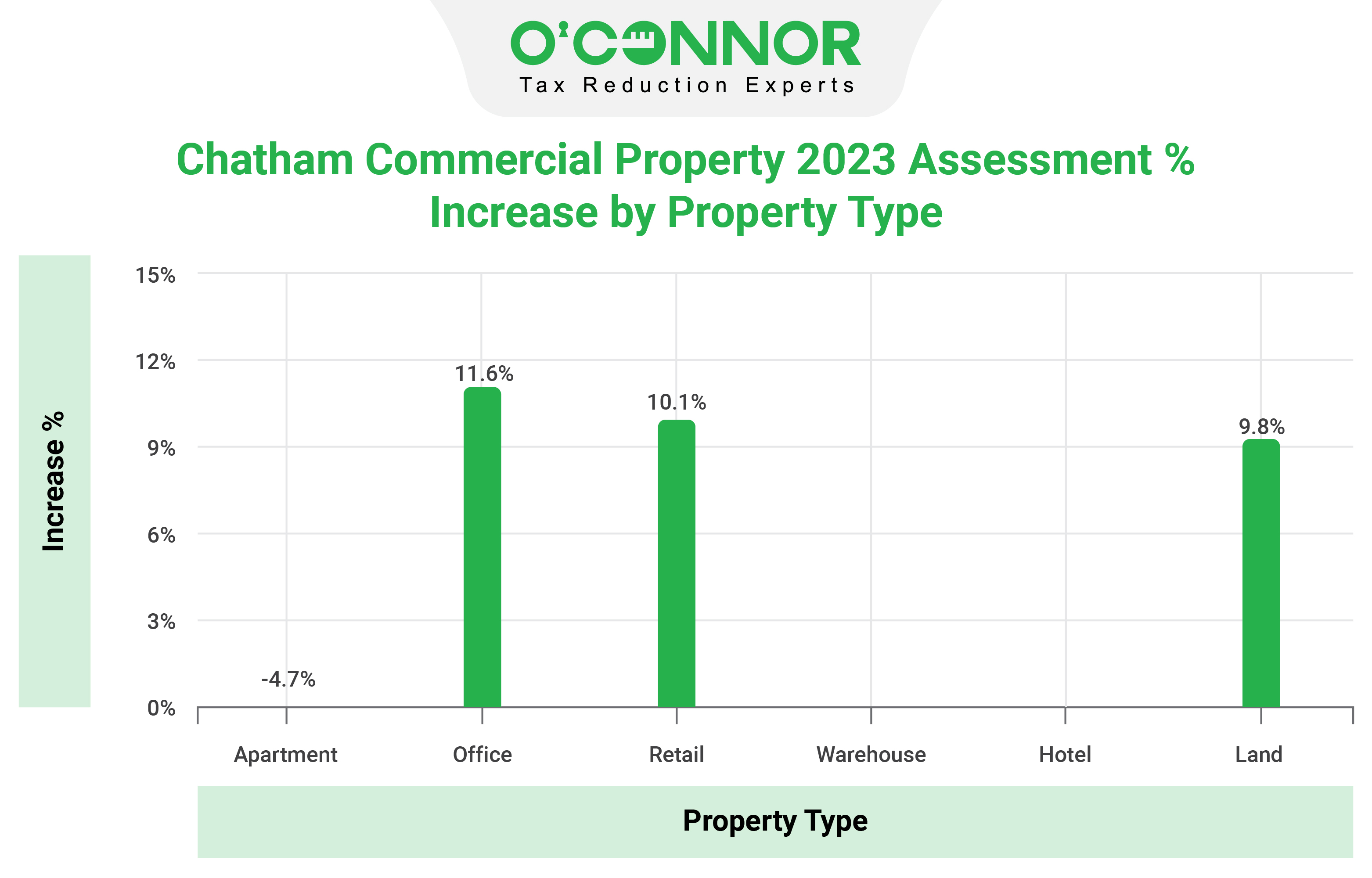

Commercial property tax assessment increases were modest at 10% versus the 83% increase in property tax assessments for homes. Office was increased by 11.6%, retail by 10.1% and land by 9.8%. Apartments property tax assessments in Chatham County were reduced by 4.7%.

Chatham County property owners should protest tax assessments, particularly in years when the tax assessor revalues property. Given the average increase of 83% for residential, there are undoubtedly many homes misvalued on market value or unequal appraisal. Chatham County property owners can appeal excessive value (assessor value exceeds market value), unequal appraisal property over-valued compared to similar properties and errors with the property description. Given the large volume of properties valued by the Chatham County Tax Assessor, there are many properties where the assessor has overstated the quantity or quality of improvements.