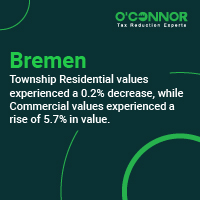

Residential Assessment Surges The residential property values of property owners in Cook County, Bremen Township experienced a decrease by the end of 2024. The residential property market in Bremen Township experienced a decrease of -0.2% in 2024, the value fell from $7.42 billion in 2023 to $7.4 billion. The houses with the most significant value increase … Read more

Property Taxes

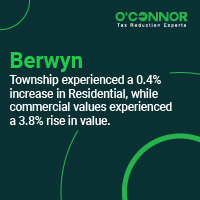

Residential values in Berwyn Township experienced a 0.4% increase, while commercial values experienced a 3.8% rise in value

Residential Assessment Surges The residential property values of property owners in Cook County, Berwyn Township increase annually. The residential property market in Berwyn Township experienced a modest increase of 0.4% in 2024, rising from $3.54 billion in 2023 to $3.56 billion. The houses with the most significant value increase of 9% had a value range of … Read more

When Can Property Owners File for Appeal?

In Cook County, Illinois, the Cook County Assessor’s Office reassesses the value of all properties in the city every three years. This process is known as the triennial reassessment. Depending on the township and suburb – North suburb South suburb, and City of Chicago- property owners in Cook County will receive the reassessment of their … Read more

Triennial Reassessments Explained

Property Assessments in Cook County Property valuations and assessments are different in townships in Cook County, Illinois. The appeal and reassessment process is governed by the regulations of each county and township in Illinois. The Cook County Assessor’s Office is in charge of determining the value of more than 1.8 million single-family homes and other … Read more

Is 1,642% Increase a World Record Property Tax Increase?

Cook County Assessor raised the market value of 103 N Laramie Avenue, Chicago by 1,642% increase in just one year! This is for a duplex in West Chicago Township. The total market value was raised to $310,000 in 2024 from $17.800 in 2023. The assessed value rose from $1,780 in 2023 to $31,000 in 2024. … Read more

How is Property Valued in Cook County?

In Illinois, every county and township has its own regulations. In Cook County, residential properties are evaluated as of January 1st of the current year, utilizing three to five years of prior market sales data. This enhances the stability of market value estimates by employing multiple years. It is important to use prior market sales … Read more

Are You Receiving All Your Property Tax Exemptions?

Now that the second installment of the Cook County tax bills are out, all Residential property owners should check their bills for exemptions. Cook County is notorious for making exemption errors and not applying those to bills. The three most common errors are the Homeowners, Senior, and Senior Freeze exemptions. If you find you are … Read more

Cook County Assessor Increases & Errors

As a homeowner, property taxes are unavoidable. Unfortunately, recent assessments in Cook County have left many Chicago residents and landlords grappling with unprecedented increases and errors. It is important to keep track of your assessment notices and challenge them when it is appropriate. The I-Team at ABC 7 has uncovered many instances of dramatic assessment … Read more

New Trier Township 2023 Property Tax Assessments

2023 Property tax assessments for New Trier Township apartment complexes have increased significantly and now total $62.4 million. Retail buildings saw a gain of $6 million, commercial real estate increased by $9 million, and institutional and special properties saw an increase of $979,000. In comparison, the cumulative rise in commercial and single-family property tax assessments … Read more

Property Tax Projections for Hanover Township through 2023

Hanover Township of Cook County, Illinois saw property values rise from $3.6 billion in 2022 to $3.8 billion in 2023, with an overall gain of 3.7%. The Hanover Township 2023 property tax assessment predominantly increased the value of industrial buildings, with a secondary concentration on service facilities. Hanover’s overall increase in the 2023 property tax … Read more