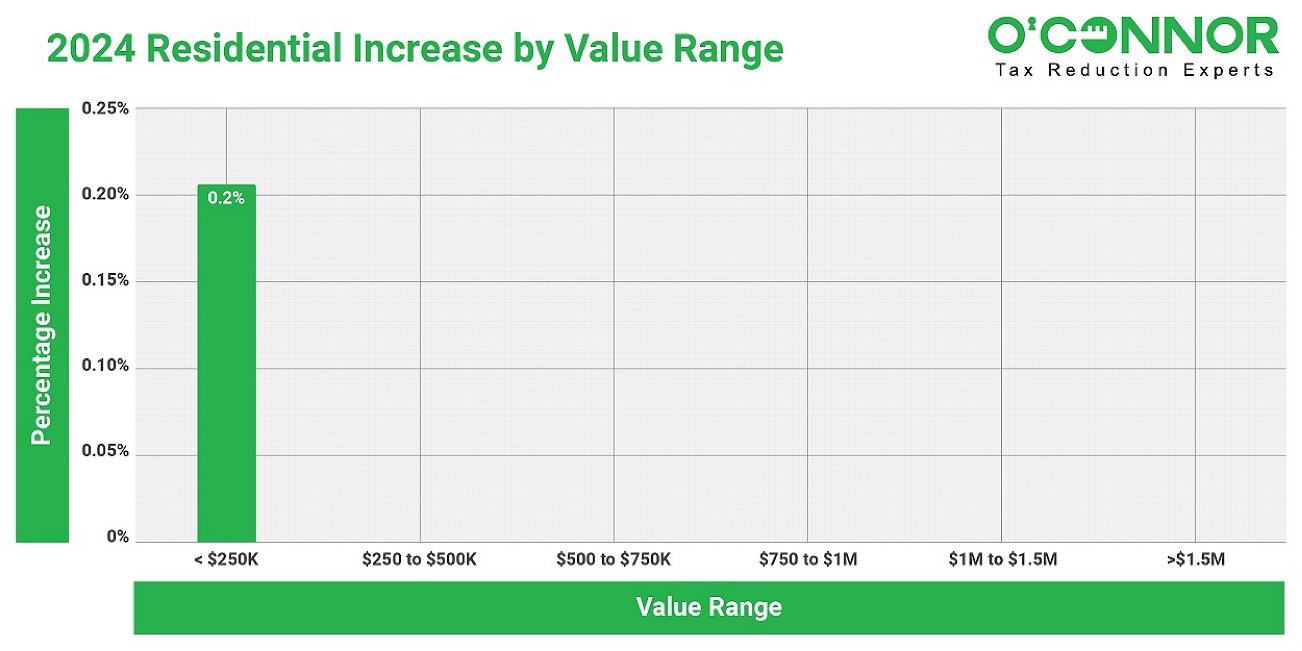

Residential Assessment Close to Flat

Between 2023 and 2024, there was a barely perceptible increase in the residential property values for most property owners in Calumet Township, Cook County. In 2024, the residential property market in Calumet Township saw a 0.1% increase in value, rising from $676 million in 2023 to $677 million. The properties with the lowest value increase of 0.2% had a value range exceeding $250,000.

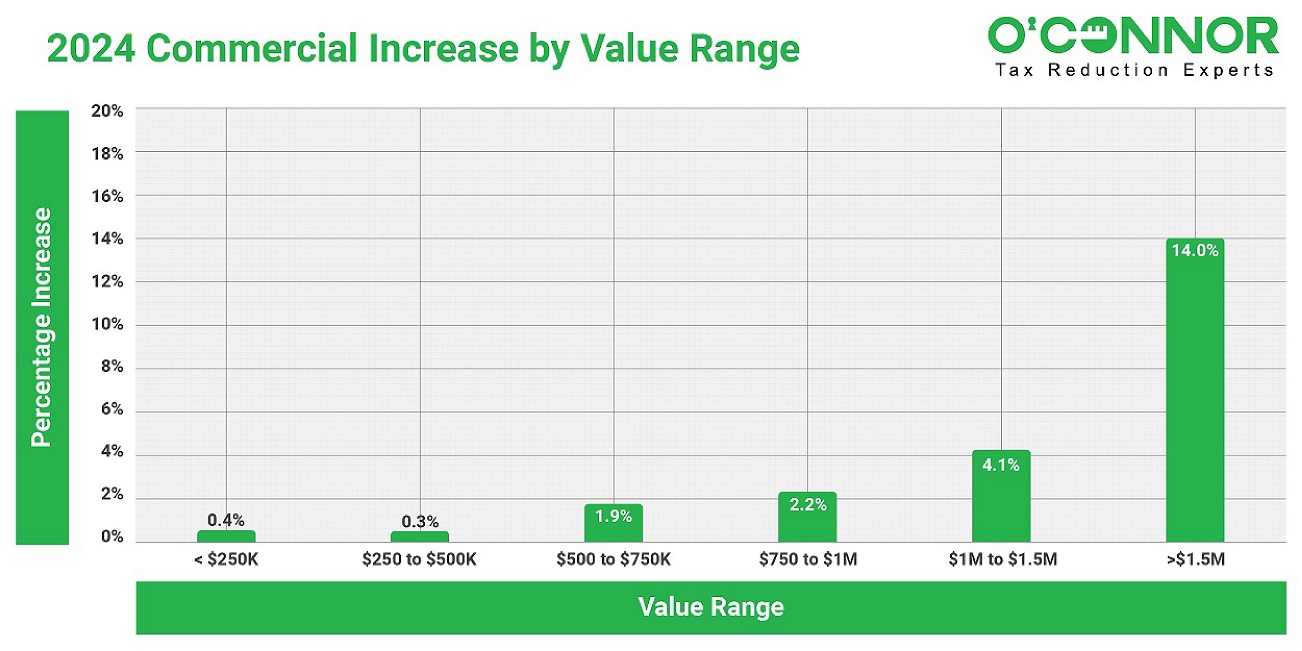

Commercial Values Gain More Pronounced

In contrast to residential properties, the value of commercial properties in Calumet Township has increased more significantly. By 2024, commercial values experienced a 4.4% increase. The most significant increases were observed in homes with a higher market value. In 2024, the maximum assessment of commercial property in Calumet Township was 14% for properties with a value exceeding $1.5 million. Owners of commercial properties valued between $1 million and $1.5 million experienced the second largest increase of 4.1%.

What Can Property Owners Do?

The data shows that residential assessments in Calumet Township, Cook County, Illinois, slightly increased, while commercial assessments soared considerably. Property owners must check for exemptions before disputing the assessment value. Cook County residents who are approved for property tax exemptions may save money yearly. Property owners may find the appeals process complex, but O’Connor can help. O’Connor works with recognized property tax professionals to assist tax reduction and unequal appraisal claims with the best evidence. O’Connor and his property tax lawyers investigate all options to lower their clients’ property taxes.