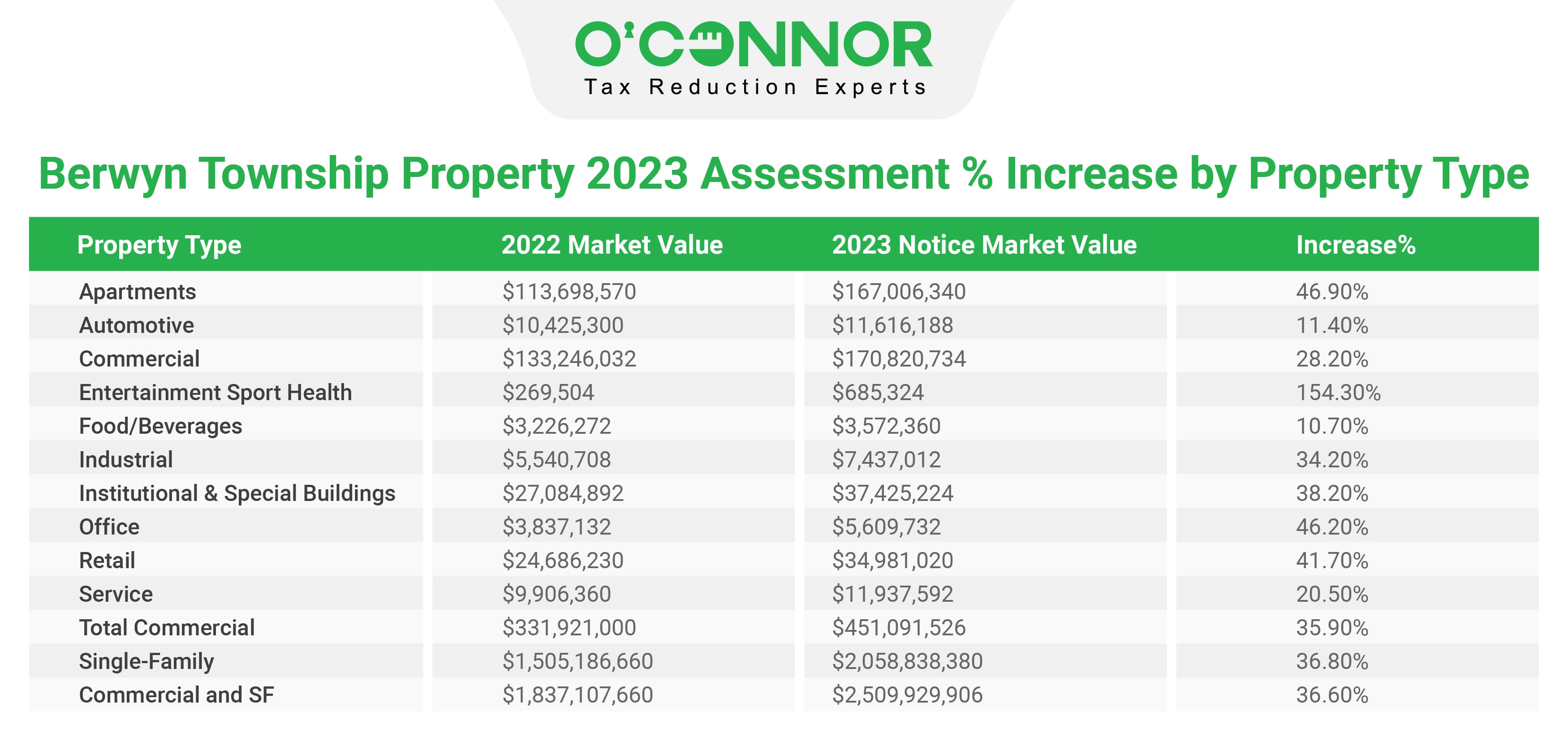

Berwyn Township entertainment sports health properties received a notable increase in value for the 2023 property tax assessment, with values up an astonishing 154%. Values on apartments and office buildings also saw considerable gains in assessment. Berwyn’s total property tax assessment rose by $672 million in 2023, including $415k for entertainment sports health property value increases, $53 million for residences, and $1.67 million for office buildings. The overall increase was 36.6%, from $1.83 billion in 2022 to $2.5 billion in 2023.

This is based on analysis of Cook County assessment data performed by O’Connor, one of the nation’s top property tax consulting firms.

Berwyn homes values adjusted upward in the 2023 tax assessment

Houses were revalued in the 2023 Berwyn Township reassessment, with the overall value of residential properties increasing by 36.8%, for new value totalling more than $2 billion, compared to $451 million 2023 market value for commercial buildings.

Property that is Taxable vs. Property that is Exempt

Tax-exempt properties in Berwyn Township include schools, post offices, churches, and parks, with a total of 1435 commercial tax properties. Berwyn contains 396 tax-exempt accounts, compared to 1039 taxable business tax lots.

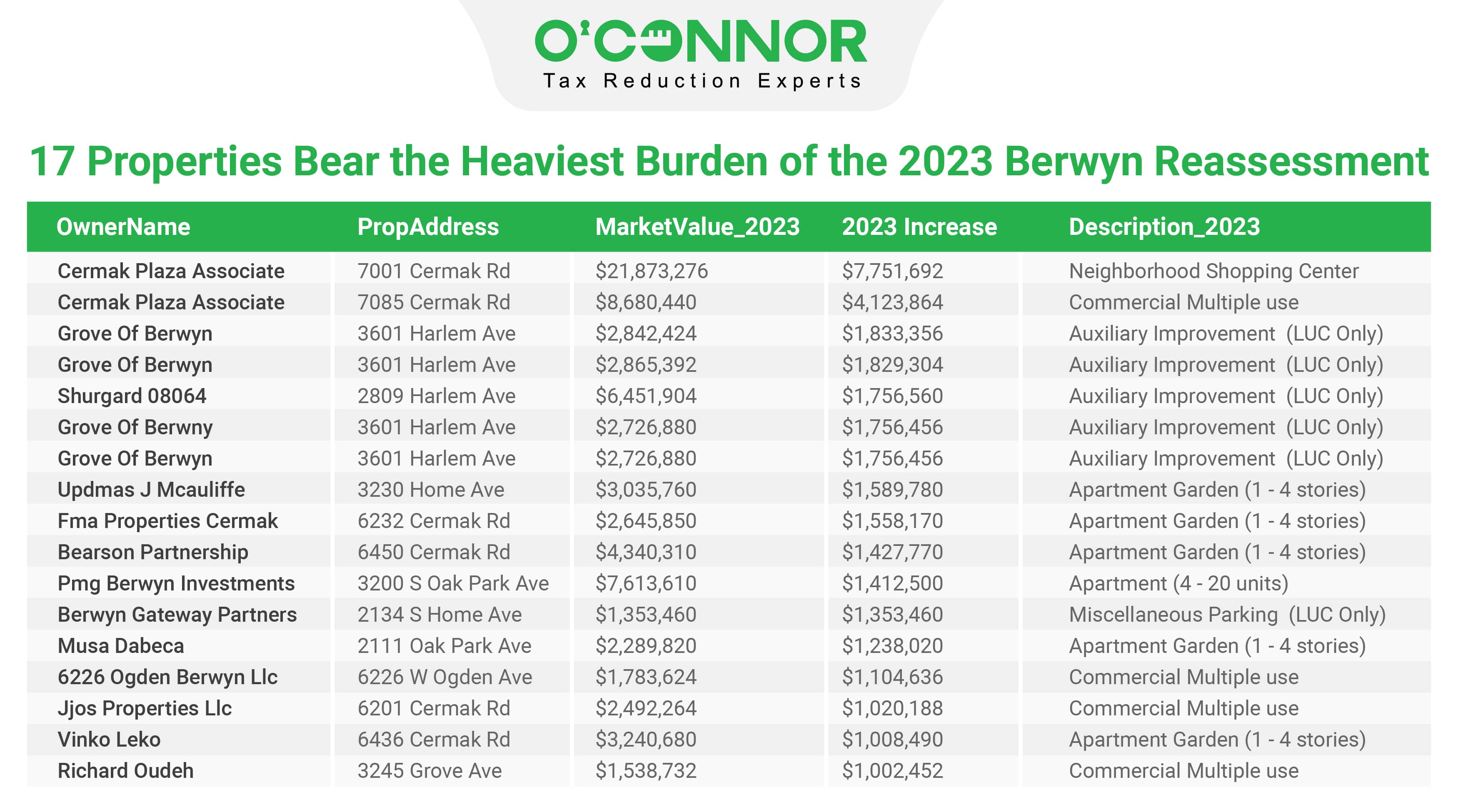

17 Properties Bear the Heaviest Burden of the 2023 Berwyn Reassessment

The total tax assessment increase for the following properties in 2023 will be $33.5 million. That total includes 17 properties. The top two increases are a neighborhood retail mall, which experienced a tax assessment increase of more than $7 million, and a commercial multiple use property, which saw a $4.12 million increase. Cermark Plaza Associate, Grove of Berwyn, and Shurgard 08064 are the commercial property owners with the highest assessment increases for 2023.

How Berwyn Township assessments compare across property types

All Berwyn property categories experienced assessments hikes for 2023. Both residential and commercial property were up over 35% from their previous market values.

The Market Value vs. Examined or Taxable Value

In Illinois, property taxes are levied based on taxable value. The taxable value is 25% of the market value for commercial properties and 10% for residential properties. The 2023 residential market value was roughly $2 billion, compared to the taxable value of $205 million. The commercial 2023 taxable value was $112 million, compared to the $451 million market value.

Final adjusted tax assessments

Property tax assessments are frequently challenged by commercial property owners, especially when values rise. With so many of the commercial values elevated, appeals are likely to generate decreased amounts before the 2023 tax roll is settled.

Protest Right of Property Owners

In Illinois, there are four phases of property tax assessment: 1) assessor, 2) board of review, 3) Illinois property tax appeal board, and 4) judiciary. Residential and commercial property owners have the legal right to dispute their property tax assessment at numerous levels. Owners have the right to appeal even if their tax assessment is unchanged or diminished.

Find Out If Your Property Tax Assessment Is Reasonable

Do you want to know if your property tax is fair to you? Click the linkto get a free evaluation to determine if you’re overpriced in comparison to your neighbors.