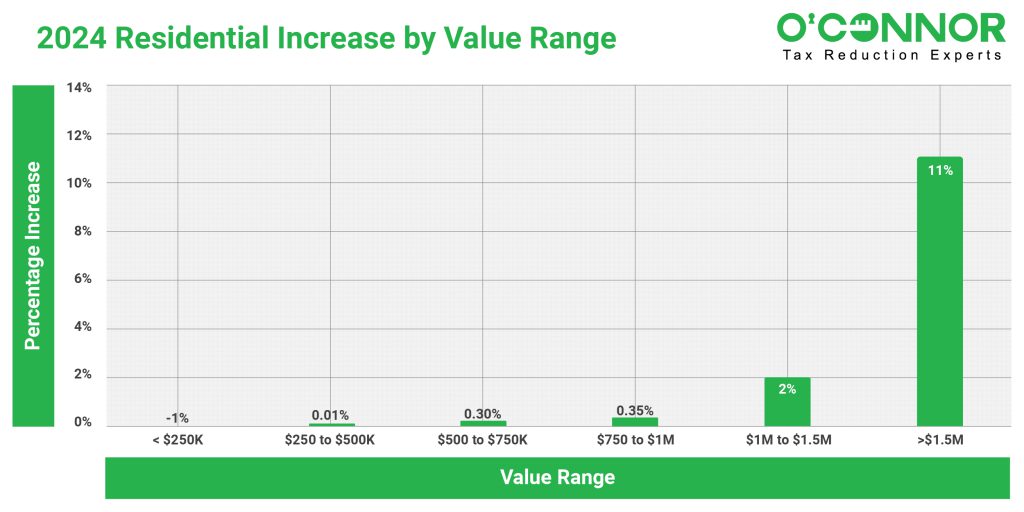

Residential Assessment Surges

The rise of property values in Cook County is not a surprise for residential property owners. Residential property in Barrington Township had a 2% increase showing the rise from $4 billion in 2023 to $4.1 billion to 2024. The highest and lowest-value houses get the biggest assessment increases. Residential property owners of homes ranging between $1 million to $1.5 million saw a high increase of 2%.

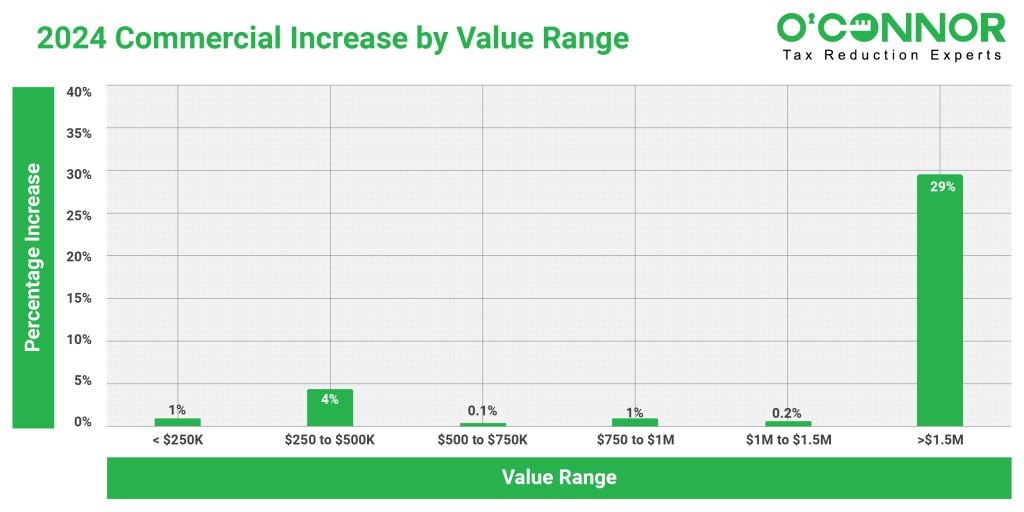

Commercial Values Gain Even More Pronounced

In contrast to homes, commercial property increases exponentially grew in valued accounts in Barrington Township. By 2024, commercial values rose 24%, while residential only increased by 2%. Commercial property worth over $1.5 million in 2024 in Barrington Township of Cook County, Illinois was on average assessed at 29%. Owners of commercial properties valued between $250K and $500k had a 4% increase. Property owners of commercial valued at $250k and between $750k to $1million had an increase of 1%.

What Can Property Owners Do?

The figures are a visual representation of the significant increase in assessments that has occurred in Cook County Barrington Township. Property owners should confirm that they have all eligible and accurate exemptions before appealing the assessment value for the best reduction. O’Connor is prepared to provide support during the appeals procedure, which may be challenging for property owners to comprehend. To substantiate sales and unequal appraisal reduction arguments, our team at O’Connor works in close collaboration with our licensed property tax consultants to present the most compelling evidence. O’Connor collaborates with attorneys who specialize in property tax to execute every conceivable approach to reduce our clients’ property taxes.