Understanding the basics

Property taxes are local taxes that are determined by the local officials. The property tax process starts off with valuing your property, setting your tax rate, and finally collecting your taxes.

However, the entire process is governed by Texas law. In Texas, property taxes are a major source of revenue and play a major part in offering government services when compared to any other source. The property tax collected is used to pay for the roads, streets, schools, police, fire protection, etc.

Property tax standards set by the Texas constitution

The state constitution has set up a few standards for property tax. These include:

Equality & Uniformity:

This property tax standard makes sure that all properties are taxed equally and not even one single property pays more than its share.

Tangible properties to be taxed with a few exceptions at their market value as of January 1st:

The market value refers to the price at which the property would sell for without any pressure on the seller or the buyers’ side with regards to the price. The exceptions refer to parks, agriculture, timber, etc.

All properties are taxable unless federal or state law offers an exemption.

Right to notice:

Property owners have the right to receive a reasonable notice if the appraisal value of the property increases.

Properties in the appraisal district can have only one appraised value.

An overview of how the property tax system works?

There are three major bodies involved in the Texas property tax system:

Appraisal District

Set up the taxable property every year. The chief appraiser is responsible for its operations.

Appraisal Review Board

Settles disagreements on the value of the property between the taxpayer and the appraisal district.

Local taxing units

Decide how much money to spend every year which in turn is used to determine the tax rate.

How does the process go?

Property tax season

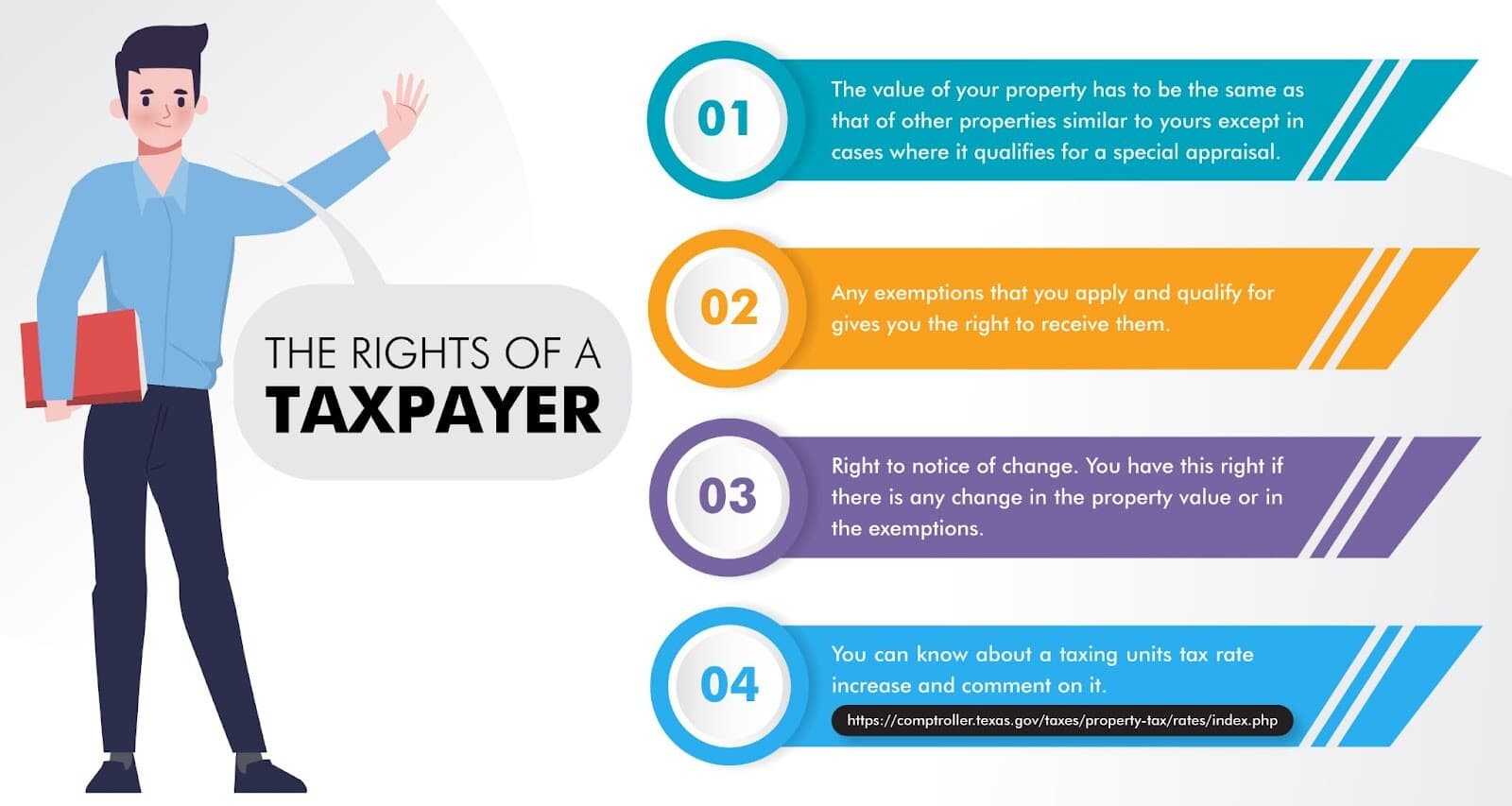

The rights of a taxpayer

Know your options

As a taxpayer, if you feel your property is appraised more than the market value, or if you are not given an exemption, you can protest or you can take the case to the court.

Taxpayers have the right to speak out at public hearings when the elected officials decide on how to spend the taxes.

Along with your fellow taxpayers, you can limit your tax increases in an election.

The responsibilities of a taxpayer

Apply for exemptions before the deadline.

Check if the property is listed right in the appraisal records.

For business personal properties, make sure you render it every year to the chief appraiser.

Make sure your taxes are paid on time.

Seeking the help of a property tax consultant

The tax season can be a real burden for owners of residential or commercial property. But O’Connor can help you save on your property taxes this year. We do not bill you for court costs, appraisals, expert witness fees or legal fees. You pay us only if we reduce your taxes! Get in touch with one of our experts and you will know why we should be your first choice.