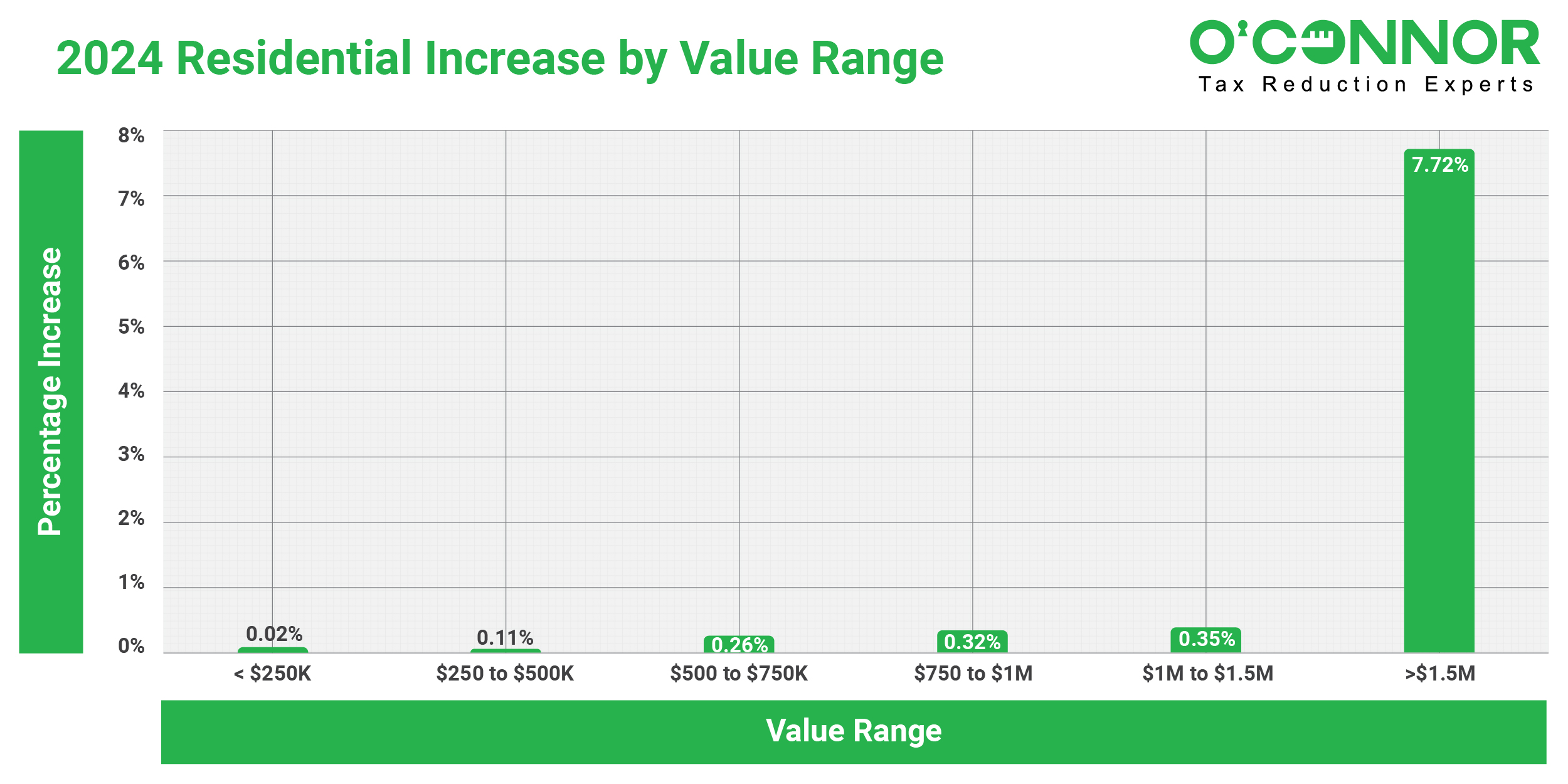

Residential Assessment Surges

Property owners in Cook County experience an annual increase in their residential property values. Residential property in Proviso Township had a slight increase of 0.1% that shows the growth from $11.74 billion in 2023 to $11.75 billion in 2024. The houses with the most significant value increase of 7.7% had a value range of more than $1.5 million. Higher value homes had the greatest increases, for example, homes ranging between $1 million to $1.5 million had an increase of 0.35%

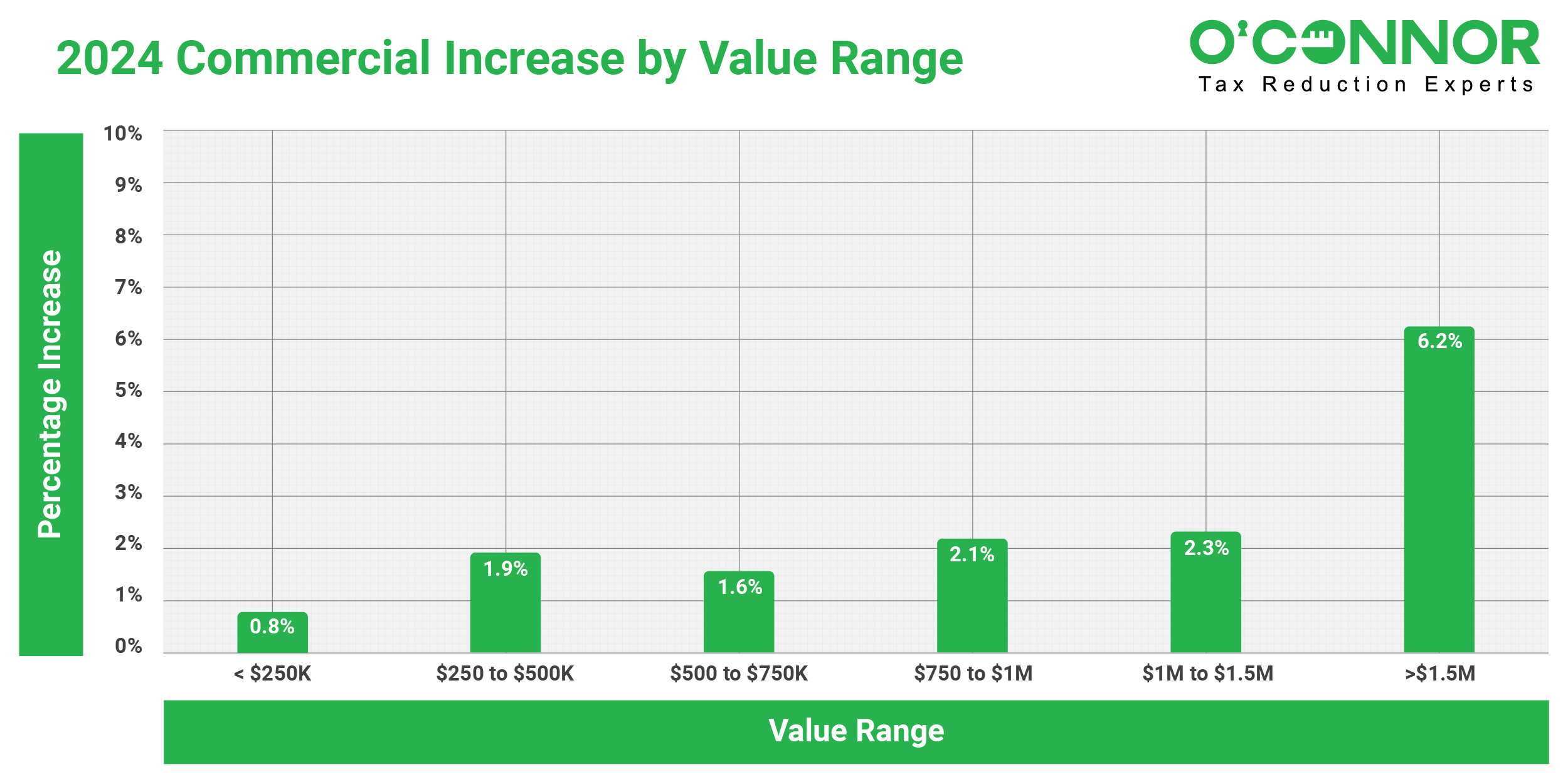

Commercial Values Gain Even More Pronounced

Commercial property in Proviso Township experienced a substantial increase in value in accounts, in contrast to residential properties. Commercial values showed a remarkable increase of 4.3% by 2024. The value of commercial property in Proviso Township of Cook County exceeded $1.5 million, with an average assessment of 6.2% in 2024. The second highest increase of 2.3% was experienced by owners of commercial properties valued between $1 million and $1.5 million.

What Can Property Owners Do?

The data suggests that the assessment for Proviso Township in Cook County, Illinois, has increased significantly. Initially, property owners must determine whether they are eligible for any exemptions prior to protesting the assessment value. Using exemptions in property taxes can help Cook County residents to save every year they apply. The appeals procedure may be perplexing to property owners; however, O’Connor simplifies the process. O’Connor collaborates with prominent property tax specialists to ensure that the most robust evidence is used to support requests for tax reductions and unequal appraisals. O’Connor and his team of property tax attorneys pursue a reduction in their clients’ property tax expenses by exploring all available options.