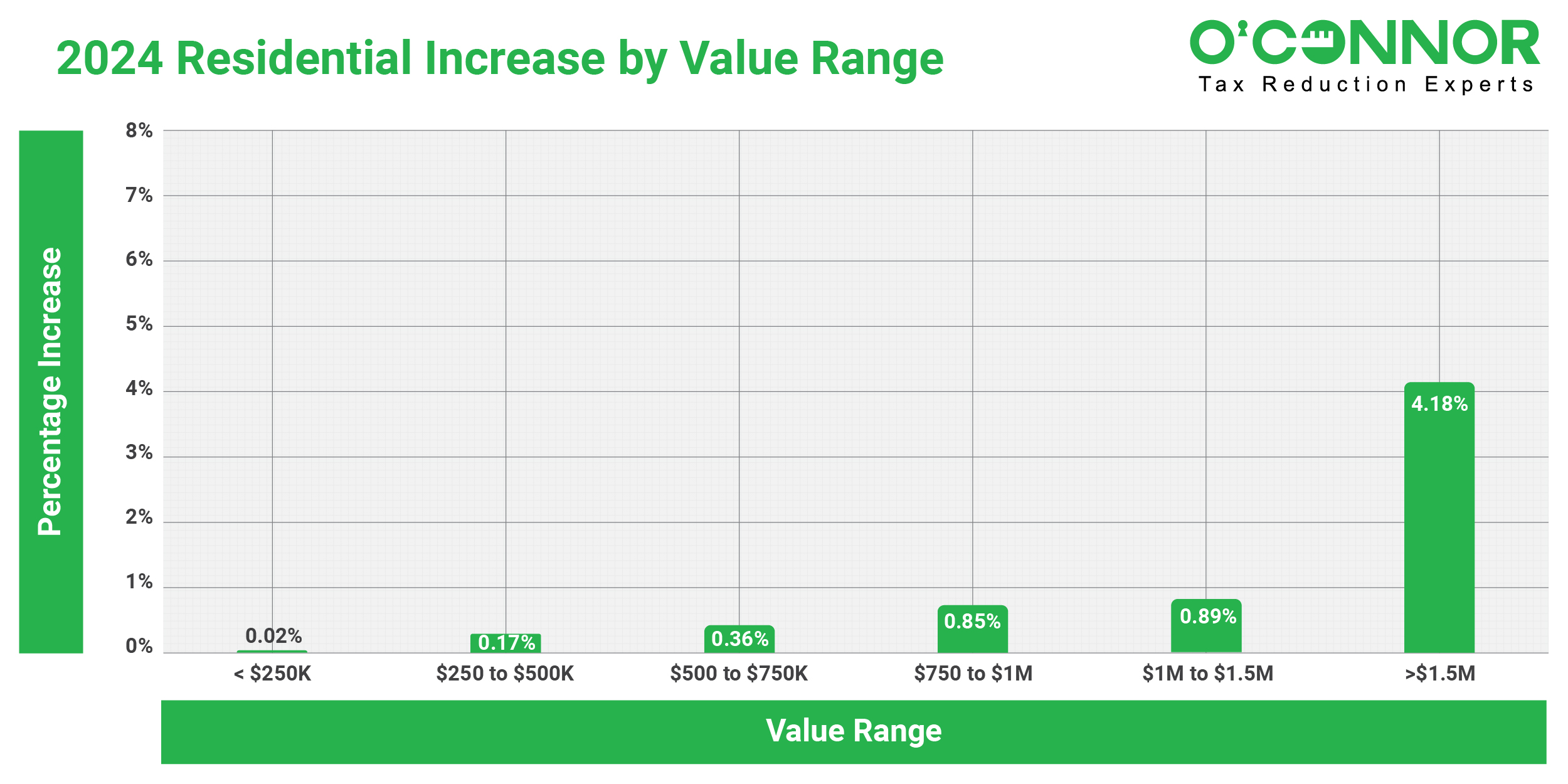

Average Residential Assessment is Level

The residential property market values of property proprietors in Oak Park Township, Cook County, experience an annual increase in market value. From $6.62 billion in 2023 to $6.64 billion in 2024, the residential property market in Oak Park Township experienced a slight increase of 0.4%. The properties with the most significant value increase of 4.18% were in the $1.5 million or higher value range. A comparatively modest increase was observed in residences of lesser value, while the most significant increases were observed in residences of higher value. For example, the value of residences valued at $250k or less increased by 0.02%. A 0.36% increase was observed for properties valued between $500k and $750k.

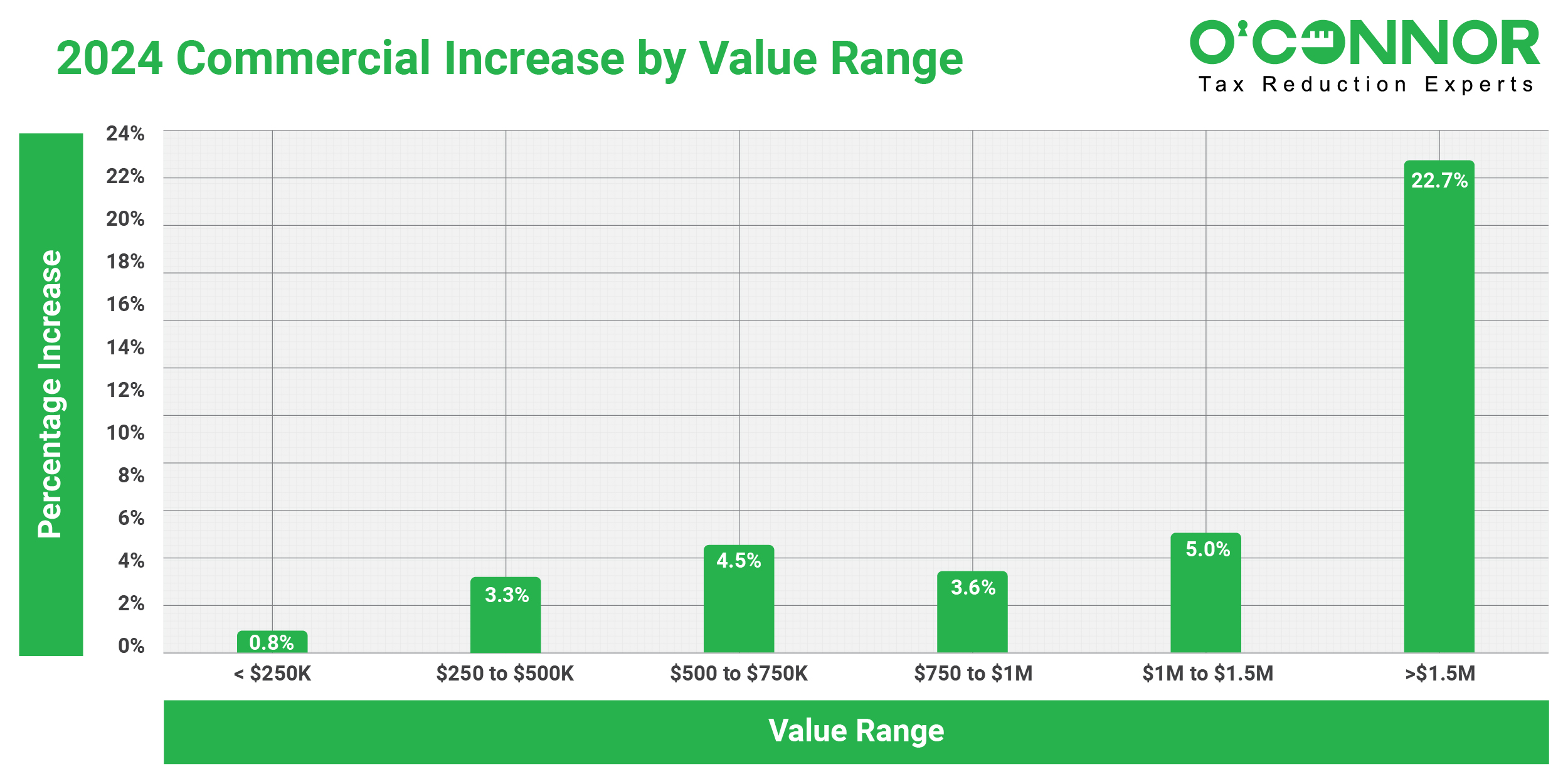

Commercial Values Strikingly Higher

Commercial properties in Oak Park Township have encountered a substantial increase in value in accounts, in contrast to residential properties. By 2024, commercial values experienced a large increase of 17.3%. In 2024, the total value of commercial property in Oak Park Township of Cook County exceeded $1.5 million, with an average assessment of 22.7%. A substantial increase of 5.0% was observed among commercial property owners who possess properties valued between $1 million and $1.5 million. Property of varied market values exhibited moderate increases. Properties ranging in value between $500k to $750k had an increase of 4.5%.

What Can Property Owners Do?

The graphs indicates that the assessment for Oak Park Township in Cook County, Illinois, has increased significantly. Before protesting the assessment value in order to potentially obtain a reduction, taxpayers in Cook County must initially ascertain whether they are eligible for any exemptions. If approved, residents of Cook County may save money on their property taxes each year by applying for exemptions. Taxpayers may find the appeals procedure to be perplexing; however, O’Connor is available to offer assistance. O’Connor ensures that the most reliable evidence is used to support requests for tax reductions and unequal appraisals by collaborating with esteemed property tax specialists. O’Connor and his team of property tax attorneys endeavor to minimize their clients’ property tax expenses by conducting a comprehensive analysis of all viable alternatives.