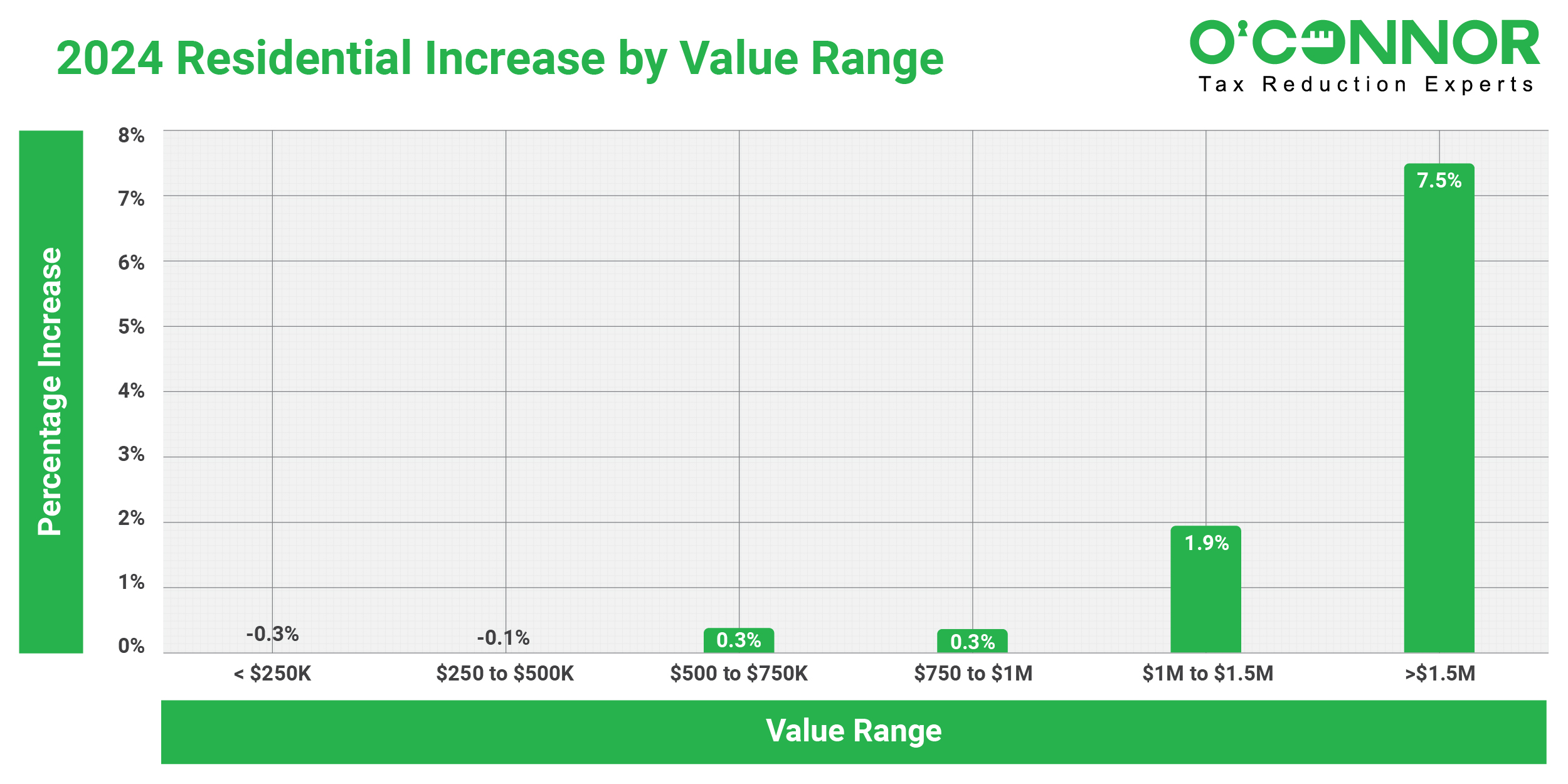

Residential Assessment Surges

Annually, residential values rise in Cook County for property owners. Residential property in Lyons Township had a 0.6% increase illustrating the growth from $14.8 billion in 2023 to $14.9 billion in 2024. The lowest value houses with a range of $1MM to $1.5MM had a great assessment increase between 2023 and 2024. Residential property owners of homes greater than $1.5MM saw the highest increase in value of 7.5%.

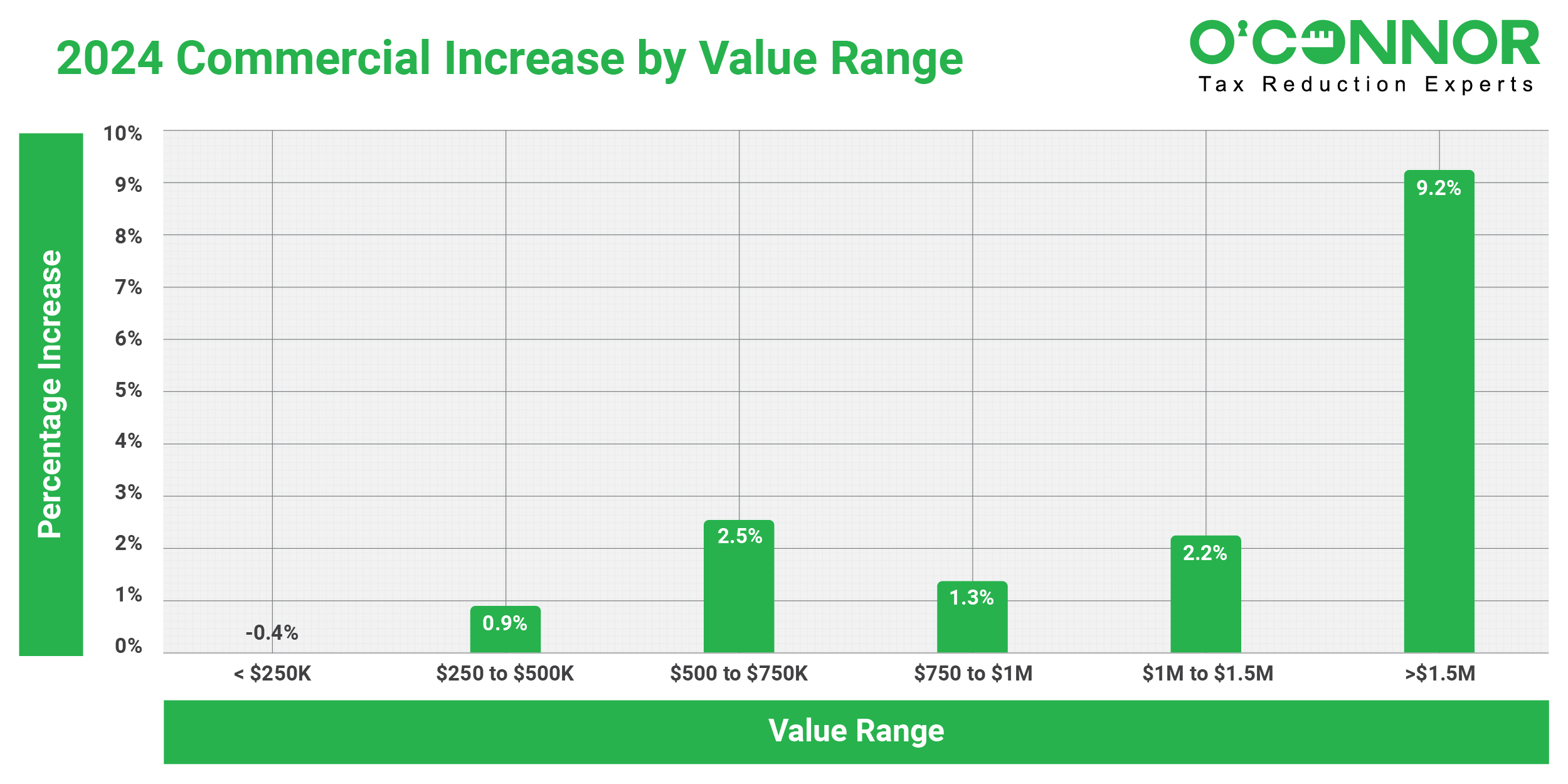

Commercial Values Gain Even More Pronounced

In contrast to homes, commercial property had an inflated value increase in accounts in Lyons Township. By 2024, commercial values had tremendous growth of 6.7%. In 2024, the average assessment for commercial property in Lyons Township of Cook County was 9.2%, with a value exceeding $1.5 million. Owners of commercial properties valued between $500k to $750k had one of the highest increases of 2.5%.

What Can Property Owners Do?

The data indicates a substantial rise in the assessment for Lyons Township in Cook County, Illinois. First things first: before protesting the assessment value, property owners need to see whether they qualify for any exemptions. Owners of real estate may find the appeals procedure confusing, but O’Connor simplifies everything. O’Connor works with leading property tax specialists to make sure that requests for tax reductions and unequal appraisals are backed by the strongest evidence available. O’Connor and his team of property tax lawyers exhaust all avenues in their pursuit of a reduction in their clients’ property tax bills.