2023 Property tax assessments for New Trier Township apartment complexes have increased significantly and now total $62.4 million. Retail buildings saw a gain of $6 million, commercial real estate increased by $9 million, and institutional and special properties saw an increase of $979,000. In comparison, the cumulative rise in commercial and single-family property tax assessments was 2.07%, or $85.6 million, exceeding the market value in 2022.

O’Connor, one of the largest national property tax specialists, developed the data analysis.

What was the single-family residential tax assessment revaluation for 2023 in New Trier?

The market value of single-family residences in New Trier remained level at $3 million in 2023. In New Trier Township, there has been a noticeable fall in home purchases, despite values holding at a modest 0.20% increase in property value. The biggest revaluation rises for 2023 was $4 million over the 2022 market value for homes valued at more than $1.5 million.

What distinguishes New Trier’s taxable properties from exempt properties?

The market value of single-family residences in New Trier remained level at $3 million in the 2023. In New Trier Township, there has been a noticeable fall in home purchases, despite values holding at a modest 0.20% increase in property value. The biggest revaluation rises for 2023 was $4 million over the 2022 market value for homes valued at more than $1.5 million.

What distinguishes New Trier’s taxable properties from exempt properties?

New Trier Township has 1632 commercial properties, of which 1007 are tax-exempt and 625 are taxable. Office buildings, supermarkets, country clubs, and apartment complexes are a few examples of taxable real estate. The overall highest number of any single property type in New Trier Township is 248 commercial multi-use buildings.

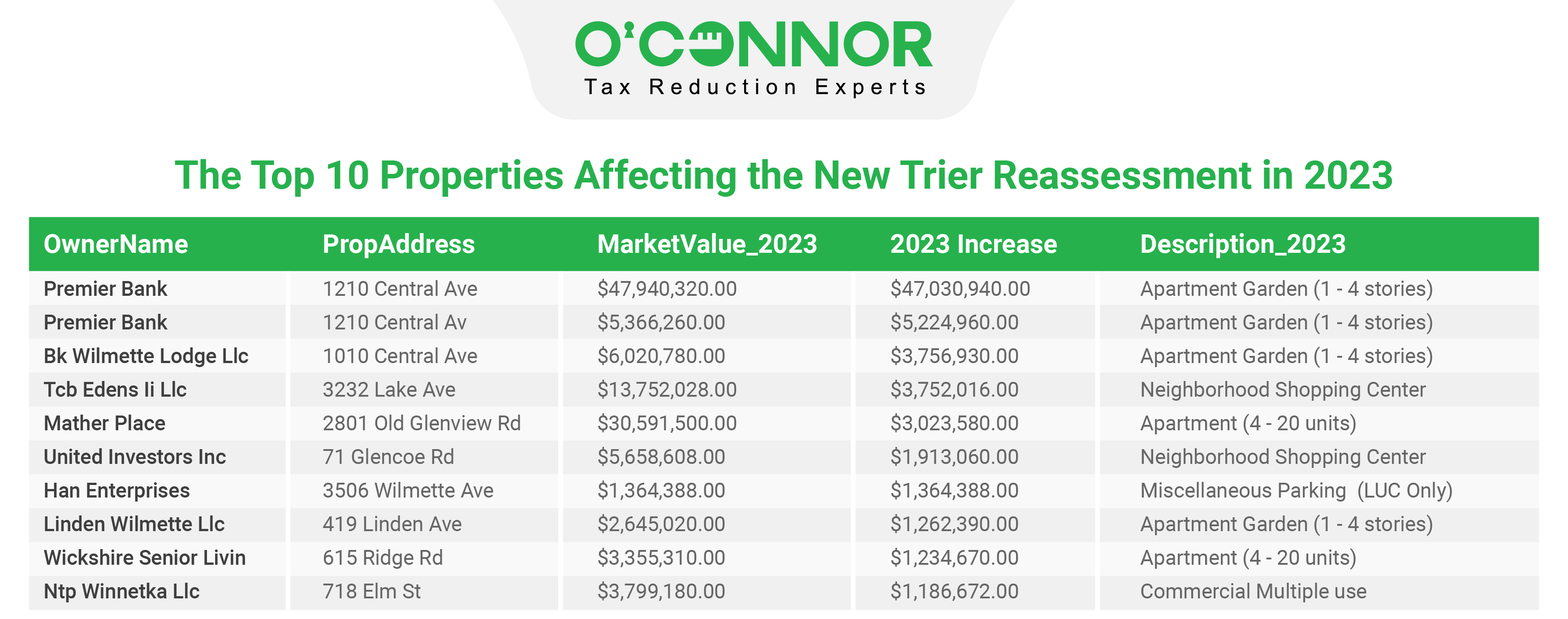

The Top 10 Properties Affecting the New Trier Reassessment in 2023 are listed below.

For the top 10 corporations, the total increase in tax assessments is $69 million. The highest rise is a staggering $47 million for the apartment towers. The bulk of the apartments have expansive lawns, trees, bushes, and other plant life, making them a popular choice for families and pet owners. Interesting given that apartment complexes have experienced the most growth among all business property categories for the 2023 reassessments.

Neighborhood shopping complexes with gains of $1.9 million, other parking with increases of $1.3 million, and commercial multi-use with increases of $1.18 million are some of the other properties linked to the top 10 reassessment rises.

Have Property Types Changed?

In 2023, there was no increase in the automotive, entertainment sports health, food/beverages, or industrial markets for New Trier Township.

What are the market and taxable values for New Trier Township?

Compared to the taxable value of $200 million, the commercial market value in 2023 was $802 million. The market value of residential properties in 2023 was close to $3.4 billion, but the taxable value was $340 million. Did you know that the taxable value is used to calculate property taxes in Illinois? Commercial buildings are taxed at 25% of market value while residential dwellings are taxed at 10% of market value.

The Final Tax Assessments Will Be Adjusted, Right?

Commercial business owners frequently like to challenge their property tax assessments, especially when the values soar. Therefore, the values for the majority of businesses will be significantly lower before the final 2023 tax file is finished.

Who is Permitted to Appeal?

Property owners, both residential and commercial, have the option of challenging their property tax assessments on a variety of levels each year. No matter if the tax assessment is unchanged or lowered the owner may contest the value. The assessor, board of review, property tax appeal board, and the judiciary level are the four stages where an Illinois property tax appeal can be held.

Want to know what your property is worth for tax purposes?

Visit the Property Tax Fairness Checker for a free evaluation to find out how much your property is worth in relation to the nearby properties.