Hanover Township of Cook County, Illinois saw property values rise from $3.6 billion in 2022 to $3.8 billion in 2023, with an overall gain of 3.7%. The Hanover Township 2023 property tax assessment predominantly increased the value of industrial buildings, with a secondary concentration on service facilities. Hanover’s overall increase in the 2023 property tax assessment was $135 million, which includes increases of $77 million for industrial structures and $6.1 million for service facilities.

The report that follows was created by O’Connor, among the top property tax consulting organizations in the nation

Hanover’s 2023 Tax Assessment Does Not Revalue Single-Family Homes

Most significantly, the 2023 Hanover Township reassessment does not appear to revalue homes, with the cumulative hike in single-family property values only amounting to a relatively low amount at $3 million or 0.12%.

Taxable VS Exempt Property

Hanover Township includes a total of 991 tax-exempt properties, as opposed to 1,010 commercial lots that are subject to tax.

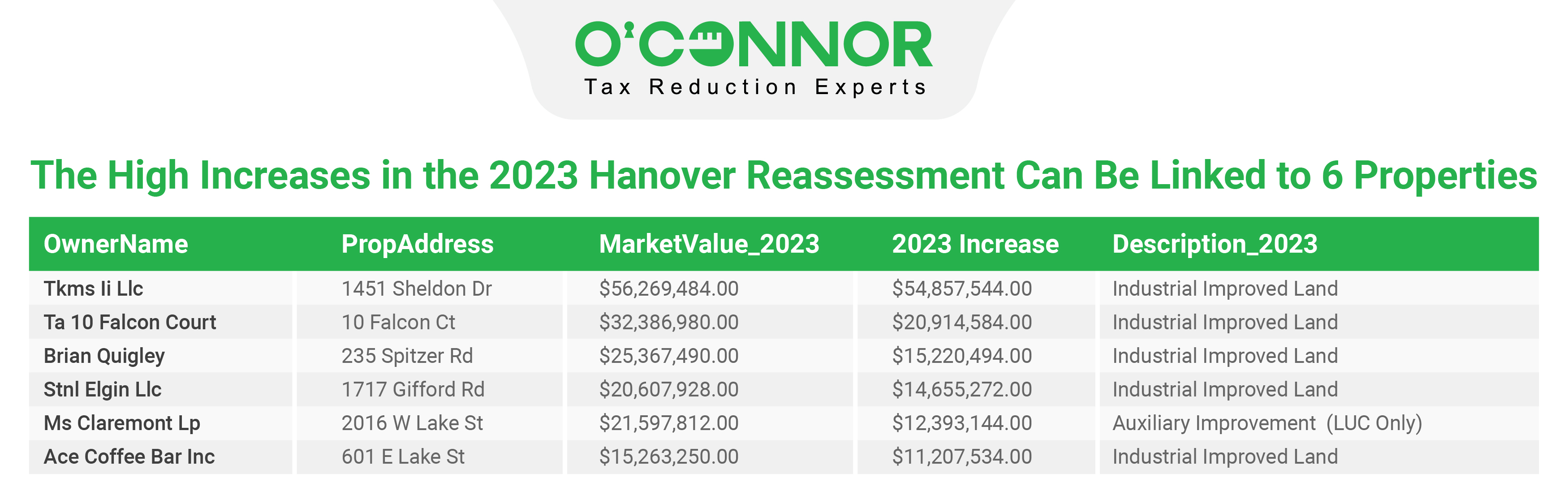

The High Increases in the 2023 Hanover Reassessment Can Be Linked to 6 Properties

The properties listed below experienced the $129 million in biggest increases in 2023. $54 million is the amount that comes out on top, followed by $20.9 million, $15 million, $14.6 million, $12.3 million, and then $11.2 million. These price increases mostly affected industrially upgraded land and auxiliary upgrades, leading to a significant increase in industrial buildings.

Which Types of Property Have Not Increased?

Assessments for properties related to food and drink were unaffected in 2023.

Analyzing the market value to the taxable value for 2023

In Illinois, property taxes are calculated using an estimated value. Commercial properties are taxed at 25% of market value, whereas residential buildings are taxed at 10% of market value. “Market value” refers to the price at which a property would sell in a free market, while “taxable value” is used to calculate property taxes. Hanover Township’s total market value for residential property was around $2.6 billion in 2023, but the taxable value was $263 million. The market value of commercial property in 2023 was $1.18 billion, as compared to a total taxable value of $299 million.

Finalized Corrections to Tax Estimates

Since business property taxes are regularly contested, particularly when values have increased dramatically, it is anticipated that the values of commercial firm property taxes will be greatly lowered before the final 2023 tax assessments are produced.

Right of Property Owners to Refute Property Taxes

Are you an Illinois property owner who needs to be aware of the primary levels of property tax appeal? The board of review, property tax appeal board, assessor, and then the court are the correct answers. Property owners, whether commercial or residential, unquestionably have the right to challenge their property tax assessments at the various levels stated.

What Your Property Tax Valuation Is and How to Find Out?

If you want to find out if you are overestimated in comparison with the properties around you, visit the Property Tax Fairness Checker