Calumet Township’s most significant property tax assessment increases in 2023 were 506.80% for institutional & special structures and 150.10% for service facilities properties. Calumet’s total property tax assessment increase across both residential and commercial property for 2023 was $259 million, which included an eye-popping $39.7 million for institutional and special constructions and $10.5 million for service. Calumet assessments were up by 56.0%, from $463 million in 2022 to $722 million in 2023.

This analysis was prepared by O’Connor, the nation’s leading property tax consultancy firm.

Residential property values in Calumet have increased in the 2023 tax assessment

In the Calumet Township reassessment for 2023, homes were revalued, with the total value of residential properties rising by an average of 54.5%, or more than $418 million, from the market value of $271 million in 2022.

Difference between taxable and exempt property

For 2023, Calumet Township tax rolls included 842 taxable businesses and 705 tax-exempt parcels among the 1547 commercial tax properties.

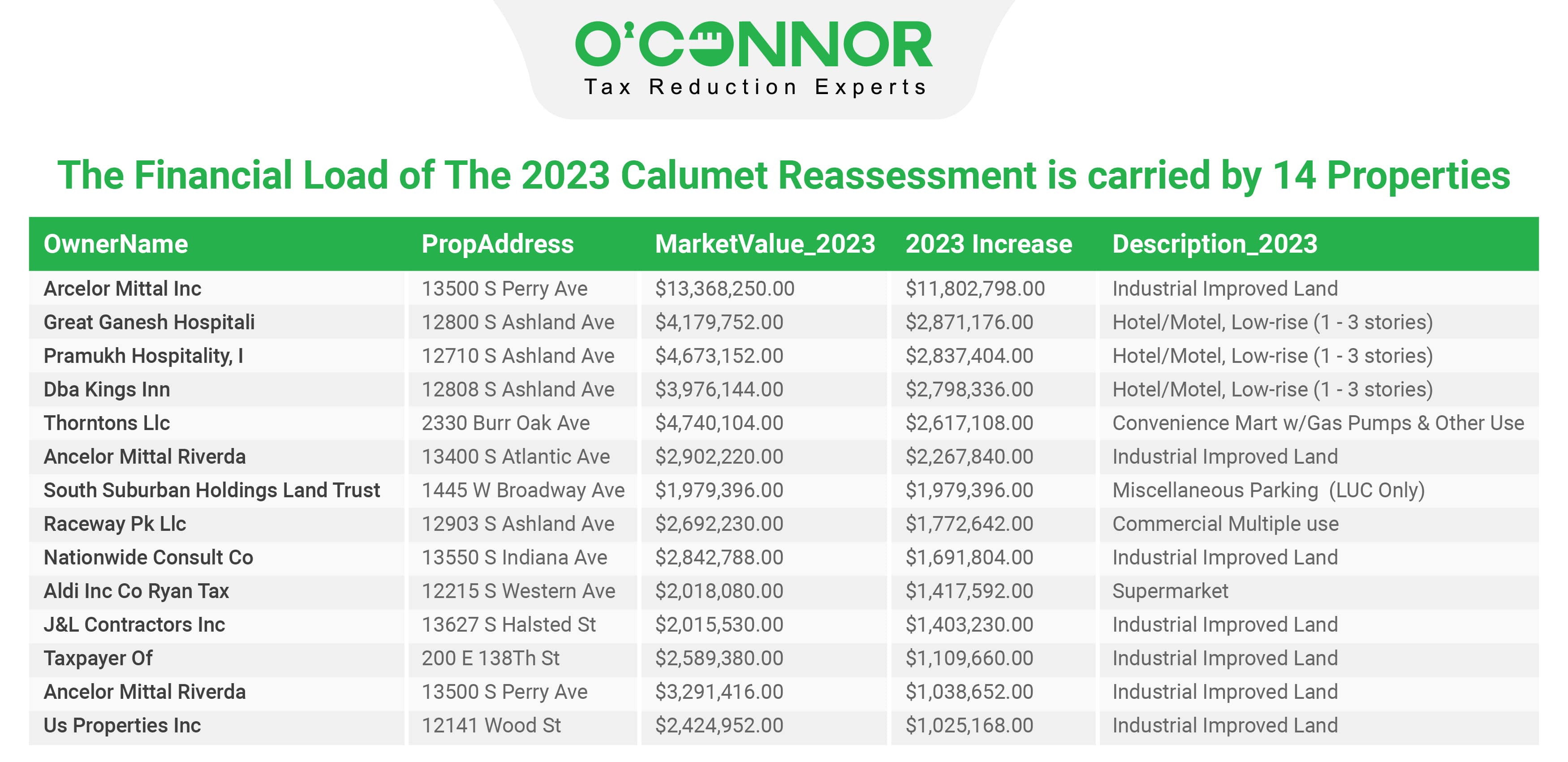

The financial load of the 2023 Calumet Reassessment is carried by 14 properties.

Arcelor Mittal Inc. was the property owner whose 2023 property tax assessment grew the most, with a rise of $11.8 million. $36.6 million was the sum for the 14 properties that saw a rise. Low-rise hotels and motels, gas stations, parking lots for various purposes, supermarkets, and upgraded industrial land are just a few of the categories highlighted with high increases.

Property Types Did Not Change

For Calumet Township, market values rose significantly in 2023 for both residential and commercial properties.

Comparing Taxable Value and Market Values

The starting point for comparing the single-family taxable and market prices is the $418 million market value in 2023 as opposed to the $41 million taxable value. In contrast, commercial 2023 taxable values were estimated at $75 million, with market value of $303 million. For commercial, the taxable value is 25% of market value, whereas for residential buildings it is 10%, as property taxes in Illinois are calculated based on taxable value.

Assessments for Final Taxes Will Vary

The owners of commercial properties in Calumet are more likely to file an appeal as a result of the considerable increases in their property tax assessment values. Having said that, a number of these hikes will be lowered via the appeal process before the tax roll’s completion in 2023.

Protesting is Permitted for Property Owners

The Assessor, Board of Review, and the Property Tax Appeal Board (PTAB are the main stages to contest property tax assessment in Illinois. Owners of properties have the legal right to challenge their property tax value, whether they own a residential or commercial property. Even if the tax assessment is flat or reduced, owners can still appeal.

What’s the best way to check your property tax assessment?

To see whether your property taxes are fair, click the link. It’s a free assessment to determine whether you are valued excessively in comparison to others in your community.