The findings of the O’Connor ratio research on the median time-adjusted sales price for an average homeowner in Fulton County, Georgia is $363,000, but the median assessed value is $368,500, thus being $5,500 higher than the market price. As a result, much residential real estate in Fulton County is overpriced. The research investigation analyzes the time-adjusted sales price to the value allocated by the Fulton County tax assessor for 2023.

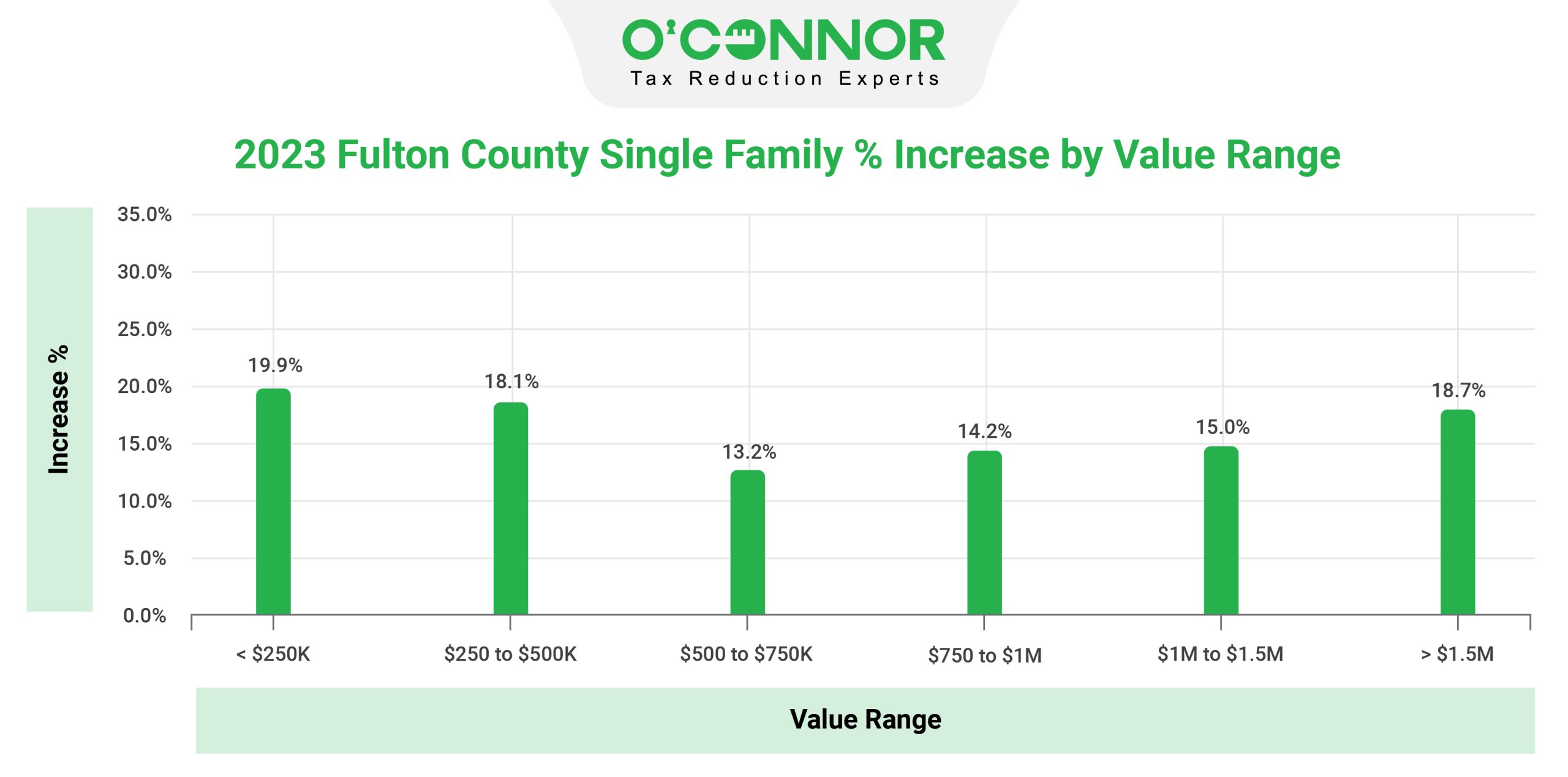

The market value of an average residence in Fulton County has gone up by 16.2%, but residences under $250K have suffered the most, spiking by 19.9%. Homes valued above $1.5 million are also seeing a likely unwelcome boost in the form of 18.7% higher appraisals for 2023.

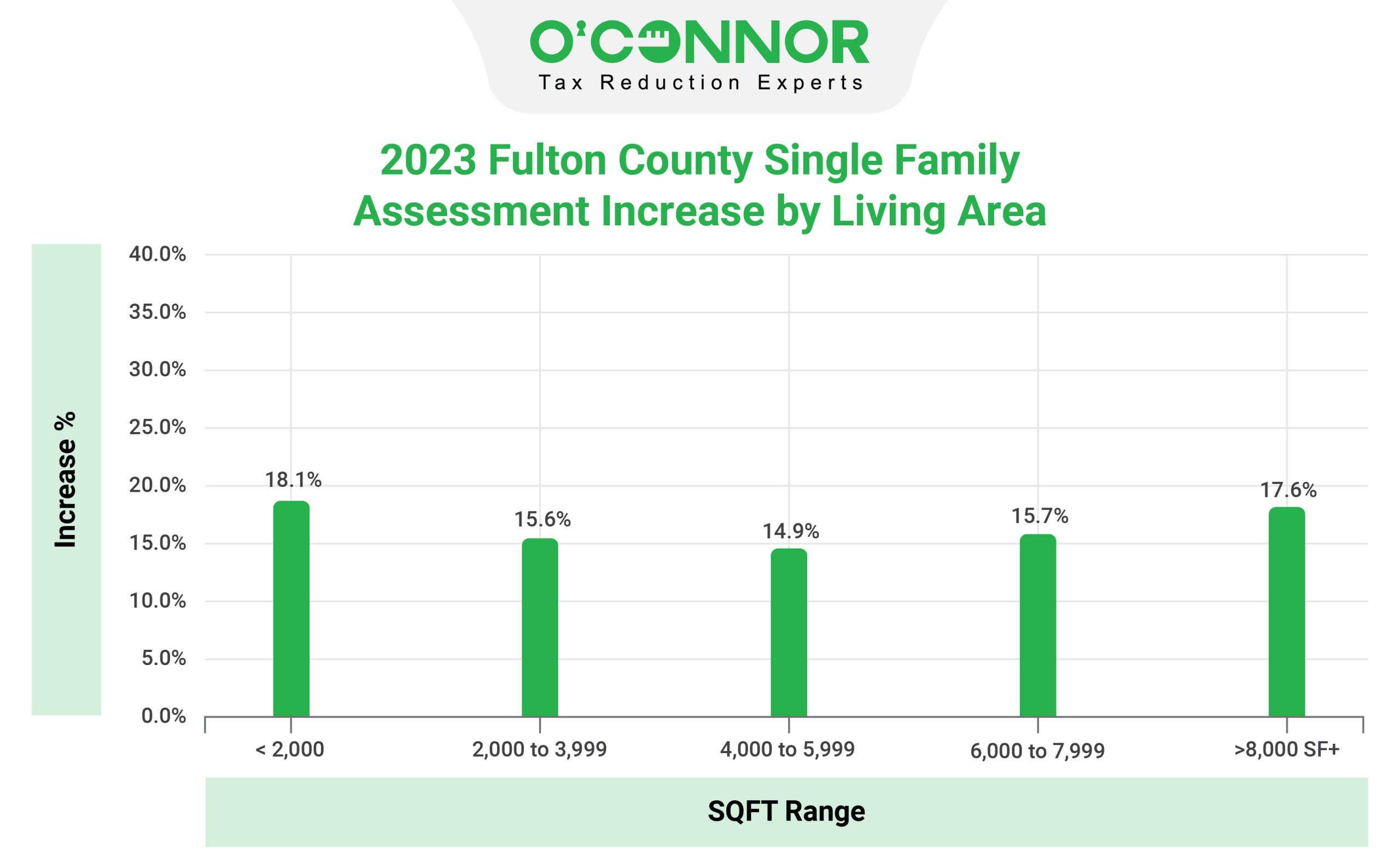

Fulton County single-family houses with fewer than 2,000 square feet have witnessed the most dramatic increases of over 18%. Property tax appraisals for homes more than 8,000 square feet increased by 17.6%, while those between 2,000 and 3,999 and 6,000 to 7,999 square feet increased by 15.7% and 15.6%, as well.

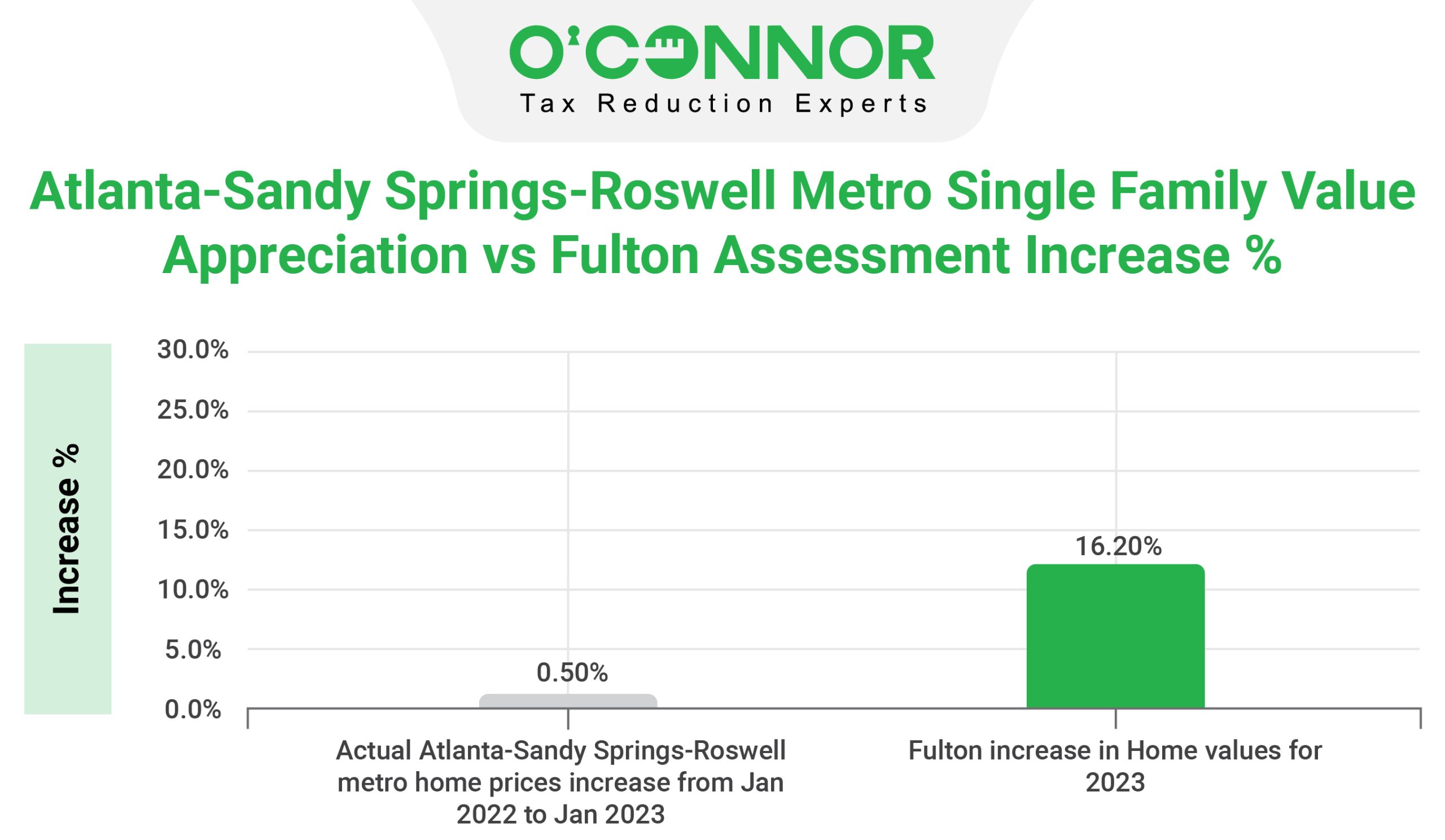

According to Atlanta-Sandy Springs-Roswell Metro sales price figures, house prices increased by 0.50% while Fulton County property tax appraisals climbed by 16.2% . Simply put, appraisals climbed dramatically while sales increased only somewhat in the metro region.

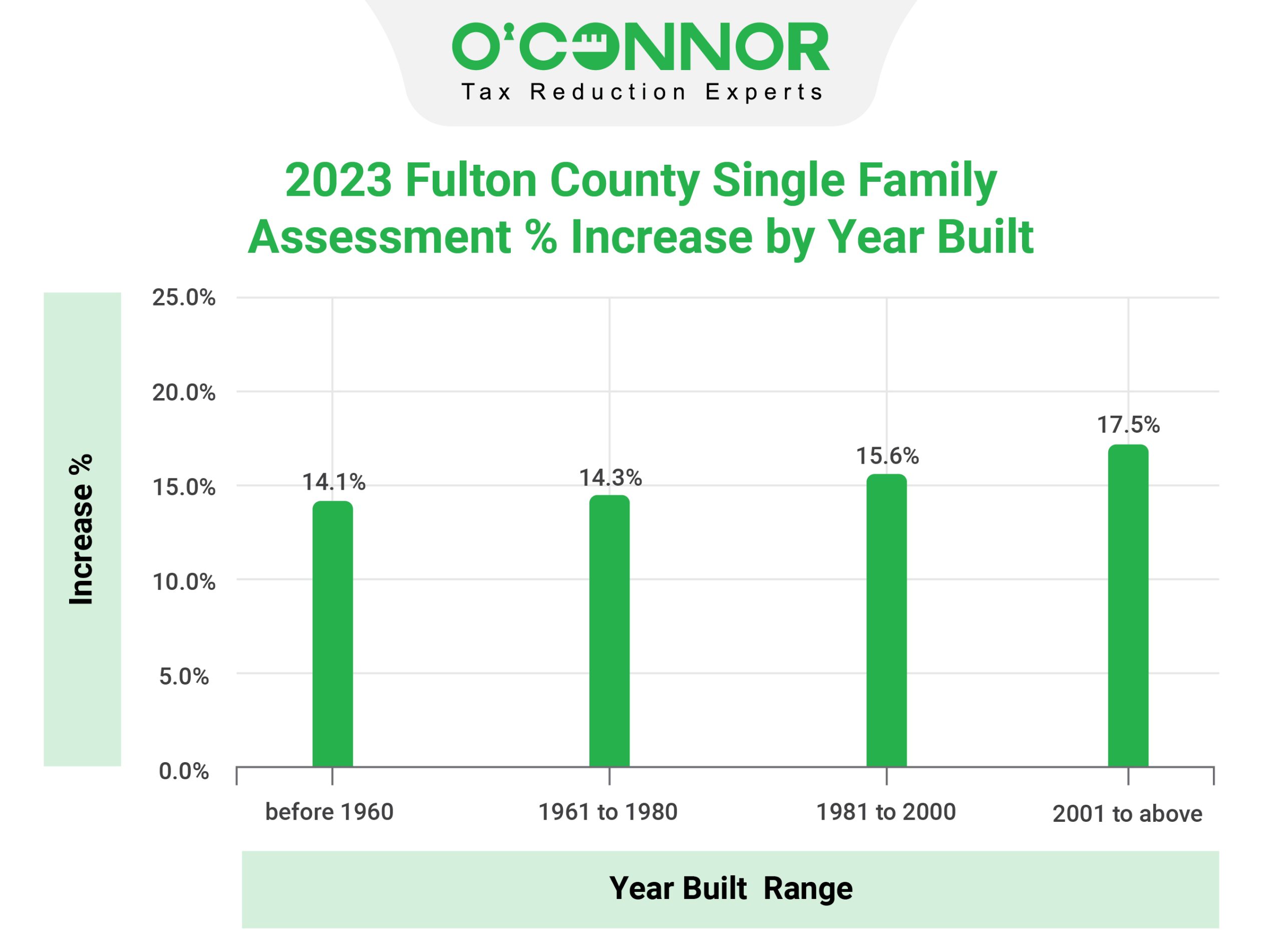

Appraisals for residences built after 2001 and above in Fulton County are observing a 17.5% gain in value in 2023. Single-family residences assembled before 1960 were least affected of all property age ranges, yet their appraisal values still grew by 15.7% on average.

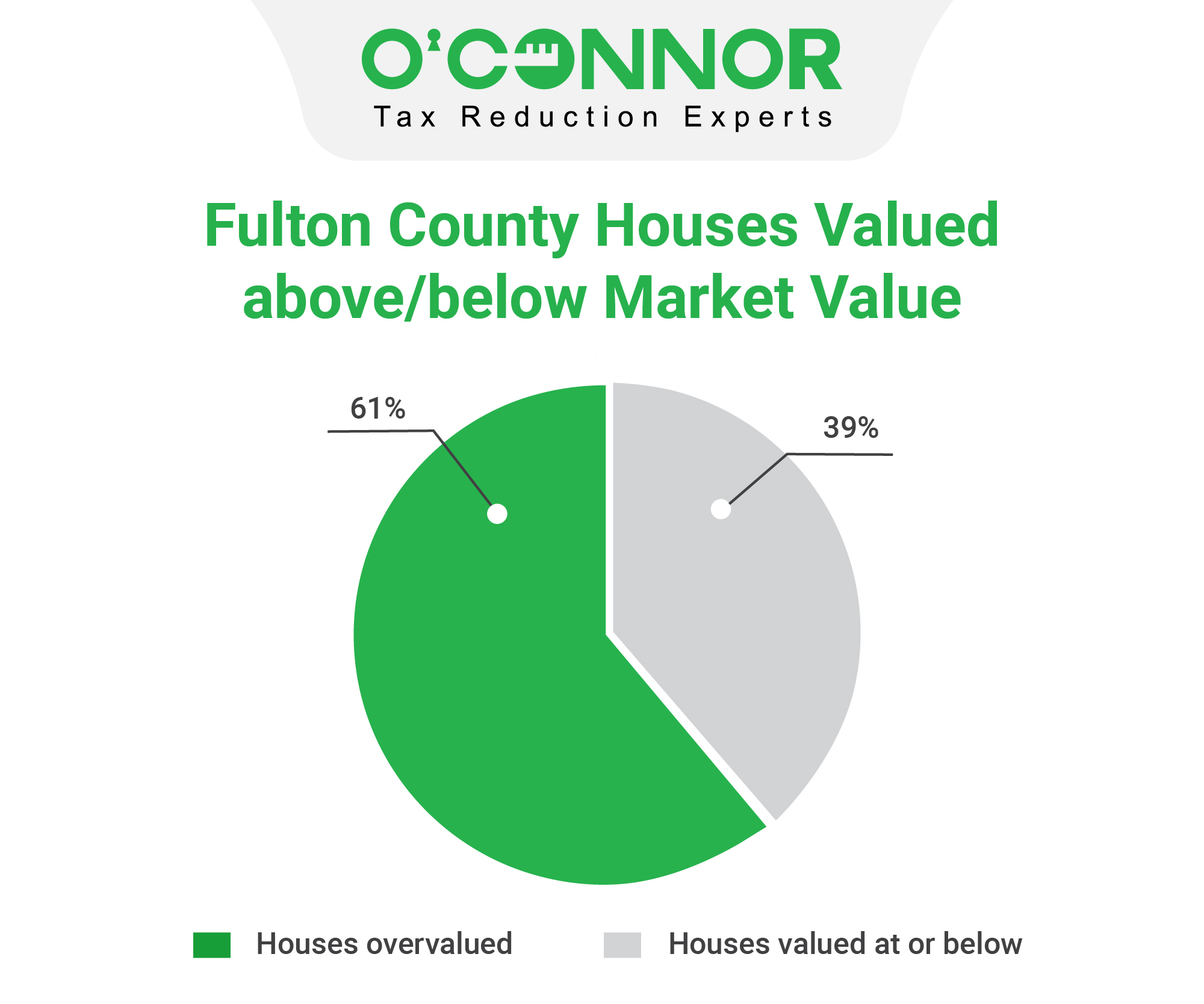

The circle data visualization above compares homes in Fulton County with taxable values that are above their market values versus those below their market values. In Fulton County, 61% of properties were overpriced, while only 39% were priced below market.

The Fulton County Tax Assessor faces a challenging task in valuing homes around the county. Property owners have an obligation and the right to contest their appraised values. It’s worth revisiting in 2023 when property values have climbed by more than the average 16% and 61% are above market value.