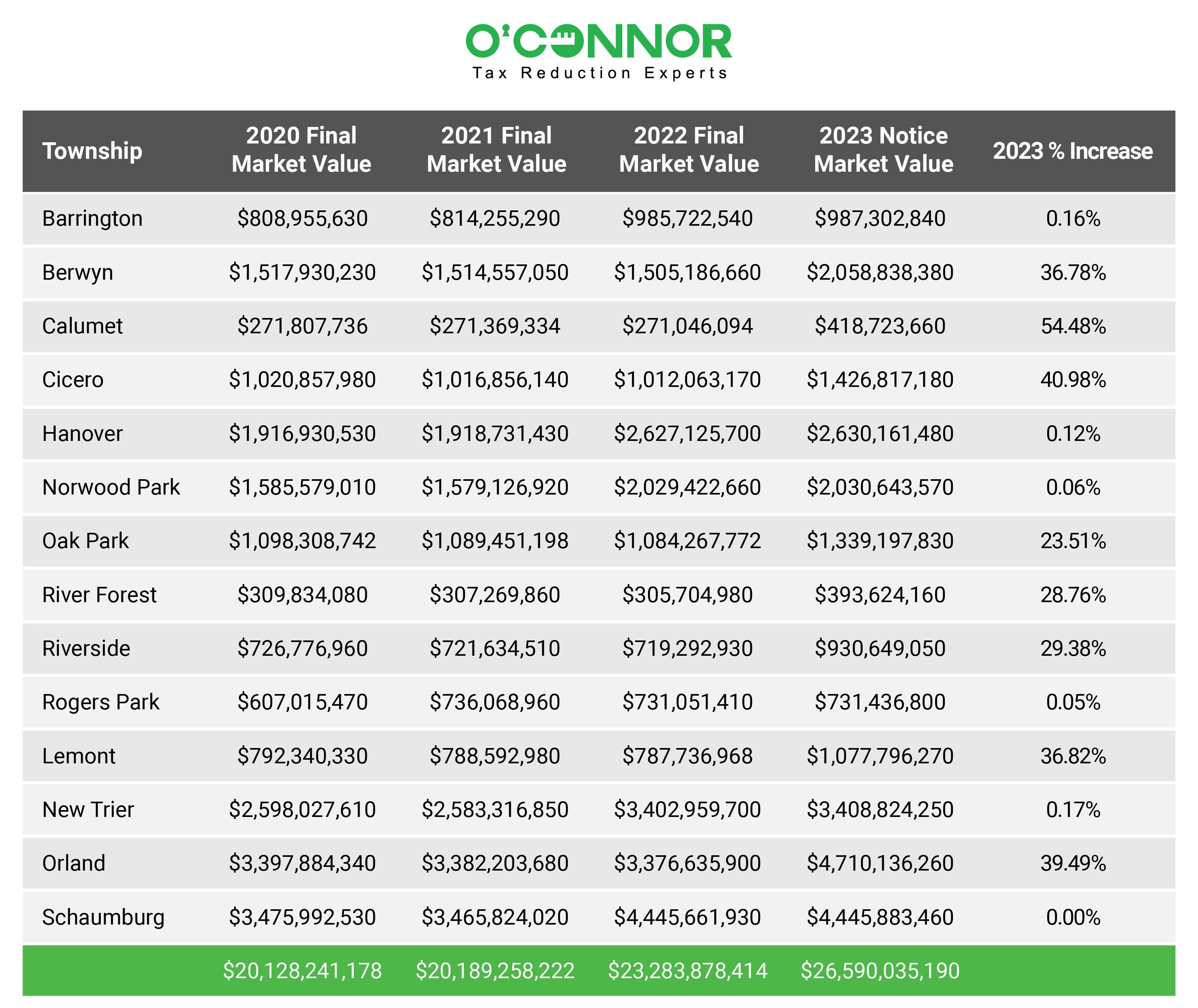

Chicago property tax assessments are skyrocketing for homeowners, with some seeing increases over 100%. For the fourteen Cook County townships reviewed, residential property tax assessments increased most in Calumet, a whopping 54.5%. The townships reviewed include Barrington, Berwyn, Calumet, Hanover, Oak Park, River Forest, Riverside, Rogers Park, Lemont, New Trier, Orland, and Schaumburg. Six of the fourteen did not have a major reassessment in 2023, including Barrington, Hanover, Norwood Park, Rogers Park, New Trier, and Schaumburg.

Townships reassessed in 2023 had value increases of at least 23%, despite a flat housing market in 2022. However, the 2023 reassessment includes property appreciation that occurred in 2020 and 2021. The 2023 assessment increases by township include: Calumet (54%), Cicero (41%), Orland (39%), Lemont (37%), Berwyn (37%), Riverside (29%), River Forest (29%), and Oak Park (24%)

The total estimated market value of homes in these townships has increased from $20.1 billion in 2020 to $26.6 billion in 2023, based on data from the Cook County Assessor’s office

Huge Tax Increase? What Can You Do?

Many, if not most homeowners believe there is no remedy except to pay the higher tax bill. However, that is simply not true. Commercial owners have deep knowledge of the nuances of protesting property taxes assessment increases. Appealing property taxes is an annual duty for most commercial property owners because they know it works.

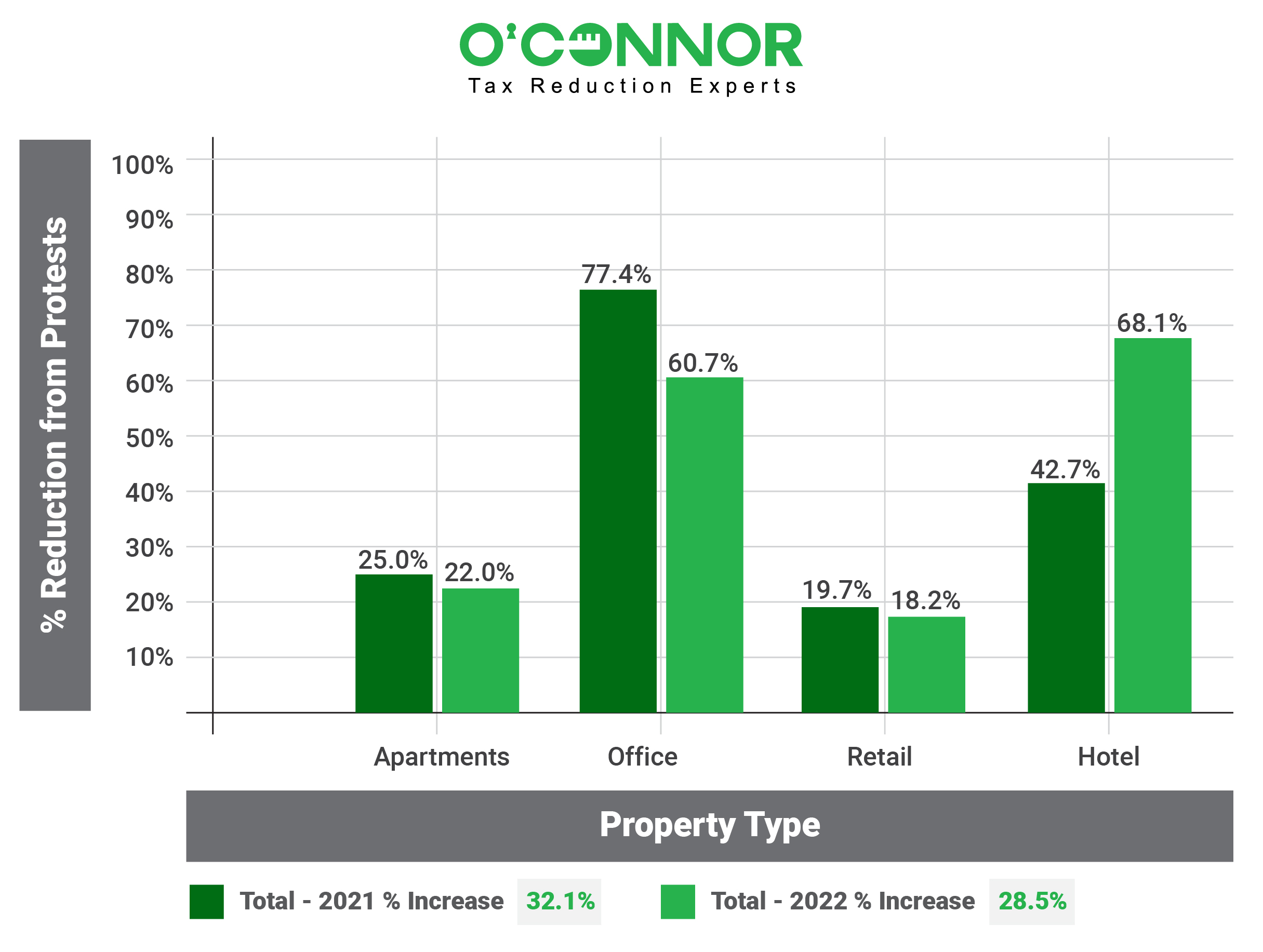

Massive Increases in Proposed Commercial Values but Modest Increases in Net Taxable Value

Commercial values were increased by 32.1% in 2021 and by 28.5% in 2022, for a total increase of 60.6%. However, the net increase from 2020 to the final 2022 values was 15.0%, just 25% of the increase proposed by the Cook County Assessor. Stated differently, commercial owners in these townships received notices of increase of $3.63 billion. However, after completing the appeals process, the net increase in assessed value was $0.86 billion. Alternatively, the value increases would have increased the commercial property values from $5.75 billion to $9.38 billion. However, instead of a final value for 2022 of $9.38 billion, property tax protests reduced the value to $6.61 billion.

Commercial Property Owners Appeal Consistently and Win

The above table shows the efficacy of property tax appeals by commercial property owners. They understand the process for property tax appeals and utilize it effectively, eliminating 75% of the proposed tax assessment increases.

What Can Cook County Homeowners Do to Reduce Property Taxes?

- Managing property taxes is just one of the responsibilities of home ownership, along with maintenance and insurance. Make reviewing property taxes a part of your annual home care duties. You can check to see if you are over-taxed relative to other homeowners at Cutmytaxes There is no cost and reviewing the fairness of your property taxes takes just a few minutes

- As a bare minimum, protest property taxes in the years when the Cook County Assessor does a major reassessment. Homes are reassessed every three years in Cook County.

- In years between a major reassessment, check your valuation for both unequal appraisal and market value. You can check unequal appraisal at Cutmytaxes and check market value by reviewing comparable sales.

- Check the Cook County Assessors website to determine if they have overstated the quantity or quality of improvements at your home. For example, when I bought my home, the assessor had it listed at 1,700 square feet, but the actual size was 1,450 square feet. After I notified the assessor, they corrected the size, and this simple one-time action has reduced my property taxes by 10 to 15% annually for the last 34 years.

- Be proactive in property tax reduction. For many homeowners, property taxes are simply a part of the monthly mortgage payment. If homeowners had to write a check annually for property taxes, most would be keener on understanding and reducing property taxes. By being proactive, you can likely reduce your property taxes by 5 to 10% annually for your home.

- The benefit of a protest in the reassessment year generally extends to the next two years with no further action. However, even if your home is valued below market value after the first-year appeal, there is still an opportunity to appeal on unequal appraisal. The Cook County Assessor values 1,800,000 properties. The challenge of consistently valuing 1,800,000 properties in Cook County provides opportunity for homeowners to appeal on unequal appraisal.

If you have any questions, visit us at Cutmytaxes or call our Chicago office at 708-630-0944.