Cook County IL Assessment Appeal

Learn more about our integrated solution for reducing your property taxes

- Yes, O’Connor CAN help you reduce your property taxes in Cook County

- Yes – there is NEVER a fee unless we reduce your property taxes

- Simple online enrollment in just 2 or 3 minutes

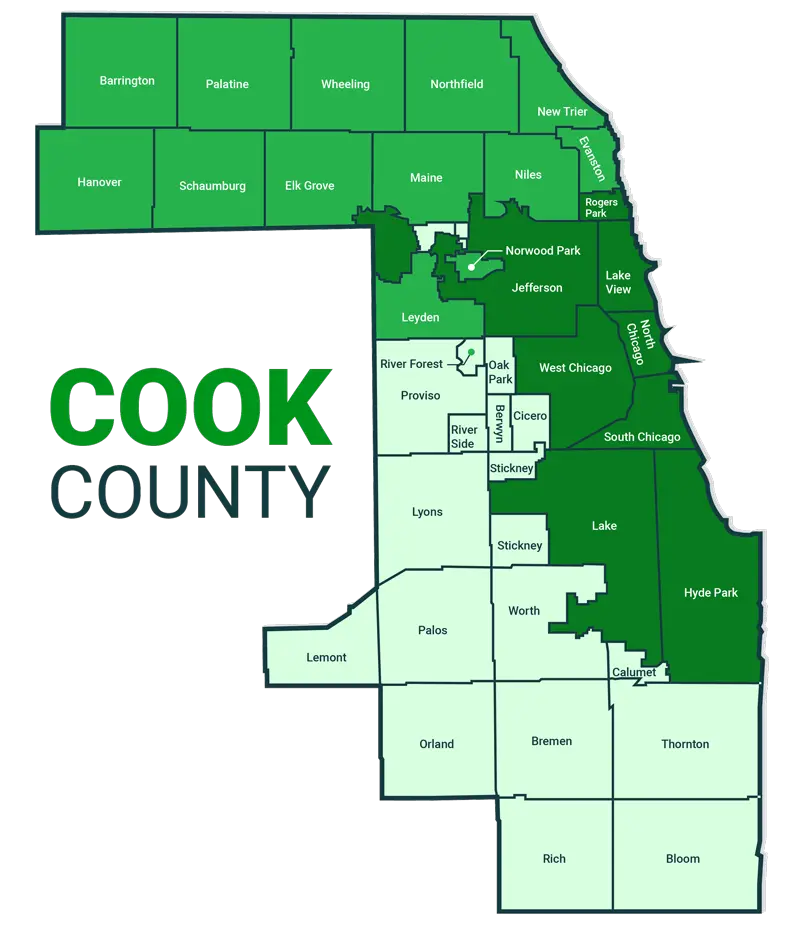

According to the 2024 Assessment Calendar, City of Chicago properties will undergo reassessment this year. Townships included in the reassessment are listed below. Other townships in Cook County are not scheduled for reassessment, but individual properties may be reassessed if there are significant changes. Property owners may file for an appeal even if their property is not reassessed.

| Township | County | Enrollment Deadline | Filing Deadline |

|---|---|---|---|

| Geneva | Kane | 7/20/2023 | 7/24/2023 |

| Sugar Grove | Kane | 7/18/2023 | 7/20/2023 |

| Richmond | McHenry | 7/18/2023 | 7/20/2023 |

| Bloom | Cook | 7/25/2023 | 7/26/2023 |

| Chemung | McHenry | 8/15/2023 | 8/17/2023 |

| Dundee | Kane | 8/17/2023 | 8/21/2023 |

| Hampshire | Kane | 8/17/2023 | 8/21/2023 |

| Kaneville | Kane | 8/17/2023 | 8/21/2023 |

| Virgil | Kane | 8/17/2023 | 8/21/2023 |

| Waukegan | Lake | 8/24/2023 | 8/28/2023 |

| Blackberry | Kane | 9/1/2023 | 9/5/2023 |

| Benton | Lake | 9/1/2023 | 9/5/2023 |

| Cuba | Lake | 9/1/2023 | 9/5/2023 |

| Newport | Lake | 9/7/2023 | 9/11/2023 |

| Vernon | Lake | 9/7/2023 | 9/11/2023 |

Property Tax Protection Program™ is powered by O’Connor & Associates

Kelsie Neahring, Property Tax Consultant

Kelsie Neahring heads residential and commercial property tax consulting for O’Connor’s Chicago office. Prior to joining O’Connor, Kelsie worked for the Kendall County State’s Attorney’s Office as a criminal litigator. Her experience in trials and hearings provides O’Connor’s clients with an advantage in hearings and negotiations. She enjoys crafting innovative ways to make arguments and build evidence for hearings. Kelsie is a graduate of Chicago-Kent College of Law, Illinois Institute of Technology.

Kelsie Neahring heads residential and commercial property tax consulting for O’Connor’s Chicago office. Prior to joining O’Connor, Kelsie worked for the Kendall County State’s Attorney’s Office as a criminal litigator. Her experience in trials and hearings provides O’Connor’s clients with an advantage in hearings and negotiations. She enjoys crafting innovative ways to make arguments and build evidence for hearings. Kelsie is a graduate of Chicago-Kent College of Law, Illinois Institute of Technology.

Cook County Property Tax Appeal

When O’Connor’s team represents your property for appeal, we handle all the details. Our qualified tax agents work with lawyers, appraisers, and our research team, who have access to our unique database, to gather the most convincing sales and unequal appraisal data to support a value decrease on your behalf. Our tax reduction services and advisors are unparalleled in their ability to assist you in accomplishing your objectives. Our coordinated approach gives you the advantage. We pursue each step in the system to lower your taxes:

- Negotiations with the Cook County Assessor

- Cook County Board of Review

- The Illinois Property Tax Appeal Board (PTAB)

![]()

Cut My Taxes Will help you Save Money

O’Connor Property Tax Consultants help their clients save money by using two appeal strategies.

Strategy #1 – The property tax consultant will protest the high market value estimated by the assessors. Protest the fact that the assessor’s value estimate exceeds the market value. In the majority of townships, the assessor overestimates the valuation of approximately 50% of the properties, particularly residences. 100% of market value is targeted by the assessors.

Strategy #2 – The property tax consultant will protest the unequal valuation of dwellings. An unequal appraisal protest is based on the Cook County Assessor’s decision that comparable neighboring residences are assessed at a reduced value. The vast majority of properties in Cook County can be documented as unequal appraisal, as evidenced by experience.

Many property owners will assume the assessor’s value is accurate or is too high or low and there is no benefit to protesting their property taxes; however, this is not the case. Yearly revaluation appeals are likely to succeed over 95%. For townships in Cook County, the data indicates that commercial property assessments were reduced by approximately 17.7% annually.

Tax Services Offered by Cut My Taxes

O’Connor offers services for residential, commercial, and business personal property appeals as a part of the Cut My Taxes Property Tax Protection Program™. In the Property Tax Protection Program™, trained property tax experts will

- Appeal property taxes annually without any upfront costs or flat rates.

- Check market value by reviewing comparable sales,

- File protest, prepare evidence, and attend property tax hearings.

Join the Property Tax Protection Program™ Today!

One of the largest property tax business in the county will actively dispute your taxes every year. If taxes aren’t lowered, You Pay Nothing. If your taxes are reduced, you pay a portion dependent on your tax savings.

How to Begin Your Property Tax Protest with O’Connor

1. Review your property tax assessment

- Does it look right? Do you feel it should be lower?

- Are these mistakes?

- Is the assessor’s market value higher than actual market value?

2. Enroll online with O’Connor

- We analyze existing documents

- Our agents research, prepare evidence and present appeals on your behalf

- Your assigned team coordinates a mutually agreed lawsuit when appropriate

You may be eligible for a property tax exemption as a property owner. Property tax exemptions are savings that assist in reducing the property tax expense of a householder. For example, in Cook County, the Homeowner Exemption could save property owners on average over $900 dollars each year.

Get Help From Our Property Tax Protection Program™ !

You have the right to appeal your property taxes every year to avoid the County keeping YOUR MONEY when you pay too much. If you sign up for the RISK-FREE program, your family will be safe as long as you own your house.

- A free, safe customer portal is here to make things easier for you

- Free subscription to tax saving tips throughout the year

Our Proven Process:

- Analyzes existing assessments

- Your property tax appeals are researched, prepared, and presented in informal hearings

- Coordinates a mutually agreed lawsuit, if appropriate

Costs for court, evaluations, expert witnesses, and lawyers are not charged to you. You only pay us if your taxes go down! There is no risk.

ENROLL TODAY In the Property Tax Protection Program™

Your property taxes will be aggressively protested every year by one of the largest property tax consulting firms. If your taxes are not reduced you PAY NOTHING, and a portion of the tax savings is the only fee you pay when your taxes are reduced! Many FREE benefits come with enrollment.

Property Tax Locations

Property Tax Protection Program™ Benefits

- No flat fees or upfront costs. No cost ever unless your property taxes are reduced.

- All practical efforts are made every year to reduce your property taxes.

- Never miss another appeal deadline.

- Property taxes protested for you annually.

- You do not have to accept the appraisal district's initial guesstimate of value.

- We coordinate with you regarding building size / condition to avoid excess taxes.

- Free support regarding homestead exemptions.

- Some years are good - typically 6 to 7 out of 10 will result in tax reduction for you.

- The other 3 to 4 years out of 10 we strike out. Most often due to people issues in the hearing process. Some years we get an easy appraiser at the informal; some years someone who is impossible to settle with.

About O'Connor

Property Tax Help Specialists

O’Connor provides property tax appeal services to over 100,000 clients in over 40 states. Client tax savings totaled over $120 million in 2020. O’Connor has been serving property owners since 1974, almost 50 years. Client tax savings total over $1,000,000,000.

O’Connor measures its success in client property tax savings, not billings. Our goal is to save clients $1 billion annually.

With over 200 property tax experts, many of whom have worked with us for 10+ years, O’Connor has the expertise to help with your property tax questions and appeals. We literally wrote the books on property tax reduction:

- Mass Appraisal for Commercial – What Every Commercial Property Owner Should Know!

- What You Need to Know about Business Personal Property

- Cut Your Texas Property Taxes

The steps to appeal are complicated and may seem like too much work, but when O'Connor represents your property for appeal, we handle the details. We provide a property tax reduction service to residential homeowners in exchange for a contingency fee of 30 percent of all property taxes saved through administrative hearings or judicial appeal, for that tax year.