It is common for Texans to be in shock when they have their residential 2022 property tax appraisal notice in hand. Texas being the seventh state paying the highest property tax in the United States, homeowners, fortunately, have a chance to fight and lower their taxes. This can be done by filing a property tax protest. The process is of course painstaking… but the results!

The process of protesting begins in January and you are not too late to begin. Get to know how it works and start fighting to lower your property tax bill.

During the informal hearing, an appraiser reviews your property value and proposes a reduced value. It is up to you to accept the value or move on to the formal hearing.

Once you move on to the formal hearing you will be under a rapid-fire proceeding which will go long for about 15 to 20 minutes. You can present your evidence, listen and question the CAD’s evidence and provide a closing statement. The ARB panel then discusses and comes up with a final value.

The ideal solution to reduce your residential 2022 property taxes!

FILE A PROTEST!

Homeowners are left with two choices, challenge the appraisal yourself or hire a property tax consultant to protest on your behalf.

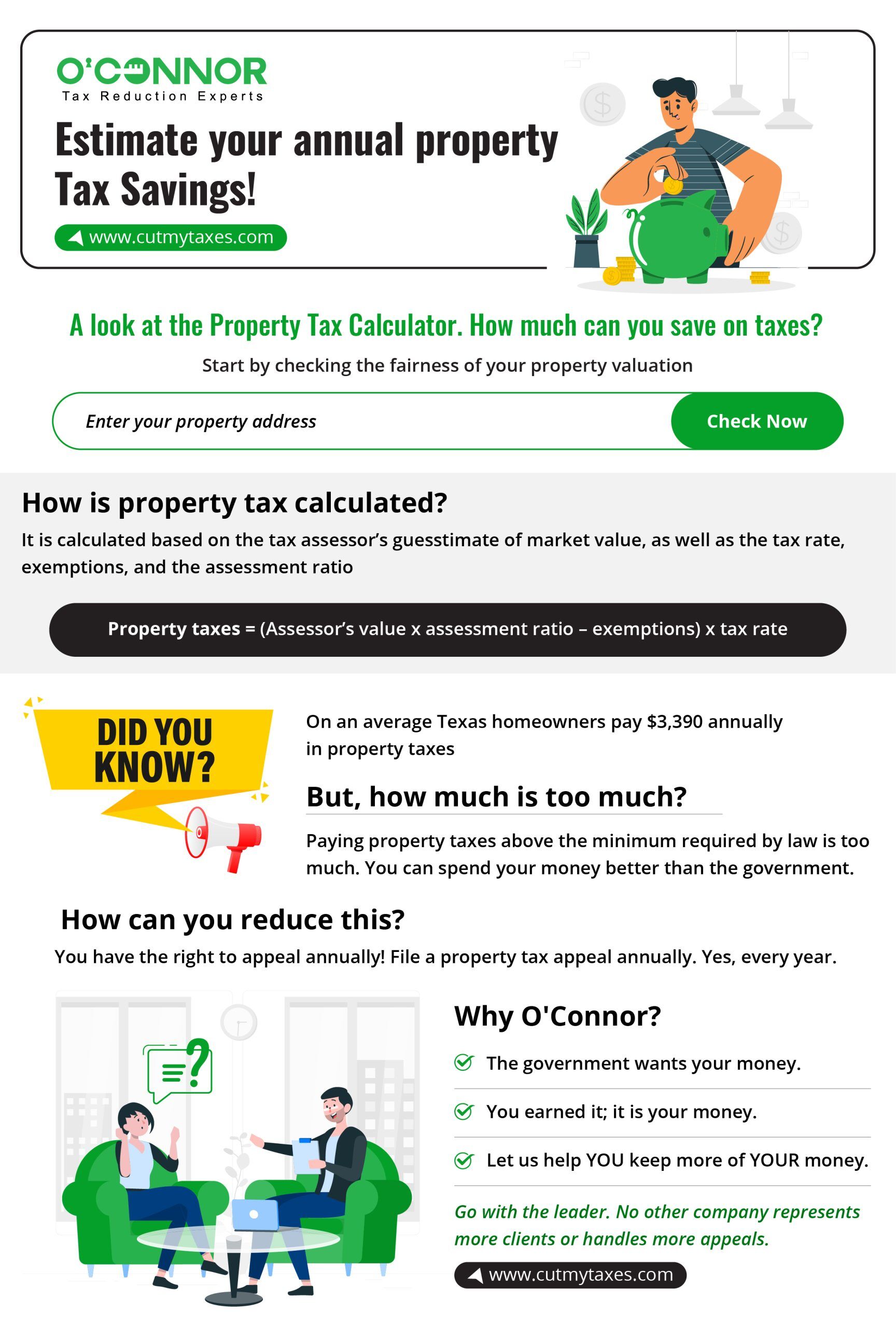

Get an estimate of your Property Tax Savings!