When it comes to Business Personal Property, handling it for a single property can be exhausting when the due dates are near. What will be the scenario when you are supposed to manage multiple properties? It might be a big burden if you don’t have an organized plan. But here are few tips to keep you noted about the tax cycle and how to stay prepared for managing BPP taxes on whole.

Are you still wondering what Business Personal Property is and how can I find out more? Find more info here!

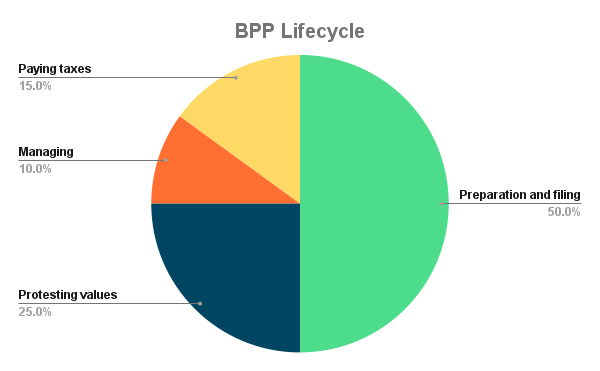

Lifecycle of Business Personal Property

The BPP cycle has the highest time consumption only to prepare and file the returns. Here is a chart that explains the time taken to get ready for BPP:

Keep an eye on the asset information

The asset information can help you to stay updated while you are about to file your taxes. Since there are a lot of digital options to keep a track of your assets like Oracle or any other Enterprise Resource Planning system, make use of it to track the current status of your assets.

The dates for tax preparation are some of the most important things to keep track of when doing a property assessment. You might have different properties in different counties and each county has a different set of calendars to follow for assessing assets. Try to prepare a document of all your properties along with the counties they are located at. This can help you to stay organized on assessment dates.

Update your assets list

Property owners should have record of asset information such as:

Asset purchased date

Asset disposed date

New asset added date

Asset transfers (In or out)

These are a few things that need to be continuously updated on your BPP. Tracking this data in one place can give you a clear picture of how many assets that you own on a particular property. With such filtered tracking, you need not pay for the disposed BPP’s.

Once you are ready with all this information, you can file your taxes with the BPP form. Don’t forget to and manage the deadlines for your assessments now and then. If you feel like your taxes are quite high, then there is a way to reduce them by reevaluating with BPP experts. Get connected with O’Connor to reduce BPP taxes by 40-50% every year.