The IRS has extended the tax filing and payment deadline to the 17th of May, 2021 and this extension is due to the increased complications of the pandemic. Due to the outbreak, multiple tax reliefs and acts were passed during the past year 2020. It might be hard for taxpayers to navigate between various reliefs and finally file their taxes. The due date has been extended because of the pandemic.

Are you aware of the acts that were passed?

If not, then here is a glimpse of acts that passed during the past year 2020.

Apart from this, Unemployment Insurance is about to give tax exclusion for the first $10,200 as benefits for taxpayers.

Benefits of Unemployment Insurance (UI)

As the pandemic has hiked the unemployment crisis, most of the taxpayers face a shortage in paying the right amount of taxes. UI has an option to opt for a 10% withholding rate for taxpayers. The major benefit of UI is that unpaid workers can opt for a $10,200 tax exclusion. This exclusion is only for the filers who are earning less than $150,000 during 2020. This unemployment compensation can be claimed through the 1040 form.

This UI benefit has been added only because the paid rate in the second quarter of 2020 was $64.2 billion which depicts the higher unemployment rate with 14.8 percent during April 2020.

How can you cut taxes?

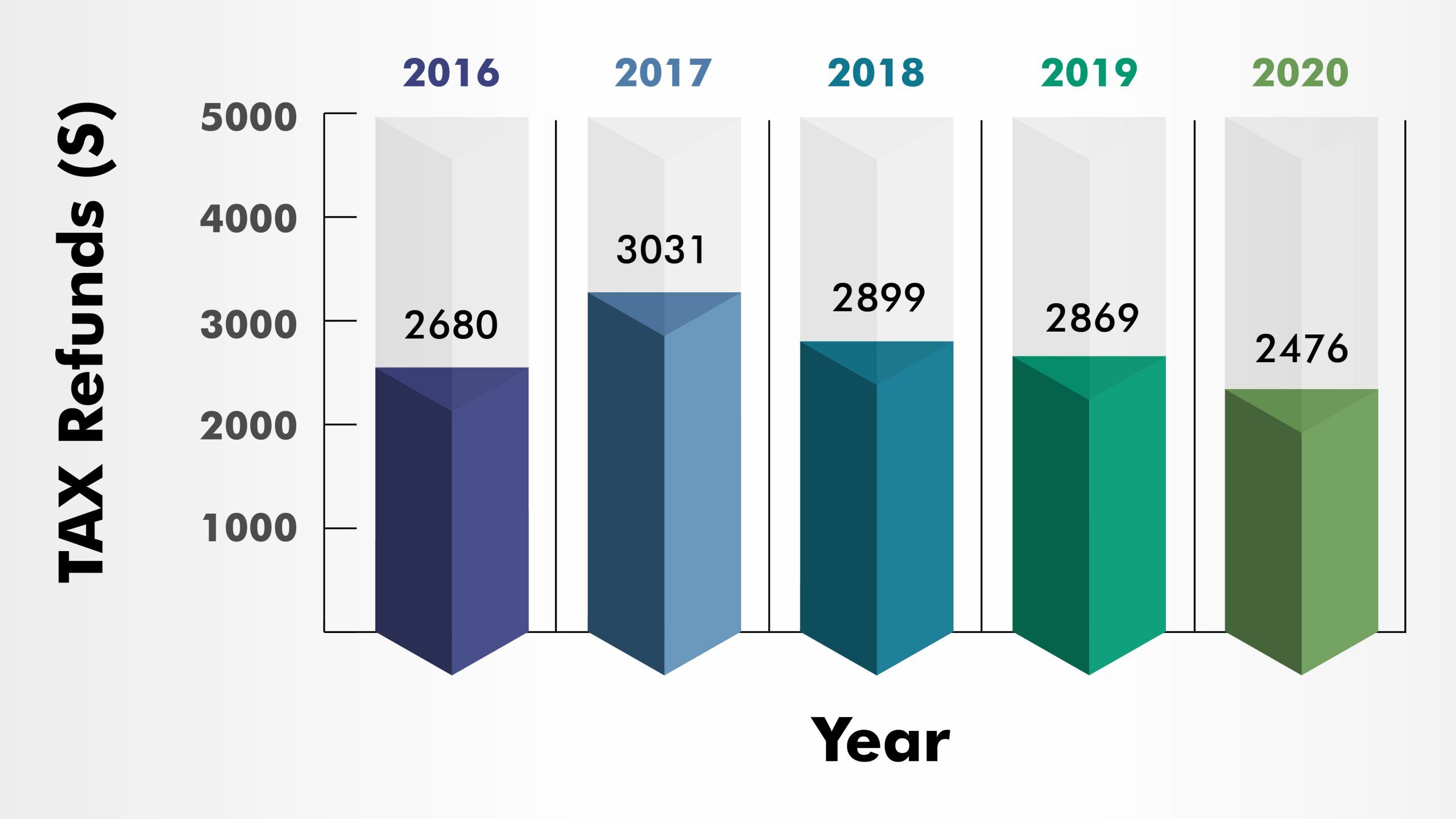

The best way to cut down your property taxes is to protest in the first phase. After the great recession, the tax refunds have gradually grown year after year. Every taxpayer doesn’t have to pay a penny more than his calculated taxes. Here is a chart that demonstrates how tax refunds have been gradually hiking up the chart every year.

The 2020 data was updated last October according to the e-file. Apart from filing for tax refunds, opting for protesting can reduce your property tax payments. Get help from Cut My Taxes, who are experts in reducing taxes with some of the promising strategies today!